Weekly CEO Buys Highlight

- By

According to GuruFocus Insider Data, these were the largest CEO buys during the past week.

Asana

Asana Inc. (NYSE:ASAN) President, CEO, Chair and 10% Owner Dustin A. Moskovitz bought 640,000 shares during the past week at the average price of $47.25.

Asana is a software company. The company provides a platform for work management that helps teams orchestrate work, from daily tasks to cross-functional strategic initiatives. It helps plan marketing campaigns, streamlines processes, manages sales and manage product launches. Also, the company provides project management and workflow management solutions.

The company has a market cap of $9.46 billion. Its shares traded at $57.80 as of June 18.

Net loss for the first quarter of fiscal 2022 was $60.7 million compared to a net loss of $35.8 million in the first quarter of fiscal 2021.

Moskovitz bought 500,000 shares on June 8 at a price of $39.49; 410,000 shares on June 10 at a price of $42.35; 320,000 shares on June 14 at a price of $46.4; and 320,000 shares on June 16 at a price of $48.1. The price of the stock has increased by 20.17% since then.

General Counsel and Corporate Secretary Eleanor B Lacey sold 20,000 shares on June 7 at a price of $40.07 and 10,000 shares on June 10 at a price of $45. Since then, the price of the stock has increased by 28.44%.

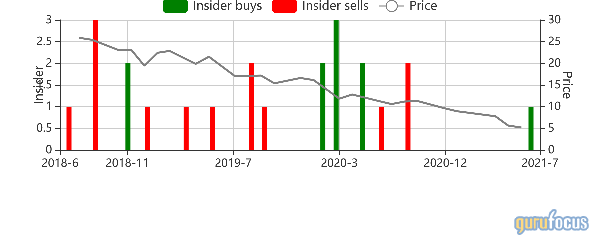

The GEO Group

The GEO Group Inc. (NYSE:GEO) Chairman and CEO George C. Zoley bought 166,644 shares on June 15 at a price of $6.75. The price of the stock has increased by 12.89% since then.

The GEO Group is a real estate investment trust specializing in detention facilities and community-reentry centers. The company leases and oversees secure detention centers, rehabilitation and reentry facilities and service centers for troubled youth. The GEO Group also provides counseling, education, drug abuse treatment, technology-based supervision programs and detainee transportation. The majority of revenue comes from leasing and managing U.S. corrections and detention facilities. The GEO Group also operates in Australia, South Africa and the United Kingdom.

The company has a market cap of $932.60 million. Its shares traded at $7.62 with a price-earnings ratio of 6.68 as of June 18.

First quarter 2021 net income was $50.5 million compared to $25.2 million for the first quarter of 2020.

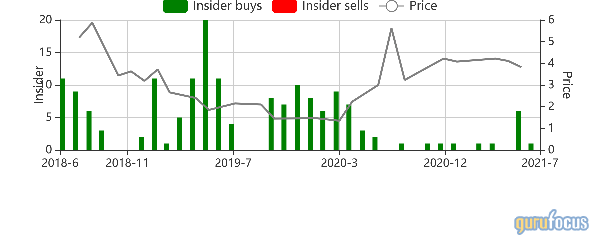

OPKO

OPKO Health Inc. (NASDAQ:OPK) CEO, Chairman and 10% Owner Phillip Frost bought 200,000 shares on June 14 at a price of $3.62. Since then, the price of the stock has increased by 2.21%.

OPKO Health is a diversified biotechnology company that operates pharmaceutical and diagnostic development programs. OPKO's diagnostics business includes a core genetic testing operation.

The company has a market cap of $2.55 billion. Its shares traded at $3.70 with a price-earnings ratio of 19.58 as of June 18.

Net income for the first quarter of 2021 was $31.1 million compared with a net loss of $59.1 million for the comparable period of 2020.

Frost also bought 400,000 shares on May 25 at a price of $3.64. The price of the stock has increased by 1.65% since then.

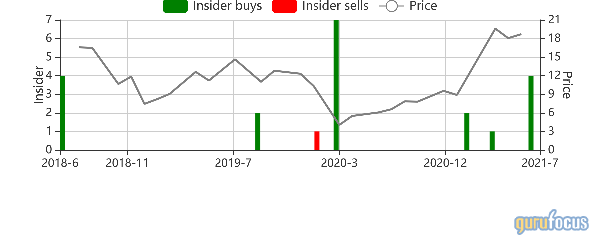

REV Group

REV Group Inc. (NYSE:REVG) CEO Rodney M. Rushing bought 19,292 shares on June 11 at a price of $15.87. Since then, the price of the stock has decreased by 6.43%.

REV Group is a United States-based designer, manufacturer and distributor of specialty vehicles and related aftermarket parts and services. It provides customized vehicle solutions for applications including essential needs, industrial and commercial and consumer leisure. The operating segments of the company are Fire & Emergency, Commercial and Recreation.

The company has a market cap of $961.42 million. Its shares traded at $14.85 with a price-earnings ratio of 138.79 as of June 18.

Second quarter net income was $20.6 million compared to a net loss of $7.6 million in the prior year quarter.

Chief Financial Officer Mark A. Skonieczny Jr. bought 7,000 shares on June 11 at a price of $15.9. The price of the stock has decreased by 6.6% since then.

General Counsel Stephen W. Boettinger bought 1,500 shares on June 11 at a price of $15.64. Since then, the price of the stock has decreased by 5.05%.

Chief Human Resources Officer Christopher M. Daniels bought 3,200 shares on June 11 at a price of $15.79. The price of the stock has decreased by 5.95% since then.

Golub Capital BDC

Golub Capital BDC Inc. (NASDAQ:GBDC) CEO David Golub bought 10,000 shares on June 15 at a price of $15.60. Since then, the price of the stock has decreased by 2.63%.

Golub Capital BDC is an externally managed, closed-end, non-diversified investment management company. The company's investment objective is to generate current income and capital appreciation by investing in senior secured and one-stop loans in U.S. middle-market companies. It also invests in second lien and subordinated loans, warrants and minority equity securities in middle-market companies.

The company has a market cap of $2.56 billion. Its shares traded at $15.19 with a price-earnings ratio of 5.89 as of June 18.

Net income for the second fiscal quarter of 2021 was $91.3 million compared to a net loss of $229.0 million for the second fiscal quarter of 2020.

Golub also bought 4,000 shares on May 28 at a price of $15.78; 4,000 shares on June 4 at a price of $16.06; 4,000 shares on June 8 at a price of $15.99; and 10,000 shares on June 10 at a price of $15.72. The price of the stock has decreased by 3.37% since then.

Chairman Lawrence E. Golub bought 4,000 shares on May 28 at a price of $15.78; 4,000 shares on June 4 at a price of $16.06; 4,000 shares on June 8 at a price of $15.99; 10,000 shares on June 10 at a price of $15.72; and 10,000 shares on June 14 at a price of $15.6. Since then, the price of the stock has decreased by 2.63%.

This article first appeared on GuruFocus.