Washington Trust settles over accusations it discriminated against Black, Hispanic borrowers

PROVIDENCE − The Westerly-based Washington Trust bank has agreed to a $9-million, five-year settlement with the Department of Justice over allegations that it discriminated against Black and Hispanic residents trying to get mortgages in Rhode Island between 2016 and 2021.

The bank engaged in "redlining," defined as the practice of discriminating against communities of color by not providing them services, including offering loans and mortgages, the Rhode Island U.S. Attorney's Office alleged in a complaint filed on Wednesday morning in federal District Court.

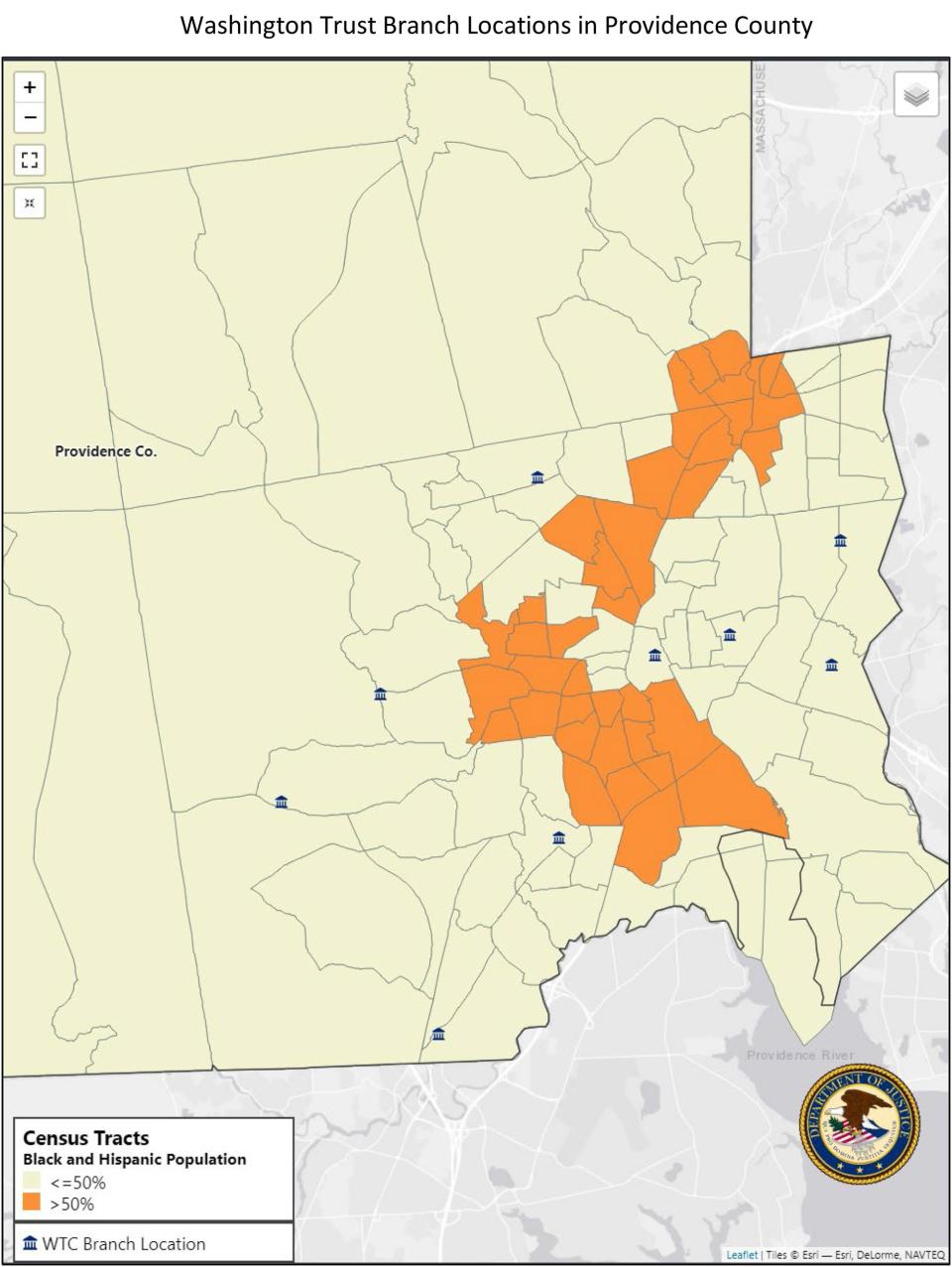

Washington Trust allegedly avoided lending to people from majority Black and Hispanic communities by not opening branches where they live, having nearly no one who speaks Spanish working as a mortgage officer and not having most of its website translated into Spanish, according to the complaint.

Washington Trust relied on mortgage officers based in its branches for the majority of its lending programs, so having no branches in major Black and Hispanic communities meant that the people who lived there did not have access to Washington Trust as a lender, U.S. Assistant Attorney General Kristen Clarke alleged during a news conference Wednesday.

