West, southwest Louisville home values are being reassessed. Here's what to know

It’s that time of year again. Homeowners in west and southwest Louisville will soon receive postcards in the mail telling them their home’s new assessed value.

The Jefferson County Property Valuation Administration is reevaluating some 63,000 residential parcels this year, including single-family homes, condominiums, and undeveloped or vacant residential lots. About 8,000 commercial parcels in the area are also getting reassessed.

"There is a substantial increase in both of the areas that’s due to the robust market and the higher prices that are coming from these bidding wars," said Colleen Younger, Jefferson County property valuation administrator, noting the degree of increase will vary from neighborhood to neighborhood.

Here's what you need to know about this year's reassessment:

Why is my house being reassessed?

State law requires properties to be reassessed at least once every four years. The Jefferson County Property Valuation Administration is tasked with assessing Jefferson County properties. This value becomes the basis for your property taxes.

Outside of the two geographic areas up for reassessment this year, properties that were recently sold and those that had renovation permits pulled will also be reassessed.

How are properties reassessed?

Assessments are based on recent "fair arms-length" sales. The PVA compares recent sales of similar house types in the area to calculate the new assessed value. Typically, this analysis takes into account a year's worth of sales in the year before the assessment, meaning the 2023 assessment is based on 2022 sales.

Inspectors do not make house calls and inspect all homes throughout the county for annual reassessments. Field inspections happen when a property sells or is damaged, when a building or wrecking permit is issued, or by the owner’s request.

You may like: Women- and queer-owned Hard Times Collective vintage shop opens in Butchertown

Which areas are getting assessed this year?

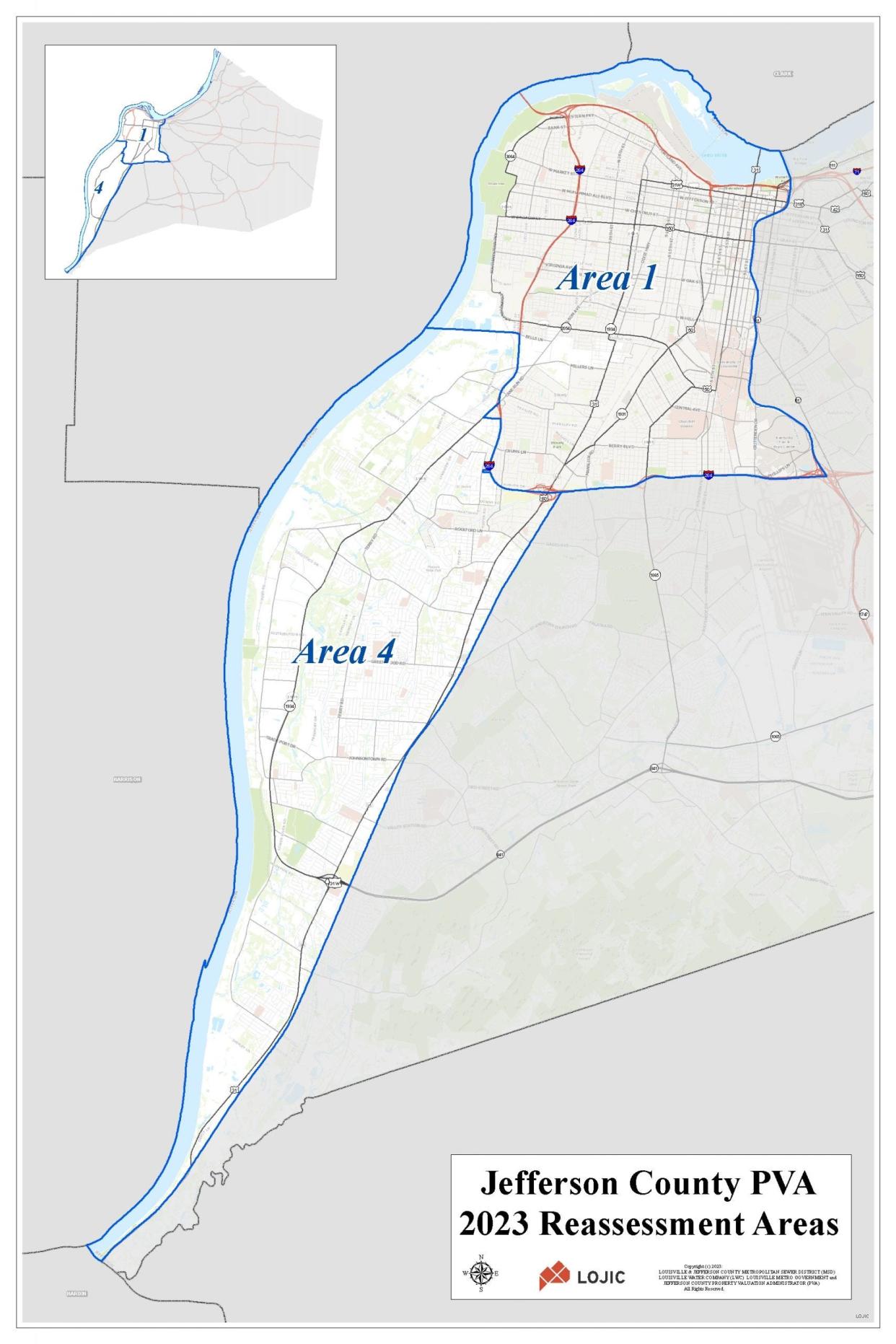

The Jefferson County PVA divides the county into nine "market areas" that are grouped and reassessed once every four years. Property owners can use a tool on the PVA’s website to see when their home will be reassessed.

