Warren Buffet, Kevin O’Leary and Other Millionaires are Concerned About Inheritances

There is something such as too much money. That is, according to several big names including Warren Buffet, Daniel Craig and Kevin O’Leary, who all recently said they will not give an inheritance to their children. Now, a new survey finds that while most high-net-worth individuals plan to leave an inheritance, 67% have concerns about leaving too much. A new factor they are also taking into consideration is the proposed tax in President Joe Biden’s American Families Plan.

See: Here’s Exactly How Much Savings You Need To Retire In Your State

Find: 10 Cheap Cryptocurrencies To Check Out

The Motley Fool survey, which describes HNW individuals as people with a net worth of at least $1 million, notes that while 76% of them plan on leaving an inheritance, 67% have concerns about leaving large ones to their family.

The top reason for concern is the worry about inheritances being used irresponsibly, with 59% of respondees citing it. Additional concerns include the fact that beneficiaries will not be prepared to handle a large inheritance, with 57%; and beneficiaries becoming lazy as a result, with 56% citing this reason.

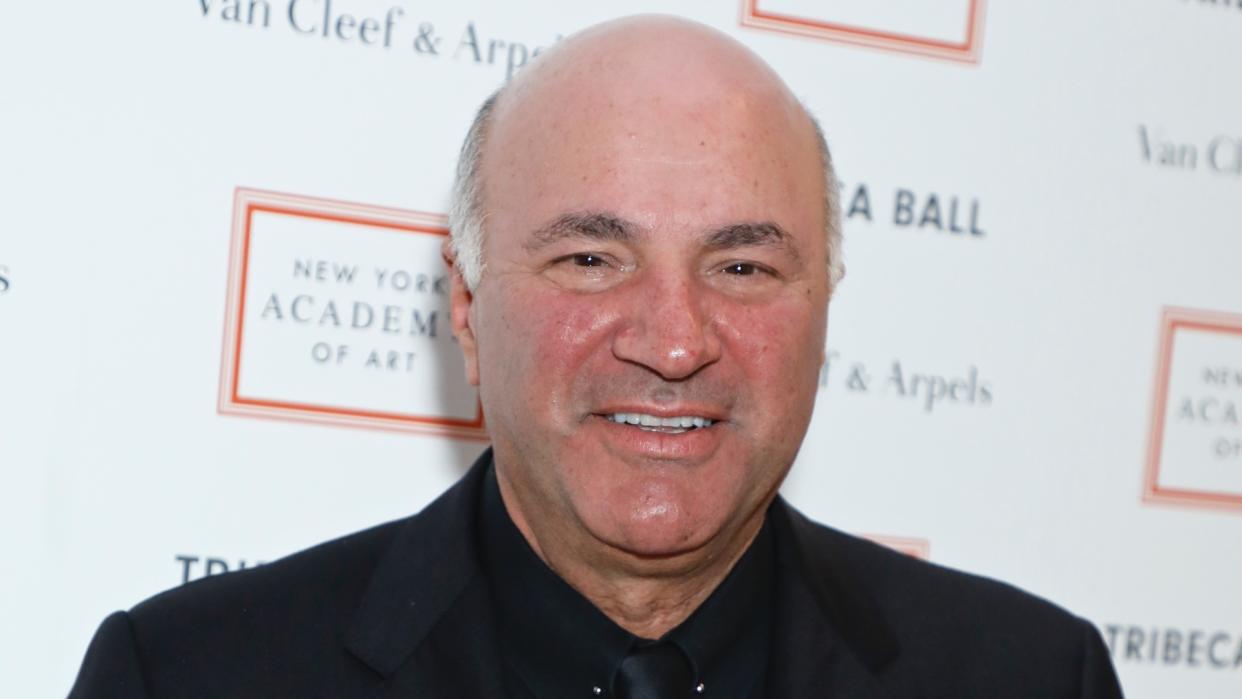

Most recently, Kevin O’Leary, O’Shares ETFs chairman and “Shark Tank” star, told CNBC that he doesn’t plan to leave any inheritance money to his children, so as to not “curse” them by taking away their need to work hard and find their own career success.

Warren Buffet, in a note to shareholders in June to announce he was halfway to distributing his fortune to philanthropic efforts and shared his thoughts on inheritances.

“After much observation of super-wealthy families, here’s my recommendation: Leave the children enough so that they can do anything but not enough that they can do nothing.”

In efforts to mitigate those concerns, 68% of those surveyed plan to leave an inheritance that requires heirs to meet conditions to access it, while 64% have considered a generation-skipping inheritance or an incentive trust, the latter of which passes assets to the grantor’s grandchildren or anyone at least 37.5 years younger than the grantor who is not a spouse or ex-spouse, according to the survey.

This is what O’Leary put in place, according to CNBC. When he earned his first substantial sum of money, he “sat down with the estate planners and built a generational skipping trust that provides for any child in my family from birth to the last day of college and then zero,” O’Leary told CNBC.

“Interestingly, the data reveals that experience has shaped how wealthy Americans think about inheritances,” Motley Fool research analyst Jack Caporal tells GOBankingRates. “Those that received a large inheritance are more likely to have concerns about leaving too large an inheritance to their heirs. And those that had to meet conditions to access assets bequeathed to them are more likely to set up a conditions-based inheritance for their heirs.”

To that point, the survey finds that 85% of HNW individuals that had to meet conditions to access their own inheritance believe it’s possible to leave behind too large of an inheritance. And 84% of those who received an inheritance worth between $500,000 and $1 million shared that belief.

Taxes are of course a huge factor to HNW individuals when it comes to inheritance, and the proposed tax changes in Biden’s American Families Plan are causing some to rethink their plans, according to the Motley Fool.

Indeed, 78% say the proposed tax changes in Biden’s plan would impact the inheritance they intend to leave, while 57% of those who don’t intend to leave an inheritance cited the tax changes as a factor in their decision.

“That a large percentage of high-net-worth individuals are aware of the Biden administration’s proposed changes to how inheritances are taxed reflects how significant those proposed changes are,” Motley Fool’s Caporal says. “It wouldn’t have been shocking if an even larger percentage of respondents said they were aware of the proposal.”

See: 5 Things Most Americans Don’t Know About Social Security

Find: Here’s How Much You Need To Earn To Be ‘Rich’ in 23 Major Countries Around the World

Leaving an inheritance remains still very important to 59% of HNW individuals and somewhat important to 26% of those surveyed. A third of the HNW individuals surveyed said they intend to leave more than 50% of their assets in an inheritance. Another 31% reported that they intend to bequeath 26-50% of their assets. Only 8.4% were unsure about what percentage of their assets would be included in the inheritance they leave.

Finally, another interesting finding is that 66% of HNW individuals plan to donate part of their estate to charitable causes– assets left to charitable organizations aren’t subject to estate taxes, which is a bonus.

More From GOBankingRates

Fourth Stimulus Checks Are Coming From These States — Is Yours on the List?

Social Security Benefits Might Get Cut Early — What Does It Mean for You?

When Social Security Runs Out: What the Program Will Look Like in 2035

This article originally appeared on GOBankingRates.com: Warren Buffet, Kevin O’Leary and Other Millionaires are Concerned About Inheritances