Wayne County budget up almost $1 million, but taxes stable for 2024

The draft of Wayne County's 2024 budget totals nearly $40 million, almost a million more than 2023, but nevertheless has no increase in taxes.

The Wayne County commissioners approved the draft on Nov. 22 for advertising, with intentions to pass the final budget at the Thursday, Dec. 14, meeting at the courthouse, which begins at 10:30 a.m.

Chief Financial Officer Vicky Botjer commented, "We have continued to budget conservatively. We tried to estimate our expenses at what is realistic, and we try not to overestimate revenues. That's how you create good fiscal management and are able to absorb some of these things that pop up. Our staff and department heads really are great; they don't overspend and are good fiscal stewards of taxpayer dollars."

Commissioner Chairperson Brian Smith stated, "Everybody here worked hard on the budget. We did ask our department heads to be conservative. We are looking at being conservative through the year... We are using carry-over funds to balance the budget because we care enough about our taxpayers to know that with interest rates up, with gasoline up, prices up, everything up, we are trying to be as conservative as we can and keep taxes level for the people that we serve."

When property values were reassessed countywide in 2021, about 30% of property owners saw an increase in taxes. Commissioner James Shook said they kept these taxpayers in mind when the budget was being prepared.

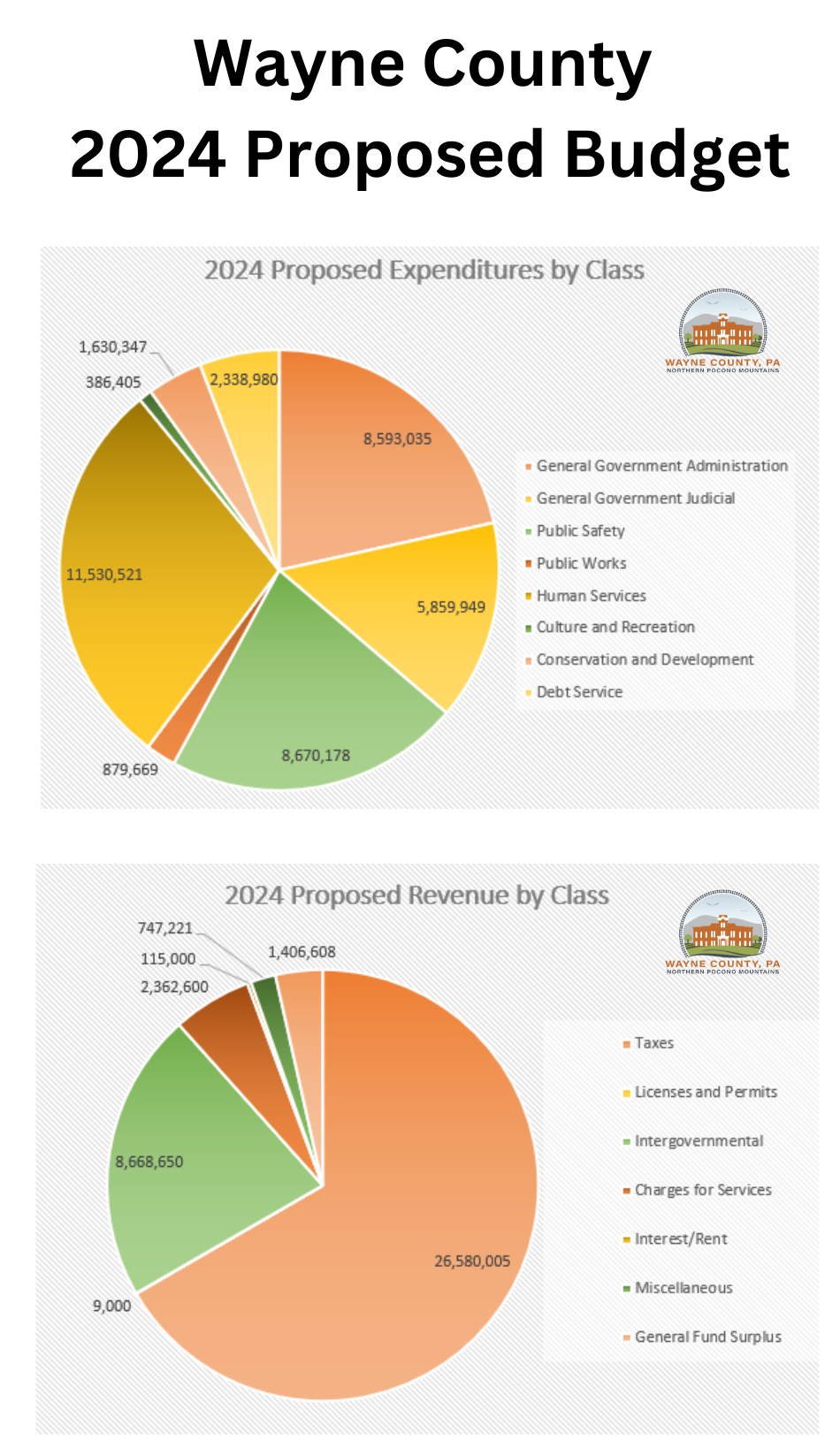

Botjer gave an overview of the $39,889,094.46 budget, which is up from 2023 by $965,037.89.

The General Fund 2023 Budget included a projected use of carryover from the prior year of $1,324,810.00. 2023 has had some savings in salaries and benefits costs for long-serving employees who retired and some staffing re-alignment.

Real estate tax collections continued to be higher than historically used estimates of 90.5%.

Unanticipated costs for IT systems in several departments were offset by some reductions in the cost of maintenance contracts related to prior and current year IT system investments. Botjer noted that while it is anticipated that the planned deficit may be closer to break-even for 2023, it is not anticipated that in 2024 there will be an operational surplus.

The commissioners challenged each department to evaluate operations during the 2024 budget process. These ranged from concepts as simple as printing two-sided copies to difficult topics including staffing levels and succession planning.

"This budget maintains and funds the level of services our citizens require and deserve and keep taxes flat for 2024," Botjer said.

The estimated collection of real estate taxes has been increased from a historic 90.5% to 92% of the gross tax duplicate. This means that the proposed tax revenue line item is larger than in 2023. The millage rate, nonetheless, is unchanged.

2024 will also be the final year to plan to actively benefit from any federal American Rescue Plan funds that can be used for operations. Botjer added that effective management of these funds has provided significant investment income and the committed funds on hand for projects will continue to provide returns.

The 2024 proposed budget has an estimated use of Fund Balance from prior years of $1,406,608.83.

"Per the adopted Fund Balance policy, the county has met our goal of having an unassigned fund balance of at least 60 days of operations, but continued use of fund balance to cover rising expenses must be monitored closely," Botjer said. "Economic outlooks expect inflation to decrease or stabilize in 2024 and the county will continue to monitor expenses, participate in cost containment programs and purchasing coops whenever available. The increase in activity with the county actively seeking grant dollars to fund programs will also help offset costs in rising human services delivery costs and investment in community and economic development projects that will assist in overall growth."

The summary budget is posted on the County website, waynecountypa.gov and is available in the commissioners' office for public inspection and comment.

Peter Becker has worked at the Tri-County Independent or its predecessor publications since 1994. Reach him at pbecker@tricountyindependent.com or 570-253-3055 ext. 1588.

This article originally appeared on Tri-County Independent: Wayne County: No tax increase as 2024 budget rises nearly $1 million