A federal judge still has to approve the tentative agreement.

Page 1 of complaint_exhibits_and_consent_order

Contributed to DocumentCloud by Wheeler Cowperthwaite (The Providence Journal) • View document or read text

What is redlining?

"Redlining" is an illegal practice where lenders, and others in the real estate industry, discriminate against people based on race or national origin by not providing them services, including offering loans and mortgages.

The practice gets its name from the practice of banks, and the federal government, outlining on maps, in red ink, the neighborhoods where people of color lived, deeming them "risky" and not lending to them.

How did Washington Trust allegedly discriminate?

In 2016, Washington Trust designated the entire state as its target area and began expanding, opening more branches, according to the complaint. When it identified the whole state as part of its market, that meant it also had to include the majority Black and Hispanic neighborhoods, U.S. Attorney Zachary Cunha said.

Bank branches were the "linchpin" of the bank's lending strategy, and the bank never opened branches in majority Black or Hispanic communities, Clarke said.

When it did lend to people in those communities, their clients were much more likely to be white, while other banks lending in the state were lending to four times as many Black and Hispanic people in those neighborhoods, Clarke said.

Washington Trust reportedly knew about problems as early as 2011

The bank knew about discrimination issues as early as 2011, both from its internal compliance team and from outside consultants it hired to conduct risk assessments, who came up with the suggestion that the bank develop a marketing campaign to encourage Black and Hispanic consumers to come to them, according to the complaint.

"Washington Trust took no meaningful action in response to these reports indicating that it was underserving Black and Hispanic borrowers and majority-Black and Hispanic neighborhoods, despite having knowledge of its underperformance and its redlining risk," the complaint says.

How did the investigation start?

In 2021, Attorney General Merrick Garland announced an initiative to target redlining. Lawyers at the Department of Justice and the U.S. Attorney's Office in Rhode Island looked at loan-application and demographic data in the state that show Black and Hispanic populations are concentrated in just a few census tracts, finding a "stark" ratio of who was getting loans at Washington Trust compared to other mortgage lenders in the state, Cunha said.

"Peer" lenders to Washington Trust were signing loans for Black and Hispanic people at a rate of four to one, Cunha said.

What would the settlement money do?

The proposed settlement funds are broken into three categories:

$1 million (at $200,000 a year) for groups that help people in majority Black and Hispanic census tracts with credit, financial education, homeownership and foreclosure prevention

$1 million in advertising, outreach, consumer education and credit initiatives

What kind of benefits would would-be homebuyers get?

With a proposed $7 million coming for home buyers, the consent order has rules on how that money can be used, including the maximum each person can get, which is $25,000:

Offering a loan at an interest rate below the market rate

Down payment assistance as a grant

Closing cost assistance as a grant

Payment of initial mortgage insurance premiums

"any other assistance measures approved by the United States"

If every person received the maximum benefit, $25,000, a total of 280 people would benefit. If every person received half the maximum, $12,500, the number of people benefiting rises to 560.

Buying your first home in RI? The state may give you $17,500 for your down payment

Who would qualify for the Washington Trust loan grants?

The loan grants would only be available to people trying to buy property in a majority Black and Hispanic census tract or who live in a majority Black and Hispanic census tract.

What else would Washington Trust be required to do under the settlement?

Washington Trust would be required to "open or acquire" two new "full-service" branches in majority Black/Hispanic census tracts. One of those branches is currently slated for Olneyville. The second branch should be open within two and a half years of the consent decree being signed.

The bank would be required to assign two full-time mortgage loan officers to work in majority Black/Hispanic census tracts. Those officers would be assigned to the two new bank branches once they open.

The company would also be required to translate much of its website into Spanish, according to the proposed agreement.

Page 44 of complaint_exhibits_and_consent_order

Contributed to DocumentCloud by Wheeler Cowperthwaite (The Providence Journal) • View document or read text

What does Washington Trust say about the allegations?

In an unsigned written statement, Washington Trust wrote that it "vehemently" denies the allegations and only agreed to the settlement agreement to "avoid the expense and distraction of potential litigation."

CEO Ned Handy III wrote that the bank has been "fully compliant" with federal fair lending laws and that multiple people at the bank speak languages other than English.

According to the complaint, between 2016 and 2021, only two mortgage loan officers at the company spoke Spanish fluently and one left their position after being there for less than a year.

"As a result, the vast majority of Washington Trust's mortgage loan officers were unable to provide credit services to Spanish-speaking applicants and prospective applicants," according to the complaint.

What happens next?

A judge must sign off on the consent order before any money will be allocated to lenders in affected areas.

Thanks to our subscribers, who help make this coverage possible. If you are not a subscriber, please consider supporting quality local journalism with a Providence Journal subscription. Here's our latest offer.

Reach reporter Wheeler Cowperthwaite at wcowperthwaite@providencejournal.com or follow him on Twitter @WheelerReporter.

This article originally appeared on The Providence Journal: Washington Trust to pay $9M for discriminating against Black, Hispanic residents