Warren Buffett's Top 5 Holdings as of the 2nd Quarter

- By James Li

According to top 10 holdings statistics, a Premium feature of GuruFocus, the top five holdings of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) as of the second quarter were Apple Inc. (NASDAQ:AAPL), Bank of America Corp. (NYSE:BAC), Coca-Cola Co. (NYSE:KO), American Express Co. (NYSE:AXP) and The Kraft Heinz Co. (NASDAQ:KHC).

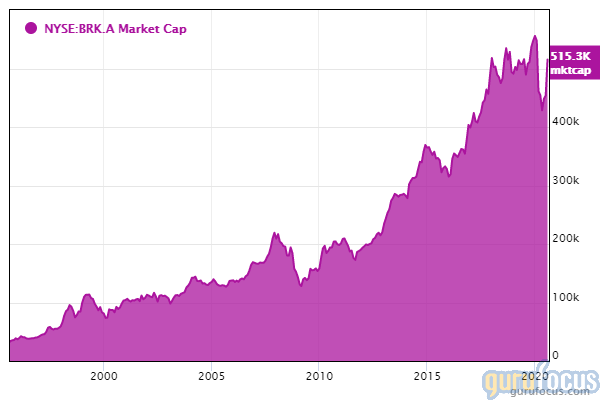

Buffett, who is celebrating his 90th birthday on Aug. 30, studied under the legendary Benjamin Graham at Columbia University in 1951. The "Oracle of Omaha" purchased Berkshire Hathaway, which was then a textile manufacturing company, during the 1960s. Under his leadership, shares of Berkshire averaged a 21.4% compounded annual gain in book value per share from 1965 to 2006. The Omaha, Nebraska-based insurance conglomerate's market cap stood at approximately $519 billion on Thursday.

Buffett follows a value investing strategy based on his mentor's approach. The legendary guru and his co-manager, Charlie Munger (Trades, Portfolio), seek companies using a four-criterion approach to investing: understandable business, favorable long-term prospects, operated by honest and competent people and available at a very attractive price.

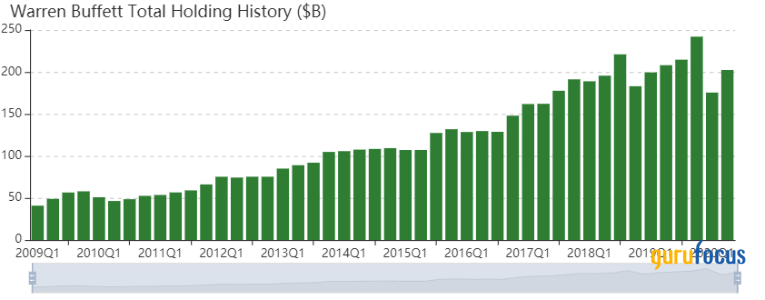

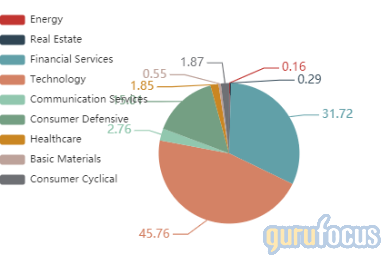

As of the June-quarter filing date, Berkshire's $202.41 billion equity portfolio contains 44 stocks, with one new position and a turnover ratio of 1%. The top three sectors in terms of weight are technology, financial services and consumer defensive, representing 45.76%, 31.72% and 15.01% of the equity portfolio.

Apple

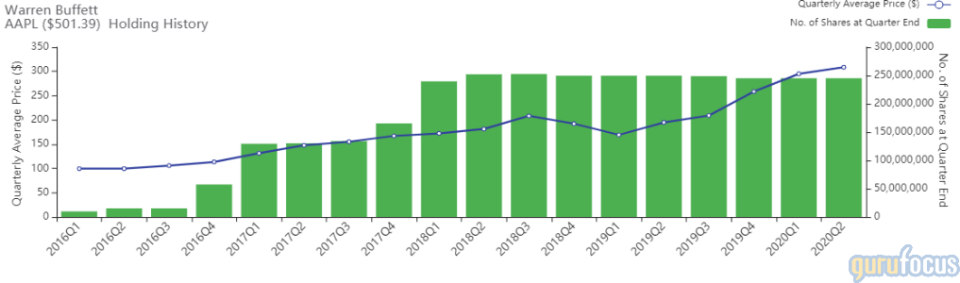

Berkshire owns 245,155,566 shares of Apple, unchanged from the first-quarter filing. Shares occupy 44.18% of the equity portfolio, up from the previous quarter's weight of 35.52%.

