WeWork's biggest problem? It's already being disrupted

WeWork's board is meeting this week as individuals tied to its major investor, SoftBank, push to have Adam Neumann step down as CEO, according to new reporting from the Wall Street Journal.

Those reports are accurate, a person familiar with the matter told Yahoo Finance. The meeting comes amid increased scrutiny of Neumann’s reportedly erratic behavior, including his drug use and mercurial nature — and, of course, the delayed IPO for WeWork, which provides shared working spaces.

WeWork is facing intense scrutiny for its losses and lofty promises — and it hasn’t even gone public yet. In addition to skeptical investors, the co-working company has to worry about competitors stealing customers. And while the concept of shared, flexible workspaces seems to be sticking, there doesn’t seem to be a moat surrounding the business model.

A crowded field of co-working companies

Regus (IWG.L), Knotel (which just became a unicorn), and Industrious are existing juggernauts. The Wing, which was seen as a WeWork for women, now allows male members.

Other players like Liquidspace want to run the platform instead of doing the cost and time-intensive work of building and designing. Akin to Airbnb, it’s merely serving as the platform for freelancers, contractors, and business owners to find a place to work.

While most are operating under the notion that people want to sign up for a yearlong membership, players like Spacious give restaurants and bars a chance to make use of its space during off-hours by renting it out to those looking for a workspace. Splacer is a platform that connects users to art galleries and penthouse suites to throw a party or host a popup for a few hours.

The non-committal nature of work has also boosted business for LiquidSpace, according to new analysis from Thinknum Alternative Data. The San Francisco-based startup has been around since November 2010, just a few months after WeWork. And it’s profitable. There are 24,000 spaces available on the database, compared to 18,000 earlier this year.

“What’s striking about the locations is that they’re not just in city centers as you would find with, say WeWork or Knotel. Instead, you could find a desk or an office in your neighborhood or in ‘cool’ spots like Williamsburg or Red Hook where young entrepreneurs want to be,” Thinknum publisher Joshua Fruhlinger previously told Yahoo Finance.

“Like Airbnb — say you’re a tourist in NYC and you don’t want to stay in midtown with all the other tourists. No, you want to live like a local, so you rent a cool brownstone in Fort Greene. People want local, convenient, and cool places to work in. That writer doesn’t want to go work in midtown, but she may grab a desk at a space in her neighborhood instead of the local cafe with bad wifi,” he added.

Softbank, WeWork’s biggest investor, has been urging the company to postpone its public offering. Last week, the company did just that amid concerns over its valuation and over Neumann. The “We Company,” once valued at $47 billion, has reduced its valuation to as little as $15 billion, according to The New York Times. In the first six months of 2019, WeWork lost $690 million. In 2018, reported a loss of $1.7 billion.

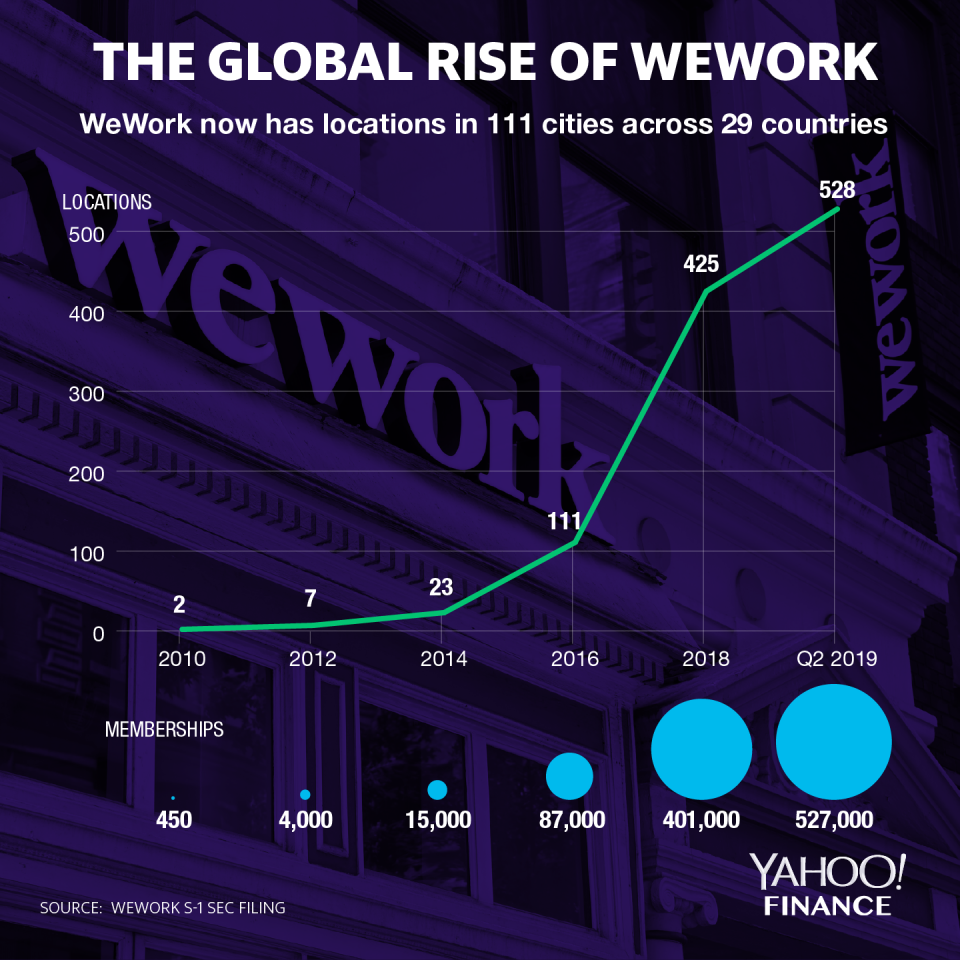

The 9-year-old firm has been trying to reach beyond its identity as a real estate leasing company. Today, its portfolio includes everything from co-living apartments to coding programs through both creation and acquisition. Still, the company makes 93% of its revenue from its core business: membership fees and services.

Forty percent of WeWork’s clients are enterprise customers, meaning large corporations like Salesforce, Microsoft, and UBS rent space for specific departments, like their sales or customer service teams. Companies of all sizes don’t want to be locked into 10- and 15-year leases.

Anyone who has been to a WeWork can identify the distinct look and feel of its spaces — call it clean millennial warehouse with lots of natural light. But that clearly isn’t enough to keep the company afloat.

Melody Hahm is a senior writer at Yahoo Finance, covering entrepreneurship, technology and real estate. Follow her on Twitter @melodyhahm. She also hosts Breakouts, an interview series featuring up-close and intimate conversations with today’s most innovative business leaders.

Read more: