Weekly CEO Buys Highlight

According to GuruFocus insider data, these are the largest CEO buys from the past week.

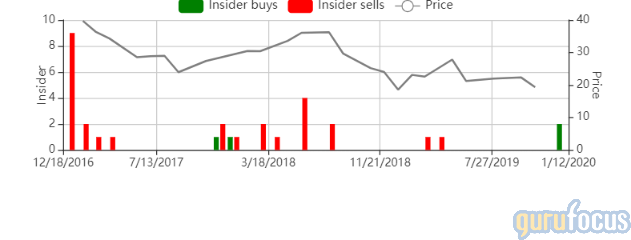

Noble Energy

Noble Energy Inc. (NYSE:NBL) CEO and Director David L. Stover bought 12,000 shares on Dec. 4 for an average price of $20.92. The share price has increased by 4.49% since then.

Noble Energy is an independent oil and gas producer with key assets in the U.S., Israel and West Africa. At the end of 2017, the company reported net proven reserves of 2 billion barrels of oil equivalent. Net production averaged 381,000 barrels of oil equivalent per day in 2017, at a ratio of 51% oil and natural gas liquids and 49% natural gas.

The company has a market cap of $10.46 billion. Its shares traded at $21.86 as of Dec. 6. Net income for the third quarter was $17 million, compared to $227 million for the same period in 2018.

Director Scott D. Urban bought 15,000 shares on Dec. 3 for $20.38 per share. Since then, the price of the stock has increased by 7.26%.

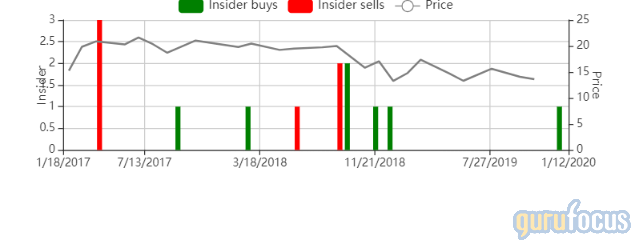

Banc of California

Banc of California Inc. (NYSE:BANC) President and CEO Jared M. Wolff bought 16,500 shares on Dec. 3 for an average price of $15.18. The stock has gained 6.52% since then.

Banc of California is a is a financial holding company. It offers banking and financial services that include lending services and private banking services.

The company has a market cap of $822.79 million. Its shares traded at $16.17 as of Dec. 6. Net loss for the third quarter was $14,132 compared to net income of $11,096 for the prior-year quarter.

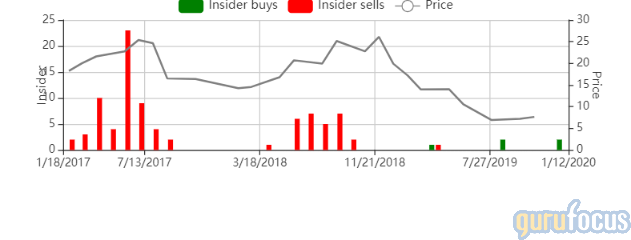

Evolent Health

Evolent Health Inc. (NYSE:EVH) CEO Frank J. Williams bought 35,000 shares on Dec. 3 for an average price of $6.51. Since then, the share price has climbed 18.74%.

Evolent Health provides technology platforms for health care providers that use value-based payment models. The platform, Identifi, provides data aggregation and stratification, value-based care content, electronic medical record optimization, clinical and financial analytics and other applications that help providers standardize care. Evolent also provides value-based operations to its clients, including delivery network alignment, population health performance, pharmacy benefit management, centralized infrastructure and financial and administrative management. Evolent Health primarily generates its revenue within the U.S.

The company has a market cap of $654.04 million. Its shares traded at $7.73 as of Dec. 6. Net loss was $25.5 million for the third quarter, up from $12.4 million in the year-ago period.

President Seth Blackley bought 14,749 shares on Dec. 4 at a price of $6.73. The stock has risen 14.86% since then.

OPKO Health

OPKO Health Inc. (NASDAQ:OPK) CEO and Chairman Phillip Frost bought 110,286 shares during the past week at an average price of $1.58.

OPKO Health is a diversified biotechnology company that operates pharmaceutical and diagnostic development programs. Its diagnostics business includes a core genetic testing operation. It has a development and commercial supply pharmaceutical company, as well as a global supply-chain operation and holding company in Ireland. It also owns a specialty active pharmaceutical ingredients manufacturer in Israel. The company's bio-reference testing business consists of routine testing and esoteric testing. Routine tests measure various health parameters, such as the functions of the heart, kidney, liver, thyroid and other organs.

The company has a market cap of $1.07 billion. Its shares traded at $1.61 as of Dec. 6. Net loss for the third quarter was $62.01 million, compared to a loss of $27.66 million last year.

Frost bought 100,000 shares on Nov. 19 at a price of $1.47; 100,000 shares on Nov. 26 at a price of $1.55; 50,000 shares on Dec. 2 at a price of $1.56; 10,286 shares on Dec. 3 at a price of $1.6; and 50,000 shares on Dec. 5 at a price of $1.6. Since then, the stock has risen 0.63%.

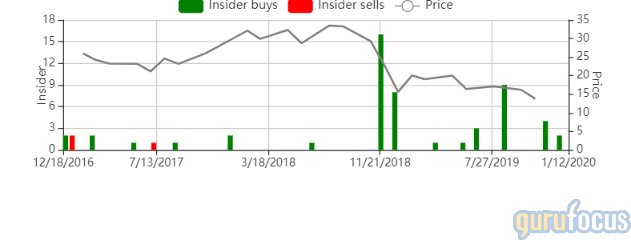

Matador Resources

Matador Resources Co. (NYSE:MTDR) Chairman and CEO Joseph W. Foran bought 10,000 shares on Nov. 29 for an average price of $14.08. The share price has increased by 5.26% since then.

Matador Resources is an independent energy company engaged in the exploration, development, production and acquisition of oil and natural gas resources. The majority of the company's assets are located in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Along with maintaining a portfolio of oil and natural gas properties, Matador works to identify and develop midstream opportunities that support and enhance its exploration and development business. The company often uses advanced formation evaluation, 3-D seismic technology, horizontal drilling and hydraulic fracturing technology to enhance the development of the basins in which it operates.

The company has a market cap of $1.73 billion. Its shares traded at $14.82 with a price-earnings ratio of 8.63 as of Dec. 6. Third-quarter net income was $44 million compared to net income of $17.8 million last year.

Foran also bought 10,000 shares on Nov. 14 for an average price of $14.3 and 10,000 shares on Nov. 18 for an average price of $13.9. Since then, the stock has advanced 6.62%.

Senior Vice President and Chief Accounting Officer Robert T. Macalik bought 1,900 shares on Dec. 3 at a price of $13.95. The share price has risen 6.24% since then.

Director William M. Byerley bought 350 shares on Dec. 2 at a price of $14.31. Since then, the stock has gained 3.56%.

Director Monika U. Ehrman bought 1,000 shares on Nov. 25 at a price of $14.54. Since then, the shares have appreciated 1.93%.

For the complete list of stocks bought by their company CEOs, go to CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.