On Thursday, shares of the Cupertino, California-based tech giant closed at $500.04, down 1.20% from Wednesday's close of $506.09. Berkshire has gained over $80 billion in its investment in Apple since initially buying shares during the first quarter of 2016.

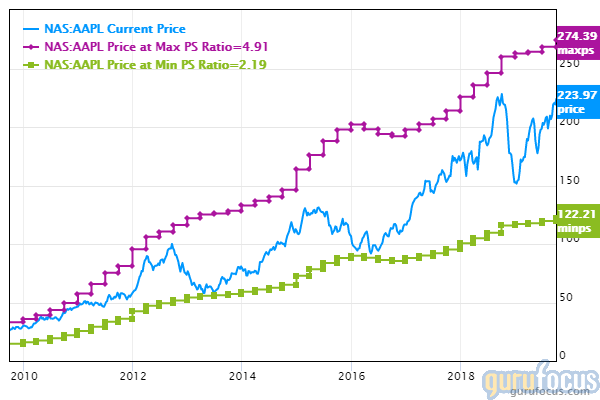

GuruFocus ranks Apple's profitability 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and margins and returns that are outperforming over 95% of global competitors. Despite this, Apple's valuation ranks 1 out of 10 on several signs of overvaluation, which include price-book and price-sales ratios near 10-year highs and are underperforming over 90% of global hardware companies.

Bank of America

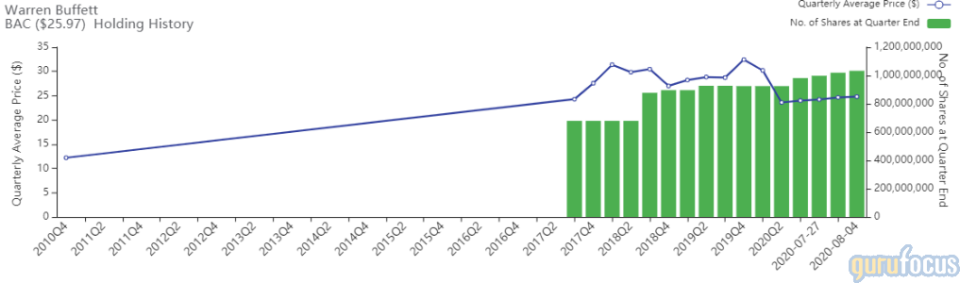

According to GuruFocus Real-Time Picks, a Premium feature, Berkshire owns 1,032,852,006 shares of Bank of America as of Aug. 4, giving the stake 14.57% weight in the equity portfolio.

GuruFocus ranks the Charlotte, North Carolina-based bank's financial strength rank 3 out of 10 on the back of debt ratios underperforming over 64% of global competitors despite equity-to-asset ratios outperforming over 56% of global banks.

Coca-Cola

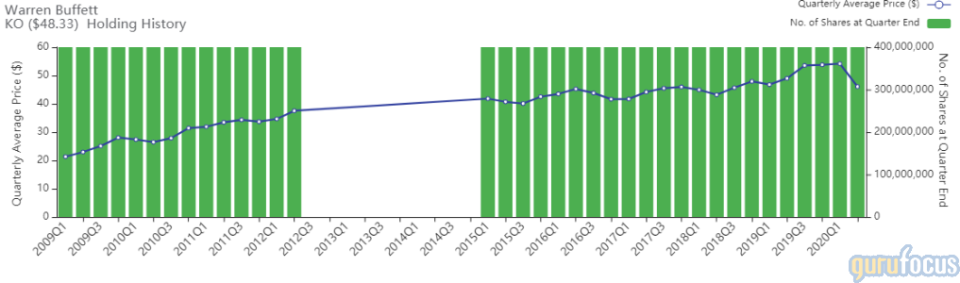

Berkshire owns 400 million shares of Coca-Cola, giving the position 8.83% weight in the equity portfolio.

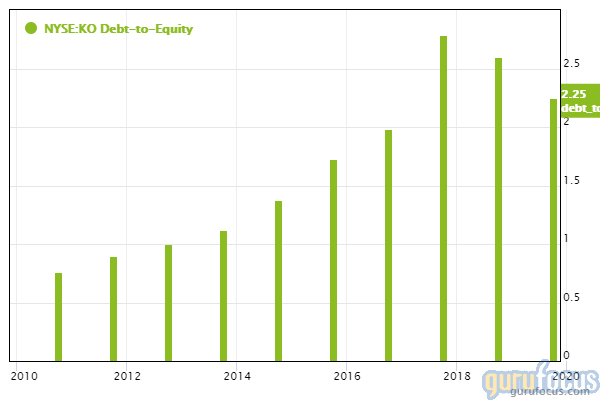

GuruFocus ranks the Atlanta-based beverage giant's financial strength 5 out of 10, weighed down by debt-to-equity ratios near 3 and underperforming 94% of global competitors despite a strong Altman Z-score of 3.43.

