Warren Buffett's Apple Soars on 4th-Quarter Earnings Beat

Shares of Apple Inc. (NASDAQ:AAPL), the top holding of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), closed approximately 2% higher in aftermarket trading on Tuesday, boosted by strong iPhone and services revenue growth during the holiday 2019 quarter.

For the quarter ending December 2019, the Cupertino, California-based tech giant reported net income of $22.236 billion, or $4.99 in diluted earnings per share, compared with net income of $19.965 billion, or $4.18 in earnings per share, in the prior-year quarter.

Company reports record revenue boosted by iPhone sales, Services and Wearables

Apple CEO Tim Cook said on the earnings call that revenues for the quarter were $91.8 billion, up 8% from the prior-year quarter and "the highest quarterly revenue ever," fueled by strong demand in the company's new iPhone products, which include the iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max. IPhone sales totaled $55.97 billion, up 8% from the prior-year quarter and outperforming the Refinitiv estimate of $51.62 billion. Chief Financial Officer Luca Maestri added that the customer satisfaction rate for Apple's iPhone 11 products were 98% in the U.S., lauding features like increased battery size and an advanced camera.

Cook further said that Services revenues reached a record $12.7 billion, driven by strong growth in Apple Music and the App Store. The CEO said App Store revenues were $386 million on New Year's Day, building on the double-digit growth set during the December 2019 quarter. Additionally, sales in AirPods and the Apple Watch boosted revenues in Wearables.

Stock rises in aftermarket trading despite wide guidance range

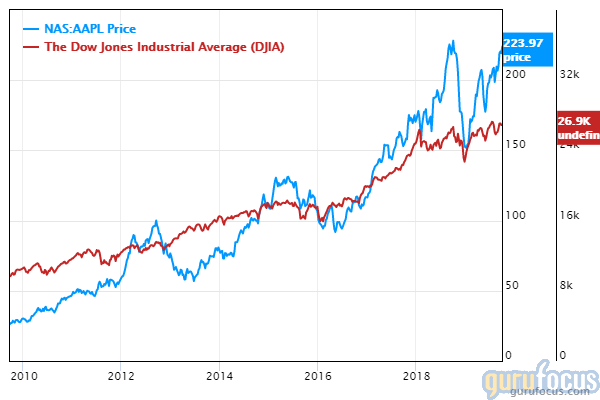

While shares of Apple closed at $317.69, shares accelerated higher in aftermarket trading on the heels of posting results that outperformed top-line and bottom-line estimates. Meanwhile, the Dow Jones Industrial Average closed at 28,722.85, up approximately 187 points from Monday's close of 28,535.80.

Apple said that revenues for the March quarter are expected to range between $63 billion and $67 billion. While the guidance range exceeded the consensus estimate of $62.45 billion, Cook warned that it is wider than normal as China continues grappling with the coronavirus outbreak. Cook said to CNBC's Josh Lipton that the company has restricted travel in China, closed one store and provided health kits to its employees in Wuhan.

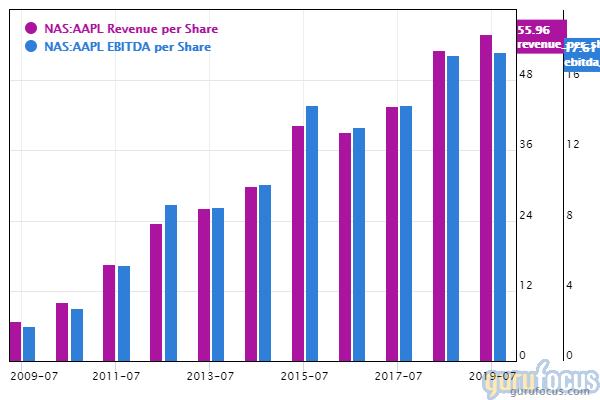

GuruFocus ranks Apple's profitability 10 out of 10 on several positive investing signs, which include margins and returns outperforming over 96% of global competitors despite operating margins contracting approximately 3.4% per year on average over the past five years. Additionally, the company's business predictability ranks 4.5 stars out of five on strong and consistent revenue and earnings growth over the past 10 years.

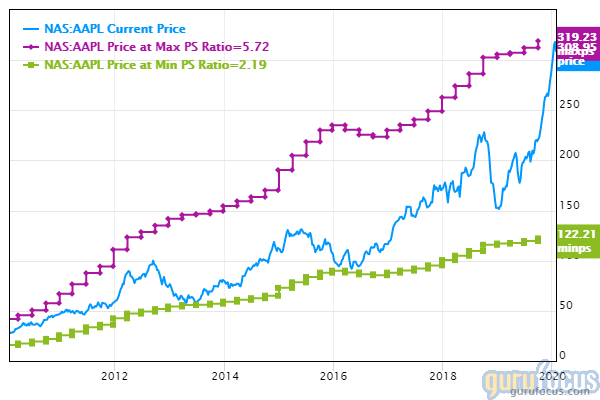

Apple's valuation ranks just 1 out of 10 on several signs of overvaluation, including a share price, price-earnings ratio, price-book ratio and price-sales ratio near a 10-year high.

Berkshire has not released its fourth-quarter 2019 portfolio as the deadline is 45 days after the quarter ends.

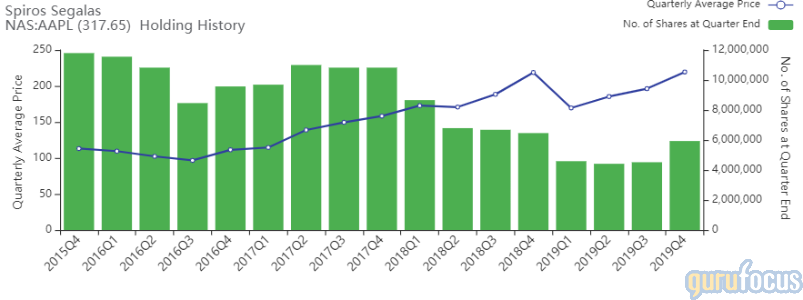

Gurus continue owning shares of Apple despite the company's high valuation: 36 gurus own shares of the tech giant according to the Aggregated Portfolio of Gurus, one of our major Premium features. Spiros Segalas (Trades, Portfolio) added 1,414,193 shares during the fourth quarter, increasing the stake 31.3%.

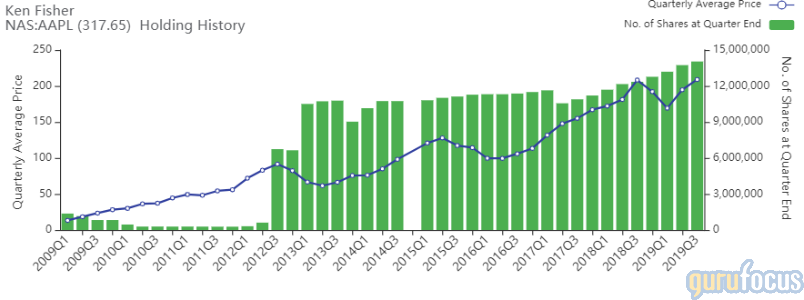

Other gurus with large holdings in Apple include Ken Fisher (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

Disclosure: No positions.

Read more here:

4 Homebuilders With the Strength to Weather Volatile Housing Market

Steven Cohen's Point72 Piles Into Menlo Therapeutics

Einhorn Short Target Netflix Soars Despite Low US Subscriber Growth

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.