Elizabeth Warren hits back at study criticizing $640 billion student debt plan

A leading think tank described presidential candidate Elizabeth Warren’s massive student debt cancellation plan as “regressive” and “expensive,” arguing that it wouldn’t help low-income borrowers much relative to higher-income counterparts.

Senator Warren’s (D-MA) office pushed back against the study, telling Yahoo Finance:

"This is a highly progressive proposal — we're taxing the fortunes of people with over $50 million in wealth to provide student loan debt cancellation to 42 million lower-income and middle-class Americans,” a Warren aide said in a statement. “Experts in student loan debt said the proposal will 'greatly benefit households with the least ability to repay,' help close the racial wealth gap by substantially increasing Black and Latinx wealth, and provide total debt cancellation to more than 80% of people in the bottom 60% of incomes, while providing no cancellation to anyone in the top 5% of incomes."

Brookings Institution Senior Fellow Adam Looney wrote a scathing analysis of the $640 billion plan, arguing that “despite her best intentions and her description of the plan as progressive, a quick analysis finds the Warren proposal to be regressive, expensive, and full of uncertainties.”

The key problem, according to Looney, is that the “loan relief is… worth more to high-income, highly-educated borrowers, and less to lower-income borrowers,” he said. So, ultimately, “the true effect of the policy is to be more regressive than the simple analysis suggests.”

Looney — who looked at data from the Federal Reserve’s Survey of Consumer Finances from 2016 and factored in interest rates and tuition fees for different courses — also noted that higher-income workers benefited much more from Warren’s debt cancellation plan.

Brookings: Top 40% of borrowers would get 66% of relief

Warren’s plan was essentially structured around annual household income.

The plan would aim to erase $50,000 in student loan debt for every person who has a household income of below $100,000. That $50,000 amount “phases out by $1 for every $3 in income above $100,000.” So a person who earns $130,000 would get $40,000 of debt cancelled, while a person who earned $160,000 would get $30,000 off.

Households who earn more than $250,000 would not qualify for the program.

The plan would be accompanied by a whole host of other public benefits, which are in addition to an increase in the number of grants given to low-income families.

