Is Weakness In Plover Bay Technologies Limited (HKG:1523) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

Plover Bay Technologies (HKG:1523) has had a rough three months with its share price down 18%. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Plover Bay Technologies' ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Plover Bay Technologies

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Plover Bay Technologies is:

35% = US$12m ÷ US$34m (Based on the trailing twelve months to December 2019).

The 'return' is the profit over the last twelve months. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.35 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Plover Bay Technologies' Earnings Growth And 35% ROE

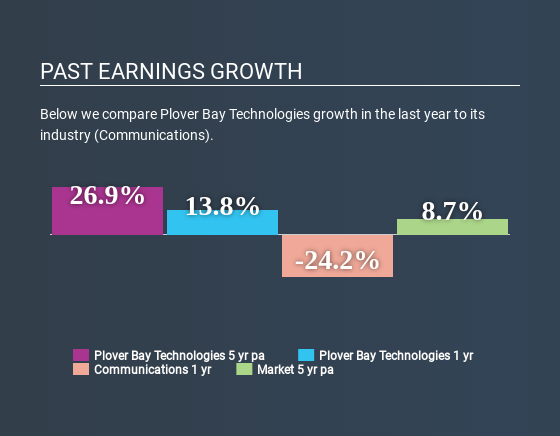

Firstly, we acknowledge that Plover Bay Technologies has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 6.7% also doesn't go unnoticed by us. Under the circumstances, Plover Bay Technologies' considerable five year net income growth of 27% was to be expected.

We then compared Plover Bay Technologies' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 4.9% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Plover Bay Technologies fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Plover Bay Technologies Using Its Retained Earnings Effectively?

Plover Bay Technologies' significant three-year median payout ratio of 89% (where it is retaining only 11% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

Besides, Plover Bay Technologies has been paying dividends over a period of four years. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 75%. As a result, Plover Bay Technologies' ROE is not expected to change by much either, which we inferred from the analyst estimate of 41% for future ROE.

Summary

Overall, we are quite pleased with Plover Bay Technologies' performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad.

So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Plover Bay Technologies and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.