Weekly CEO Buys Highlight

According to GuruFocus Insider Data, these are the largest CEO buys during the past week.

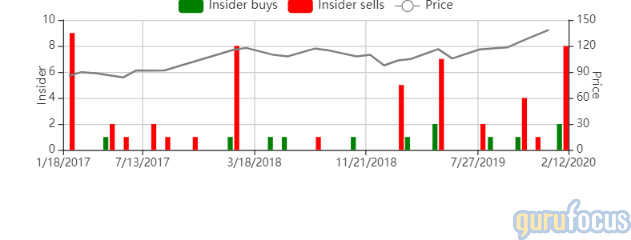

JPMorgan Chase

JPMorgan Chase & Co. (NYSE:JPM) CEO of Asset & Wealth Management, Mary E. Erdoes, bought 51,000 shares on Jan. 15 at a price of $100.00. The price of the stock has increased by 38.2% since.

JPMorgan Chase is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets and operations in dozens of countries. The company is organized into several business segments: investment banking, commercial banking, treasury and securities services, asset management, retail financial services and credit card businesses. JPMorgan Chase is also a major player in the derivatives markets.

The company has a market cap of $426.209 billion. Its shares traded at $138.20 with a price-earnings ratio of 12.89 as of Jan. 17. Fourth quarter 2019 net income was $8.52 billion compared to $7.07 billion for the fourth quarter of 2018.

Erdoes sold 29,597 shares on Jan. 15 at a price of $137.11. The price of the stock has increased by 0.79% since.

Co-President, Chief Operating Officer and CEO of Consumer and Community Banking, Gordon Smith, sold 14,750 shares on Jan. 15 at a price of $137.04. The price of the stock has increased by 0.85% since.

Chief Financial Officer Jennifer Piepszak sold 8,312 shares on Jan. 15 at a price of $137.05. The price of the stock has increased by 0.84% since.

Director Mellody L. Hobson bought 14,600 shares on Jan. 15 at a price of $136.39. The price of the stock has increased by 1.33% since.

Executive Vice President Peter Scher sold 21,949 shares on Jan. 15 at a price of $137.11. The price of the stock has increased by 0.79% since.

Executive Vice President Marianne Lake sold 9,415 shares on Jan. 15 at a price of $137.10. The price of the stock has increased by 0.8% since.

Corporate Controller Nicole Giles sold 3,015 shares on Jan. 15 at a price of $137.1. The price of the stock has increased by 0.8% since.

General Counsel Stacey Friedman sold 6,441 shares on Jan. 15 at a price of $137.10. The price of the stock has increased by 0.8% since.

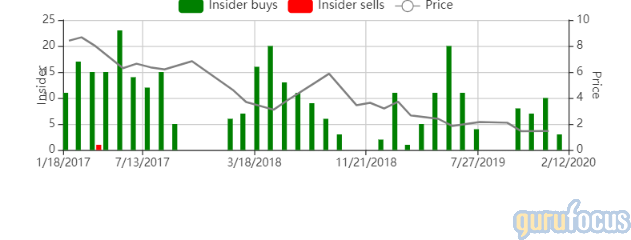

OPKO Health

OPKO Health Inc. (NASDAQ:OPK) CEO, Chairman and 10% Owner, Phillip Frost, bought 100,000 shares during the past week at the average price of $1.46.

OPKO Health is a diversified biotechnology company that operates pharmaceutical and diagnostic development programs. It has a development and commercial supply pharmaceutical company, as well as a global supply-chain operation and holding company and a specialty active pharmaceutical ingredients manufacturer in Israel.

The company has a market cap of $1.04 billion. Its shares traded at $1.56 as of Jan. 17. Net loss for the third quarter of 2019 was $62.01 million compared to a net loss of $27.66 million in the prior-year quarter.

Frost bought 100,000 shares on Dec. 27 at a price of $1.53; 100,000 shares on Dec. 30 at a price of $1.46; 50,000 shares on Jan. 8 at a price of $1.47; 50,000 shares on Jan. 10 at a price of $1.48; and 50,000 shares on Jan. 13 at a price of $1.44. The price of the stock has increased by 8.33% since.

For the complete list of stocks bought by their company CEOs, go to: CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.