We're Not Very Worried About Stoke Therapeutics's (NASDAQ:STOK) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Stoke Therapeutics (NASDAQ:STOK) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Stoke Therapeutics

How Long Is Stoke Therapeutics's Cash Runway?

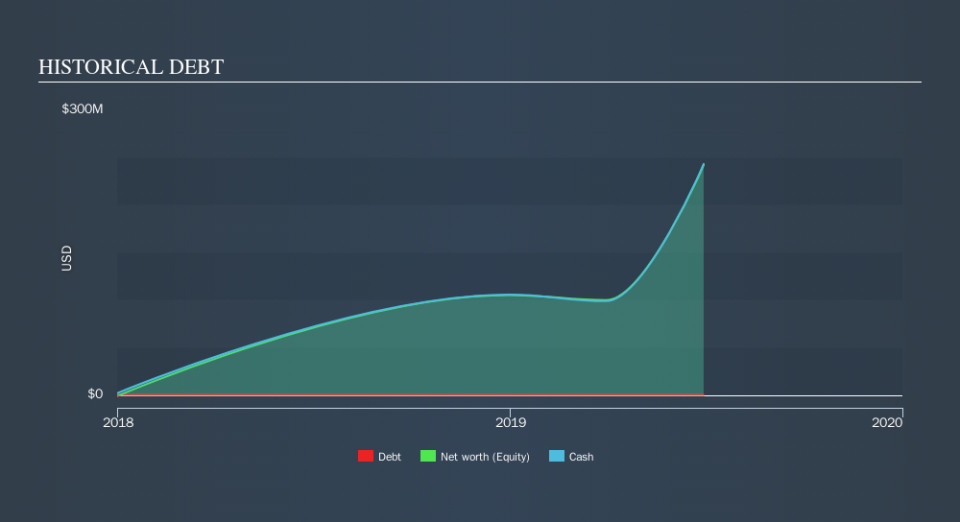

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2019, Stoke Therapeutics had cash of US$243m and no debt. Looking at the last year, the company burnt through US$20m. So it had a very long cash runway of many years from June 2019. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Is Stoke Therapeutics's Cash Burn Changing Over Time?

Because Stoke Therapeutics isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. The skyrocketing cash burn up 136% year on year certainly tests our nerves. That sort of ramp in expenditure is no doubt intended to generate worthwhile long term returns. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Stoke Therapeutics Raise More Cash Easily?

Given its cash burn trajectory, Stoke Therapeutics shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Stoke Therapeutics's cash burn of US$20m is about 2.8% of its US$721m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Stoke Therapeutics's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Stoke Therapeutics is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. We think it's very important to consider the cash burn for loss making companies, but other considerations such as the amount the CEO is paid can also enhance your understanding of the business. You can click here to see what Stoke Therapeutics's CEO gets paid each year.

Of course Stoke Therapeutics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.