Watts Water Technologies, Inc. (NYSE:WTS)'s Could Be A Buy For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Watts Water Technologies, Inc. (NYSE:WTS) is about to trade ex-dividend in the next 4 days. If you purchase the stock on or after the 29th of August, you won't be eligible to receive this dividend, when it is paid on the 13th of September.

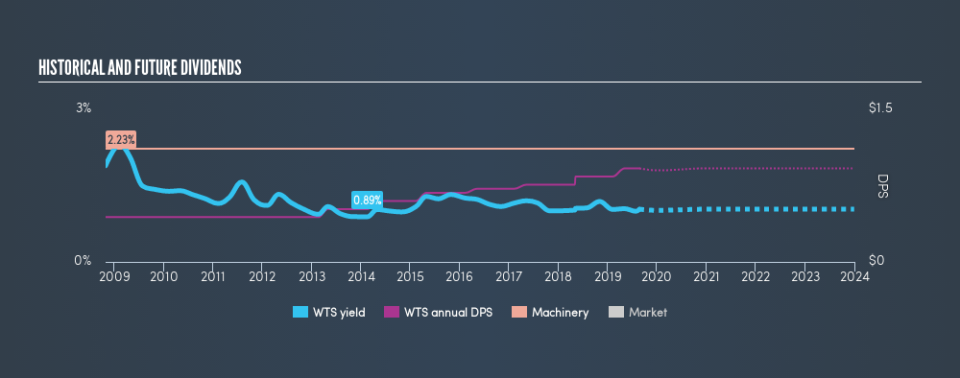

Watts Water Technologies's upcoming dividend is US$0.23 a share, following on from the last 12 months, when the company distributed a total of US$0.92 per share to shareholders. Calculating the last year's worth of payments shows that Watts Water Technologies has a trailing yield of 1.0% on the current share price of $88.76. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Watts Water Technologies

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Watts Water Technologies paid out just 22% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 19% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, Watts Water Technologies's earnings per share have been growing at 17% a year for the past five years. The company has managed to grow earnings at a rapid rate, while reinvesting most of the profits within the business. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, Watts Water Technologies has lifted its dividend by approximately 7.7% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Watts Water Technologies? Watts Water Technologies has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. Overall we think this is an attractive combination and worthy of further research.

Ever wonder what the future holds for Watts Water Technologies? See what the nine analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.