Wells Fargo Announces Privatization of Asset Management Business

- By James Li

Wells Fargo & Co. (NYSE:WFC) announced on Tuesday that it entered a definitive agreement in which the San Francisco-based bank will sell is asset management business to two private companies.

The bank said it will sell its Wells Fargo Asset Management segment, which owns Wells Fargo Bank N.A. and the business segment's collective investing trusts and all related legal entities to private companies GTCR LLC and Reverance Capital Partners L.P. Under the terms of the agreement, the $2.1 billion transaction will give Wells Fargo a 9.9% equity interest in the asset management business and remain an important client and distribution partner. The sale is expected to take place during the second quarter following customary closing conditions.

Transaction aims to continue company evolution according to new CEO

Wells Fargo Asset Management CEO Nico Marais said that the transaction represents a "significant" milestone in the company's growth and evolution. Reuters added that the sale continues efforts taken by CEO Charles Scharf to turn the company around following the sales practice scandal from the past few years.

Both GTCR Managing Director Collin Roche and Reverance Capital Managing Partner Milton Berlinski discussed their pleasure with working with Wells Fargo Asset Management to produce creative solutions for clients.

Stock fundamental data summary

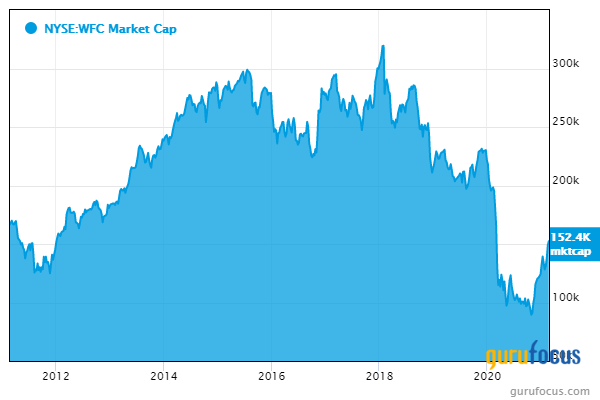

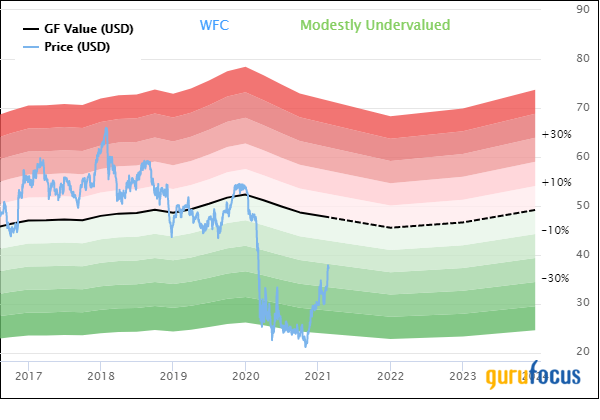

Shares of Wells Fargo traded around $37.01 on Tuesday, showing that the stock is modestly undervalued based on its price-to-GF Value ratio of 0.77.

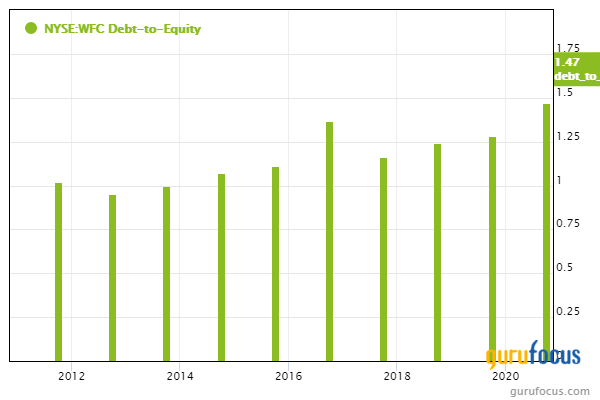

GuruFocus ranks Wells Fargo's financial strength 3 out of 10 on the back of debt ratios underperforming over 73% of global competitors, suggesting high financial leverage.

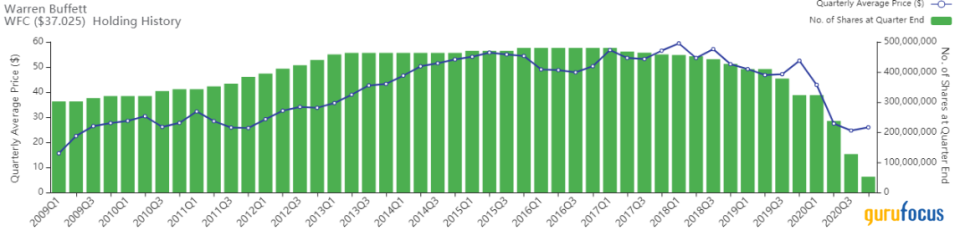

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) slashed approximately 58% of its Wells Fargo holding, selling close to 75 million shares, during the fourth quarter.

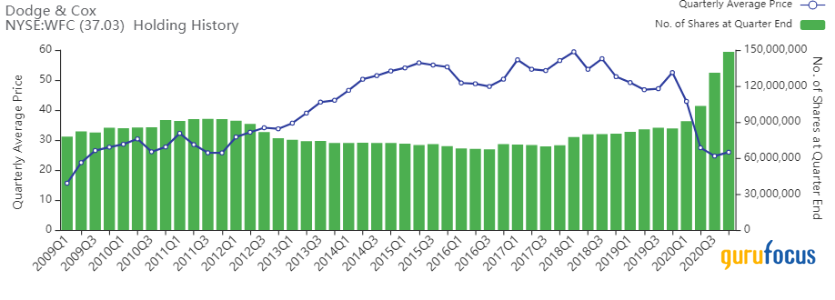

Other gurus with positions in the bank's stock include Dodge & Cox, PRIMECAP Management (Trades, Portfolio) and Chris Davis (Trades, Portfolio)' Davis Select Advisors.

Disclosure: No positions.

Read more here:

Bruce Berkowitz Slims Berkshire Holding, Axes Kraft Heinz

John Paulson's Top 5 Buys of the 4th Quarter

Prem Watsa's Top 5 Trades of the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.