Warren Buffett's Airline Holdings Rise on Wednesday

- By James Li

On Wednesday, Warren Buffett (Trades, Portfolio)'s airline holdings soared on strong earnings results from United Continental Holdings Inc. (UAL).

Warning! GuruFocus has detected 4 Warning Sign with UAL. Click here to check it out.

The intrinsic value of UAL

As of 11:30 a.m., United's share price increased 4.81% from its previous close of $83.52 on strong earnings guidance for the year. Shares of Delta Air Lines Inc. (DAL) and American Airlines Group Inc. (AAL) increased 2.47% and 2.25% respectively.

United

The Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) CEO has not released his third-quarter portfolio as the deadline is 45 days after quarter-end. As of the second quarter, Berkshire owns 26,684,542 shares of United.

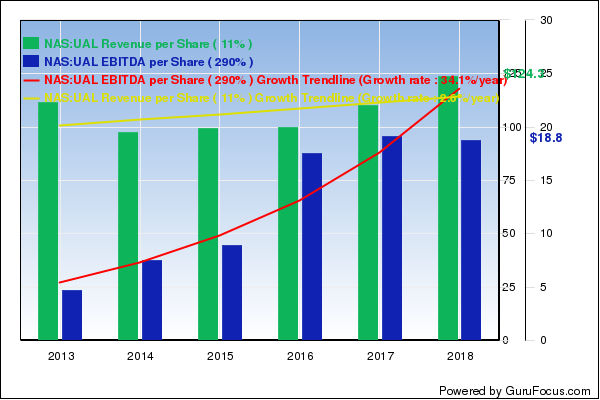

The Chicago-based airline reported net income of $836 million, or $3.06 in diluted earnings per share, for the quarter ending Sept. 30. CEO Oscar Munoz said the stand-out performance during the quarter produced double-digit revenue growth, more than offsetting the steep increase in fuel costs. GuruFocus ranks United's profitability 7 out of 10 on several good signs, which include expanding operating margins, a moderately strong Piotroski F-score of 6 and a three-year revenue growth rate that outperforms 61% of global competitors.

Chief Commercial Officer Andrew Nocella said on the earnings call that consolidated passenger revenues per available seat mile increased 6.1% year over year, exceeding the high end of the guidance range of 4-6%. Domestic passenger revenues per available seat mile increased 6.7%, driven by strong customer demand and close-in yields. Nocella discussed how the company's new "revenue management system" Gemini allowed United to increase its load factor to record levels "without increasing the involuntary denial board rate," which has declined approximately 87% from the prior-year quarter and 98% from two years ago.

United President Scott Kirby said the company's growth plan is working and the airline is making progress toward its adjusted earnings per share target of $11-13 in 2020. Management increased its full-year earnings guidance to $8-$8.75, marking "the third time in 2018."

American

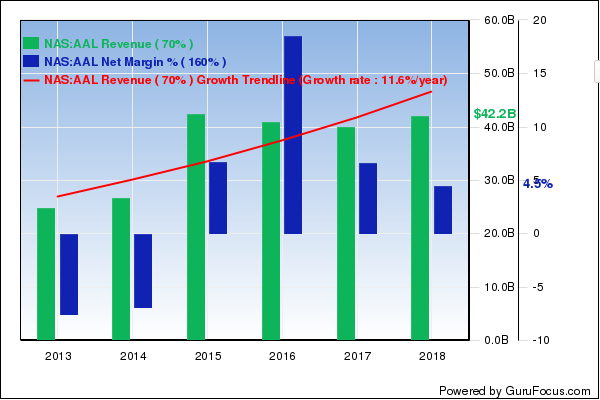

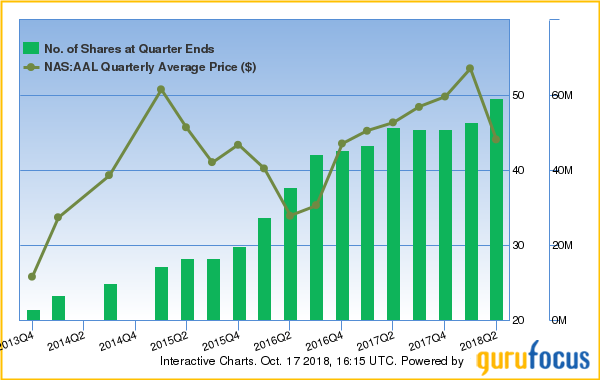

Berkshire owns 44.7 million shares of American as of the second quarter. The company's share price of $33.77 is close to its median price-earnings valuation. With a price-earnings ratio of 9.87, American trades below its Peter Lynch earnings line.

Dallas-based American operates an average of nearly 6,700 flights per day to approximately 350 destinations in more than 50 countries. GuruFocus ranks American's profitability 6 out of 10: although the company's three-year revenue growth rate outperforms 86% of global competitors, net profit margins of 3.75% are underperforming 64% of global airlines.

Other gurus with holdings in American include PRIMECAP Management (Trades, Portfolio) and Bill Nygren (Trades, Portfolio).

Delta

Berkshire owns 63,665,840 shares of Delta as of the second quarter. Shares of Delta trade around $54.07, close to its median price-earnings valuation.

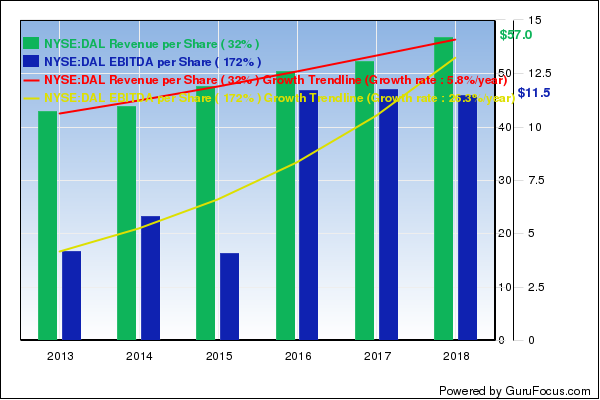

Atlanta-based Delta said on Oct. 11 that adjusted earnings for the quarter ending Sept. 30 were $1.80, the high end of the guidance. CEO Ed Bastian added the 8% revenue growth, combined with flat non-fuel unit cost performance, helped offset 85% of the $655 million fuel cost increase in the quarter. Expanding operating margins, a three-year EBITDA growth rate of 40.70% and a three-year earnings per share growth rate of 85.10% contributed to a GuruFocus profitability rank of 7.

Disclosure: No positions.

Read more here:

US Market Indexes Fall After Big Rally

Is Buffett Actually Thinking About Buying an Airline?

Charlie Munger: Investment Advisers Are Not Always Bad News

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with UAL. Click here to check it out.

The intrinsic value of UAL