Is Waterco (ASX:WAT) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Waterco Limited (ASX:WAT) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Waterco

What Is Waterco's Debt?

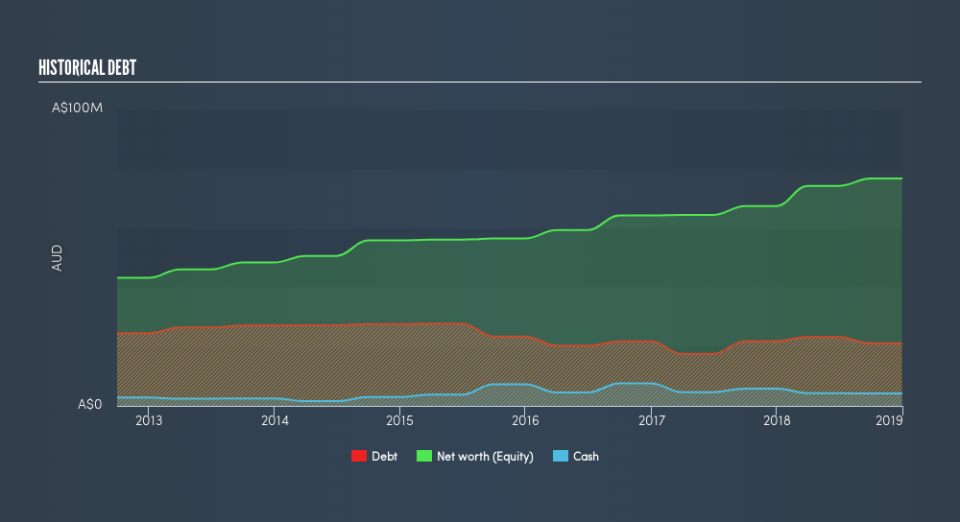

You can click the graphic below for the historical numbers, but it shows that Waterco had AU$20.5m of debt in December 2018, down from AU$21.9m, one year before. However, because it has a cash reserve of AU$4.19m, its net debt is less, at about AU$16.3m.

A Look At Waterco's Liabilities

The latest balance sheet data shows that Waterco had liabilities of AU$30.8m due within a year, and liabilities of AU$16.9m falling due after that. Offsetting these obligations, it had cash of AU$4.19m as well as receivables valued at AU$17.0m due within 12 months. So it has liabilities totalling AU$26.5m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Waterco is worth AU$64.1m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Waterco's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 5.2 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Importantly, Waterco's EBIT fell a jaw-dropping 27% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Waterco will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Waterco created free cash flow amounting to 11% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say Waterco's EBIT growth rate was disappointing. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Overall, we think it's fair to say that Waterco has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.