Areas being reassessed this year are west of Interstate 65, north of Interstate 264, and west of the railroad tracks that run parallel to Dixie Highway.

Market area one includes Louisville’s West End neighborhoods as well as Old Louisville and downtown.

Market area four includes western and southwest Jefferson County, covering Pleasure Ridge Park, Shively, Valley Station, Lake Dreamland, and Valley Village.

These areas were last assessed in 2019.

What is the homestead exemption?

Those 65 and older (and those turning 65 this year) can apply for a "homestead exemption," which helps reduce the amount property owners will pay in taxes on their primary residence.

The exemption amount for 2023-24 is $46,350, which is subtracted from a property’s assessed value, reducing the amount that gets taxed. This equates to between $533-$630 in savings, depending on which taxing jurisdiction a person lives in, according to the PVA.

This year’s exemption is up from 2021-22’s amount of $40,500.

You must apply for the exemption as it is not automatically applied. You also need to have owned your home as of Jan. 1, 2023, to qualify for the exemption this year. One exemption is allowed per household.

You may like: These 2 historic Louisville libraries are getting a major makeover. Here's a sneak peek

What is the disability exemption?

The disability exemption allows property owners who are classified as totally disabled under any public or private retirement system to receive a discount on their property taxes.

The exemption amount is the same as the homestead exemption.

Applicants need to maintain their disability classification for the whole year and have received disability payments. Online and print applications are available.

How much will my home's assessed value rise?

Against the backdrop of a hot housing market that saw steep rises in median home sale prices across the county, it's likely that assessed values will rise in this year's assessment.

"There will some values that decrease," Younger said. "I don’t think it’s a substantial amount, but there will be some whose property values go down. But by and large, property values have increased over the last year and a half."

New values for 2023 will be released on April 21. The PVA will mail postcards to property owners, who can also check their new assessed value online at the PVA's website.

You may like: This woman is shaping Louisville's physical landscape yet you've probably not heard of her

Is my house being compared to the newly renovated house down the street?

The Jefferson County PVA has implemented a system intended to flag renovated homes (using permits and real estate listing descriptions) so they are only compared to other fixed-up homes.

"We do not compare those renovated house types to everyone else's," said Jason Hancock, PVA chief of staff.

When are property taxes due?

While the PVA is notifying homeowners about their reassessed property values in April, the tax bill based on those new values won't hit until Nov. 1.

This year's reassessment adds approximately $6 billion to the now-$85 billion tax assessment roll ($55 billion of which is from residential properties).

How does the West End Opportunity Partnership tie into property value reassessments?

Part of the legislation that created the West End Opportunity Partnership and the tax increment financing district also tasked the partnership with creating a program to assist homeowners with rising property taxes. This program is still in the planning stages but expected to be operational by the fall, said Interim Board President and CEO Laura Douglas.

Background: 7 ways Louisville's next mayor can help solve the city's affordable housing shortage

Is there an appeal process?

Yes, property owners have the right to appeal under state law if they believe the new assessment value doesn’t reflect the fair market value of their property (the price it would sell for if put up for sale) as of Jan. 1, 2023.

The appeal period runs from noon on April 21 through 4 p.m. on May 15.

How do I appeal?

Those wishing to appeal need to first complete an "online conference," which can be completed online at jeffersonpva.ky.gov. Supporting documentation is required. For example, those wanting to show interior or exterior deferred maintenance should provide pictures of the home's condition. More information on the appeal process can be found on the PVA website.

In-person help with this process is also available at the following locations:

Shawnee Library, 3912 W. Broadway

WHEN: April 21: 12-4 p.m.; April 24-May 15 (Mondays-Fridays): 10 a.m. to 4 p.m.

Southwest Regional Library, 9725 Dixie Highway

WHEN: April 21: 12-4 p.m.; April 24-May 15 (Mondays-Fridays): 9 a.m. to 4 p.m.

PVA Office, 815 W. Market St., suite 400

WHEN: April 21-May 12 (Mondays-Fridays): 8 a.m. to 4 p.m.; May 6 and May 13: 9 a.m. to 1 p.m. Call 502-574-6224 to schedule.

Shively City Hall, 3920 Dixie Highway

WHEN: May 9: 5-7 p.m.

Republic Bank Foundation YMCA, 1720 W. Broadway

WHEN: May 11: 5-7 p.m.

Those with disabilities and without access to technology can set up a telephone conference with the PVA by calling 502-574-6224 by May 8.

Business reporter Matthew Glowicki can be reached at mglowicki@courier-journal.com, 502-582-4000 or on Twitter @mattglo.

This article originally appeared on Louisville Courier Journal: 2023 property value reassessments in Louisville: Here's what to know