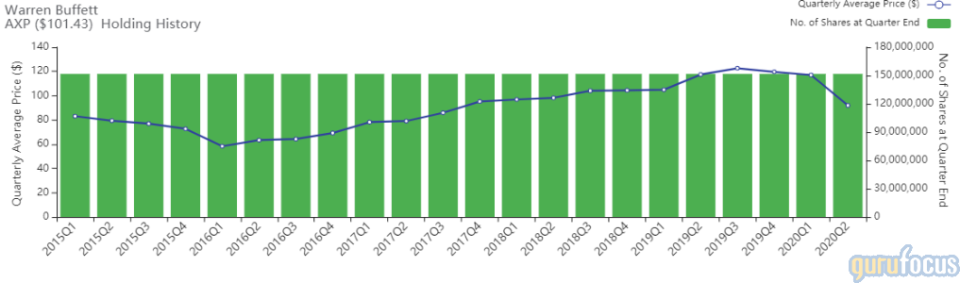

American Express

Berkshire owns 151,610,700 shares of American Express, giving the holding 7.13% weight in the equity portfolio.

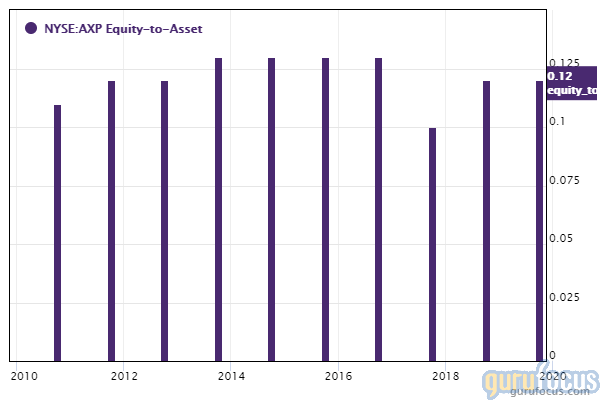

GuruFocus ranks the New York-based credit card company's financial strength 3 out of 10, weighed down by equity-to-asset and debt-to-equity ratios underperforming over 68% of global competitors.

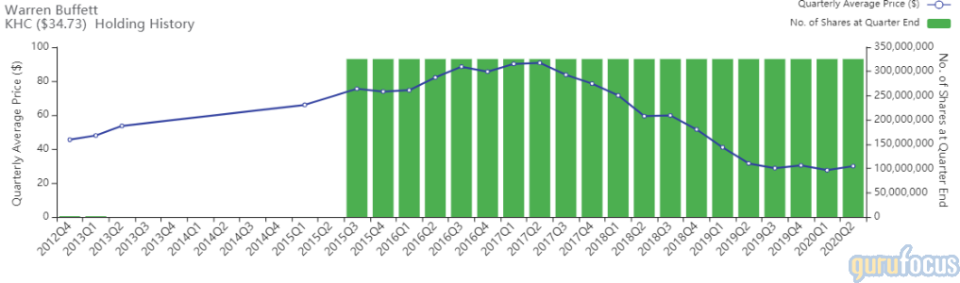

Kraft Heinz

Berkshire owns 325,634,818 shares of Kraft Heinz, giving the position 5.13% weight in the equity portfolio.

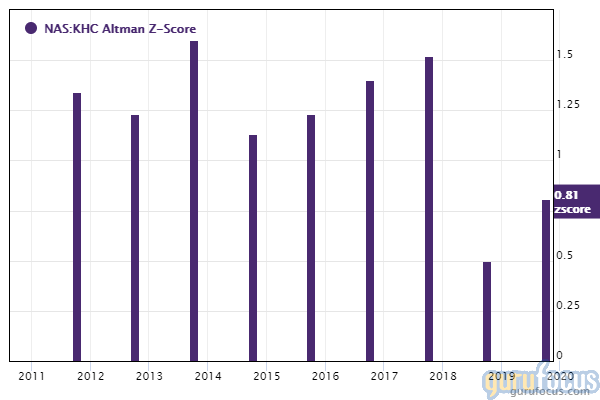

GuruFocus ranks Kraft Heinz's financial strength 4 out of 10 on several warning signs, which include a weak Altman Z-score of 0.79 and debt ratios that are underperforming over 60% of global competitors.

See also

The following video summarizes Berkshire's top holdings.

Disclosure: The author is long Apple as of this writing. The mention of holdings in this article reflect data as of the June filing and does not include trades made in July-August.

Read more here:

Warren Buffett Scores $80 Billion Gain on Top Holding Apple

Warren Buffett's Market Indicator Breaks 155%

New GuruFocus Screener Feature: Historical Data Screener

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.