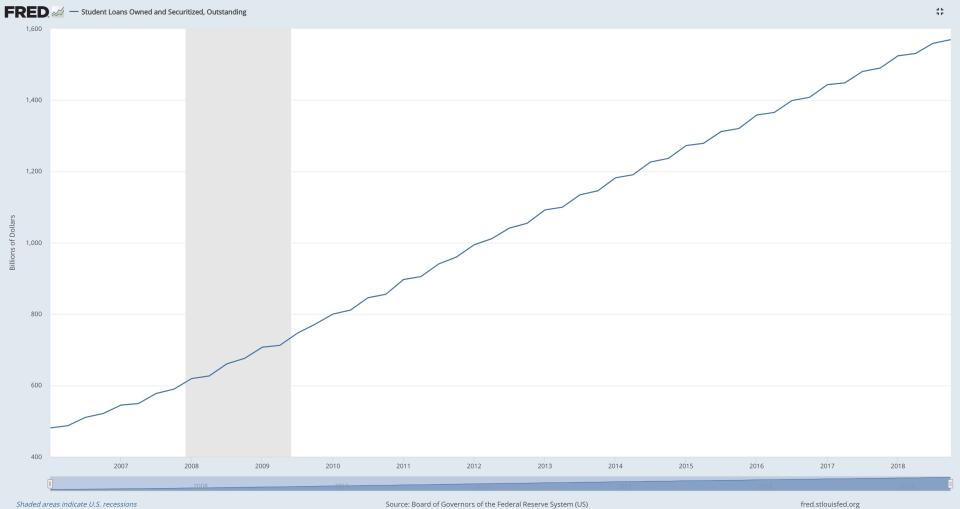

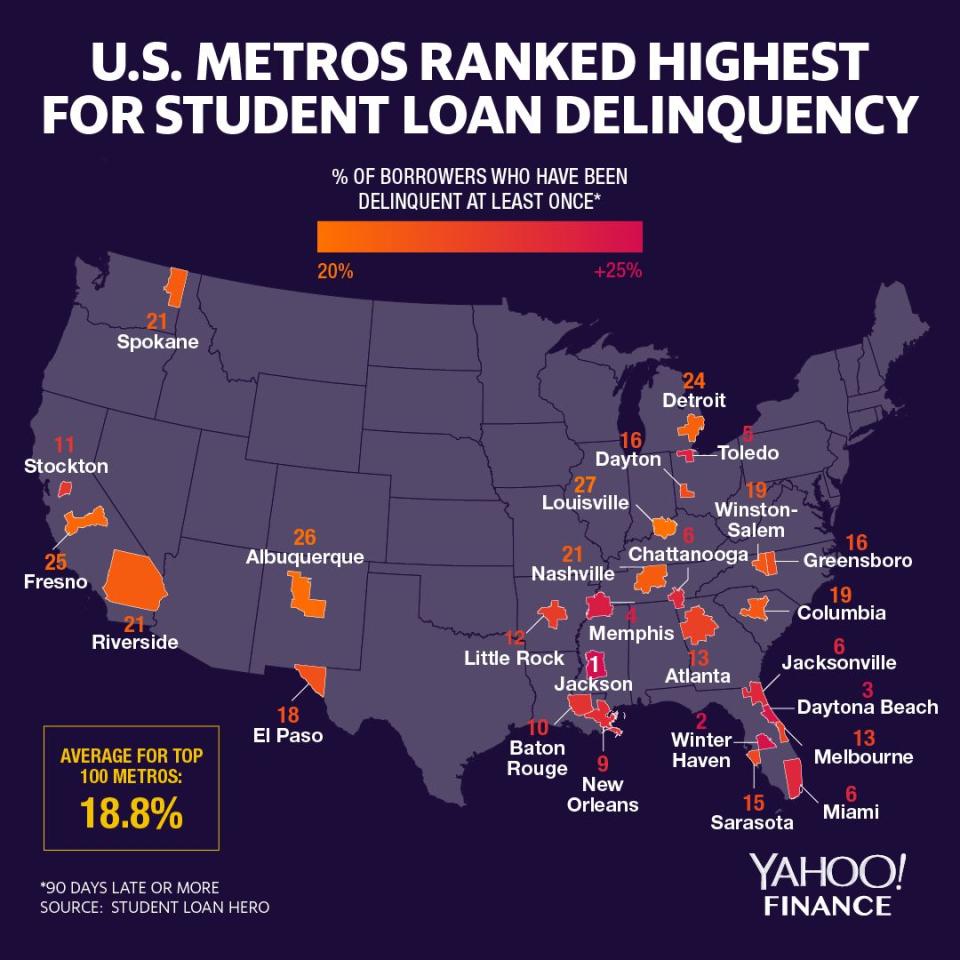

The proposal was hailed as a bold solution to a $1.5 trillion crisis, which has grown unchecked in part due to predatory lending and a lack of federal oversight, which Warren has repeatedly emphasized.

Looney argued that the plan essentially kicked back taxpayers’ money to high-income borrowers because “the top 20 percent of households receive about 27 percent of all annual savings, and the top 40 percent about 66 percent. The bottom 20 percent of borrowers by income get only 4 percent of the savings.”

He noted that in terms of actual debt service payments, while low-income borrowers would save a little — about $569 in annual payments under Warren’s proposal — the top 10% would save $900. And those in the 80th and 90th percentile (i.e. relatively high-income borrowers, but not the top) would get a whopping $2,653 in relief annually, according to Brookings’ analysis.

Marshall Steinbaum, Research Director and a Fellow at the Roosevelt Institute, called Looney’s analysis “misleading,” arguing that it “fails on its own terms, because (in this case) looking at the pure cross-section of student loan borrowers is misleading as to the causes of the student debt crisis.”

Supporters of the plan noted that lower-income borrowers would also be supported by Warren’s other point in the proposal, which is to increase the grants and assistance available to them.

Hence, by reducing the burden on borrowers overall, “this bold debt cancellation proposal, coupled with investments to let Americans graduate college without debt, offers an American promise of enabling access to a college education, regardless of one’s race or family’s ability to pay,” Ohio State University’s Darrick Hamilton said in a statement of support.

Lawyers, doctors, engineers biggest beneficiaries

Looney’s other point was that the occupational group getting the most bang for their buck from the loan forgiveness plan includes lawyers, doctors, engineers, architects, managers, and executives.

For “non-working borrowers,” Looney argued, the cancellation plan would likely have little effect because “by and large, already insured against having to make payments through income-based repayment or forbearances; most have already suspended their loan payments.”

So, for that segment in particular, “while debt relief may improve their future finances or provide peace of mind, it doesn’t offer these borrowers much more relief than that available today.”

However, while low-income borrowers can see relief through existing means, it doesn’t necessarily mean they are being helped.

Looney acknowledged this at the bottom of the study, highlighting that the primary issue is “too few borrowers are enrolled in income-based repayment plans, struggling borrowers face too many hurdles signing up, and it’s too difficult to stay enrolled.”

Happy with status quo

Looney’s recommendation was to keep the status quo, with an income-based repayment plan system that caps monthly payments at 10% of their disposable income and offers forgiveness after 20 years (or 25 if the borrower went to graduate school).

Others, including Warren and other presidential candidates, are arguing for a genuine reform to the existing system.

“When we look at some of these plans, what we’re really doing is applying some medicine to what is understandably a significant pressure point in the U.S. economy,” Bankrate.com Senior Economic Analyst Mark Hamrick told Yahoo Finance.

That pressure point is simple enough to identify — the existing system that perpetuates an increasingly high cost of secondary education and resulting student debt — but the solution was not.

Ultimately, Hamrick added, the ongoing debate over these plans is “constructive.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.