Were Hedge Funds Right About Netflix, Inc. (NFLX)?

The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Netflix, Inc. (NASDAQ:NFLX).

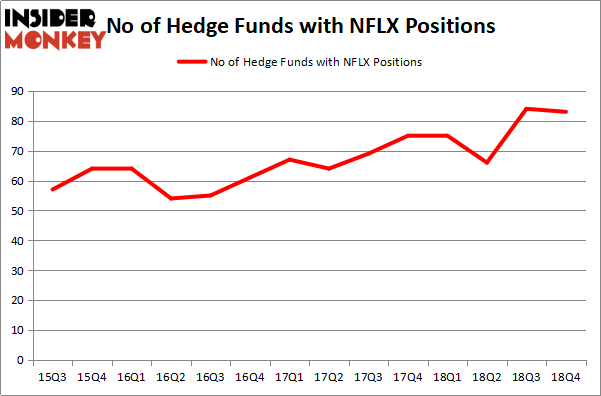

Is Netflix, Inc. (NASDAQ:NFLX) a healthy stock for your portfolio? Investors who are in the know are becoming less confident. The number of bullish hedge fund bets decreased by 1 recently. Our calculations also showed that NFLX is among the 30 most popular stocks among hedge funds, ranking 18th. NFLX was in 83 hedge funds' portfolios at the end of December. There were 84 hedge funds in our database with NFLX positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let's take a look at the fresh hedge fund action regarding Netflix, Inc. (NASDAQ:NFLX).

What does the smart money think about Netflix, Inc. (NASDAQ:NFLX)?

At Q4's end, a total of 83 of the hedge funds tracked by Insider Monkey were long this stock, a change of -1% from the second quarter of 2018. On the other hand, there were a total of 75 hedge funds with a bullish position in NFLX a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SRS Investment Management held the most valuable stake in Netflix, Inc. (NASDAQ:NFLX), which was worth $950.3 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $816.9 million worth of shares. Moreover, Viking Global, D1 Capital Partners, and Matrix Capital Management were also bullish on Netflix, Inc. (NASDAQ:NFLX), allocating a large percentage of their portfolios to this stock.

Since Netflix, Inc. (NASDAQ:NFLX) has witnessed declining sentiment from the entirety of the hedge funds we track, it's safe to say that there was a specific group of funds that slashed their positions entirely last quarter. Intriguingly, Panayotis Takis Sparaggis's Alkeon Capital Management dumped the biggest position of the "upper crust" of funds watched by Insider Monkey, worth an estimated $566.8 million in stock. Dan Loeb's fund, Third Point, also sold off its stock, about $467.7 million worth. These moves are interesting, as total hedge fund interest dropped by 1 funds last quarter.

Let's also examine hedge fund activity in other stocks similar to Netflix, Inc. (NASDAQ:NFLX). These stocks are PetroChina Company Limited (NYSE:PTR), 3M Company (NYSE:MMM), Adobe Inc. (NASDAQ:ADBE), and Novo Nordisk A/S (NYSE:NVO). This group of stocks' market valuations resemble NFLX's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PTR,14,133715,0 MMM,36,455273,2 ADBE,84,7816431,5 NVO,18,2150293,1 Average,38,2638928,2 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $2639 million. That figure was $6534 million in NFLX's case. Adobe Inc. (NASDAQ:ADBE) is the most popular stock in this table. On the other hand PetroChina Company Limited (NYSE:PTR) is the least popular one with only 14 bullish hedge fund positions. Netflix, Inc. (NASDAQ:NFLX) is not the most popular stock in this group but hedge fund interest is still among the highest. Hedge funds that didn't lose confidence in the stock were handsomely rewarded as the stock returned 35% through March 15th and beat the market by nearly 22 percentage points.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index