Were Hedge Funds Right About Souring On Nektar Therapeutics (NKTR)?

Hedge funds are known to underperform the bull markets but that's not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds' stock picks rather than directly investing in hedge funds. That's why we believe it isn't a waste of time to check out hedge fund sentiment before you invest in a stock like Nektar Therapeutics (NASDAQ:NKTR).

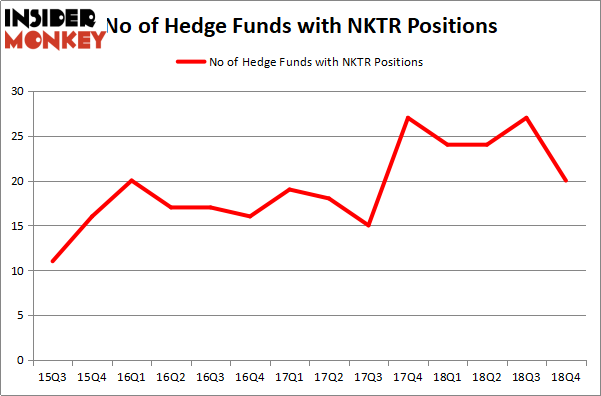

Is Nektar Therapeutics (NASDAQ:NKTR) ready to rally soon? Prominent investors are taking a pessimistic view. The number of long hedge fund bets retreated by 7 in recent months. Our calculations also showed that NKTR isn't among the 30 most popular stocks among hedge funds. NKTR was in 20 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 27 hedge funds in our database with NKTR holdings at the end of the previous quarter.

If you'd ask most investors, hedge funds are viewed as unimportant, old investment vehicles of yesteryear. While there are more than 8000 funds with their doors open at the moment, Our researchers choose to focus on the elite of this club, approximately 750 funds. These hedge fund managers have their hands on the majority of all hedge funds' total capital, and by keeping an eye on their inimitable stock picks, Insider Monkey has unsheathed a number of investment strategies that have historically outpaced the broader indices. Insider Monkey's flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We're going to check out the recent hedge fund action regarding Nektar Therapeutics (NASDAQ:NKTR).

How are hedge funds trading Nektar Therapeutics (NASDAQ:NKTR)?

At Q4's end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -26% from the previous quarter. On the other hand, there were a total of 24 hedge funds with a bullish position in NKTR a year ago. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey's hedge fund database, Stephen DuBois's Camber Capital Management has the number one position in Nektar Therapeutics (NASDAQ:NKTR), worth close to $65.7 million, accounting for 3.1% of its total 13F portfolio. On Camber Capital Management's heels is Bridger Management, led by Roberto Mignone, holding a $37.3 million position; 3.1% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that are bullish encompass Cliff Asness's AQR Capital Management, D. E. Shaw's D E Shaw and Bihua Chen's Cormorant Asset Management.

Because Nektar Therapeutics (NASDAQ:NKTR) has faced falling interest from hedge fund managers, we can see that there lies a certain "tier" of hedge funds who were dropping their full holdings in the third quarter. It's worth mentioning that Israel Englander's Millennium Management cut the biggest stake of the "upper crust" of funds tracked by Insider Monkey, totaling about $51.7 million in stock. Ori Hershkovitz's fund, Nexthera Capital, also sold off its stock, about $7.8 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 7 funds in the third quarter.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Nektar Therapeutics (NASDAQ:NKTR) but similarly valued. We will take a look at American Campus Communities, Inc. (NYSE:ACC), Teradyne, Inc. (NASDAQ:TER), Cullen/Frost Bankers, Inc. (NYSE:CFR), and Crown Holdings, Inc. (NYSE:CCK). This group of stocks' market values match NKTR's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position ACC,16,331686,-1 TER,25,410970,0 CFR,18,71492,0 CCK,35,718268,2 Average,23.5,383104,0.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $383 million. That figure was $236 million in NKTR's case. Crown Holdings, Inc. (NYSE:CCK) is the most popular stock in this table. On the other hand American Campus Communities, Inc. (NYSE:ACC) is the least popular one with only 16 bullish hedge fund positions. Nektar Therapeutics (NASDAQ:NKTR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately NKTR wasn't in this group. Hedge funds that bet on NKTR were disappointed as the stock returned 9.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index