Warren Buffett's Kraft Heinz Sets New 52-Week Low on SEC Subpoena

- By James Li

The Kraft Heinz Co. (KHC), one of Berkshire Hathaway Inc. (BRK-A)(BRK-B) CEO Warren Buffett (Trades, Portfolio)'s top 10 holdings as of fourth-quarter 2018, set a new 52-week low on Friday morning on news it had slashed its dividend and received a subpoena from the U.S. Securities and Exchange Commission.

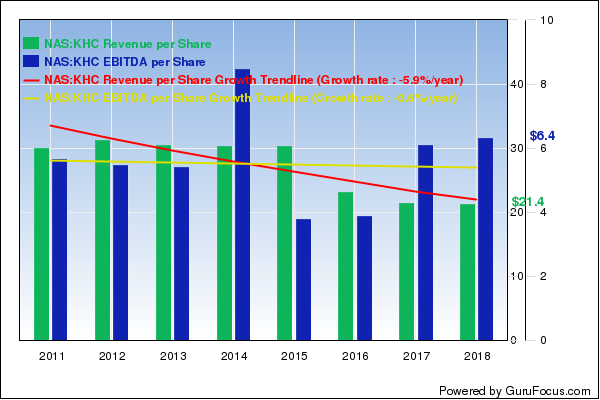

For the quarter ending Dec. 31, 2018, the Pittsburgh and Chicago-based packaged foods manufacturer reported net sales of $6.9 billion and adjusted earnings of 84 cents per share, underperforming consensus estimates of $6.93 billion for net sales and 94 cents for adjusted earnings per share.

Company discloses weak results and SEC subpoena in regards to accounting policies

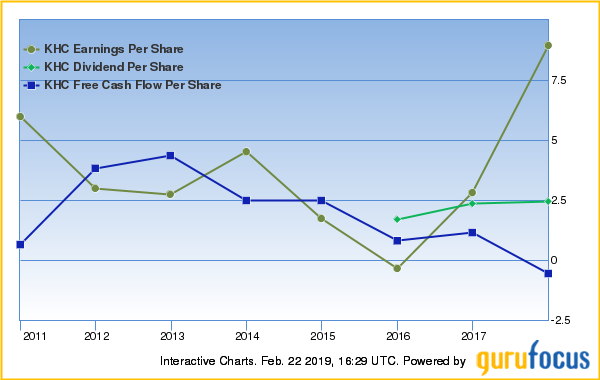

Kraft Heinz CEO Bernardo Hees said earnings results "fell short of expectations" primarily due to unanticipated cost inflation and lower-than-planned savings. The U.S. segment's adjusted EBITDA for the quarter declined 16.3% from the prior-year quarter as lower pricing and investments to build strategic capabilities offset key benefits from volume-mix growth. CNBC's Angelica LaVito and Christine Wang further added that Kraft Heinz cut its dividend to 40 cents per share as the company seeks to "accelerate the deleveraging process to provide greater balance sheet flexibility."

Kraft Heinz also disclosed it received a subpoena from the SEC regarding an investigation into the company's procurement area. Per the request, the company increased fourth-quarter 2018 cost of goods sold by $25 million as an out-of-period correction. Despite this, the company said it is cooperating with the SEC and such matters are not expected to materially change current or prior results.

Stock sets new 52-week low

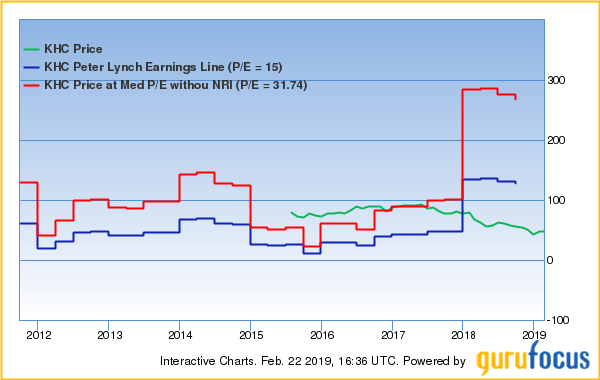

Kraft Heinz set a new 52-week low of $34.57 in morning trading, representing a 28.25% nosedive from the previous close of $48.18.

Disclosure: No positions.

Read more here:

Warren Buffett's Berkshire Sells Oracle, Trims Apple and Buys 3 in 4th Quarter

Fiat Chrysler Nosedives on Increased Economic Slowdown Fears

Walt Disney Soars on Earnings Beat

This article first appeared on GuruFocus.