Warren Buffett's Berkshire Hathaway may have suffered $70 billion in coronavirus losses on its 10 biggest investments

Chip Somodevilla / Getty

Warren Buffett's Berkshire Hathaway probably suffered about $70 billion in losses on its 10 biggest equity holdings during the coronavirus-driven market sell-off.

The value of Berkshire's stakes in Apple, Bank of America, and other blue-chip stocks dropped by an average of 37% between February 20 and March 18.

Berkshire took a $19 billion hit from Apple's stock-price decline, and a $14 billion hit from Bank of America.

Its worst performer was Delta Air Lines, down 60%, while Kraft Heinz stock fell only 14%.

Warren Buffett's Berkshire Hathaway probably recorded about $70 billion in losses on its 10 biggest equity investments in the past month. The coronavirus-fueled market sell-off decimated the value of its shares in Apple, Coca-Cola, Delta Air Lines, and other blue-chip companies.

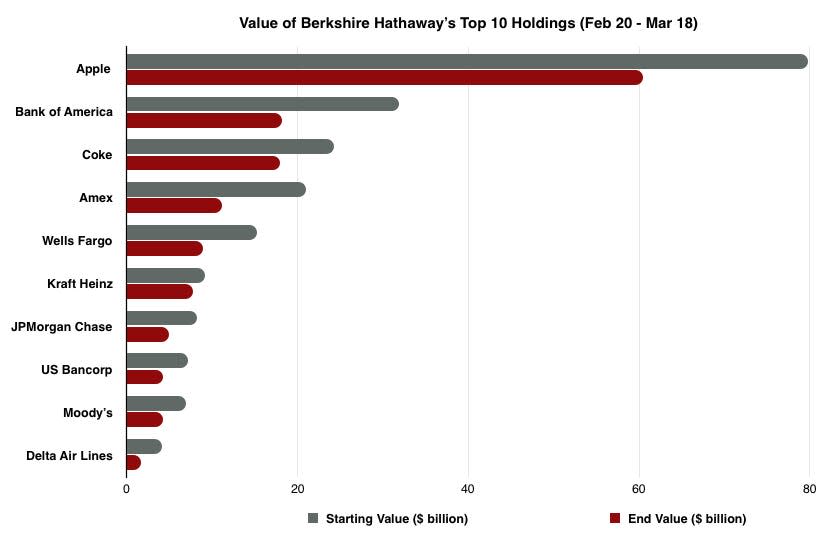

The famed investor's conglomerate saw its top 10 holdings suffer an average drop in share price of 37% between February 20 and the close of trading on March 18. These figures assume Berkshire hasn't tweaked its portfolio since disclosing it for the end of December.

Apple's stock price tumbled about 23% in less than four weeks, slashing the value of Berkshire's 5.6% stake in the iPhone maker by around $19 billion. Bank of America's stock plummeted 43% over the same period, wiping close to $14 billion off Berkshire's investment in the lender.

Berkshire's stakes in American Express, Wells Fargo, and US Bancorp shrank in value by at least 40%. Its shares in Moody's and JPMorgan Chase, down more than 37%, weren't far behind. The worst performer was Delta — the airline's stock price dived 60% as travel restrictions and fear of flying hammered demand.

Berkshire's Coca-Cola shares tumbled by a quarter as well. Surprisingly, its Kraft Heinz investment was the best of a bad lot, sliding only 14%. Investors may be betting the food titan benefits from consumers hoarding cheese slices and ketchup, or they might spy value in a stock that has already plunged more than two-thirds in the past two years.

The overall worth of Berkshire's 10 biggest stock positions dropped from about $208 billion to $140 billion in less than a month — a $68 billion decline. Here's a chart showing the astounding wealth destruction:

Business Insider

Read the original article on Business Insider