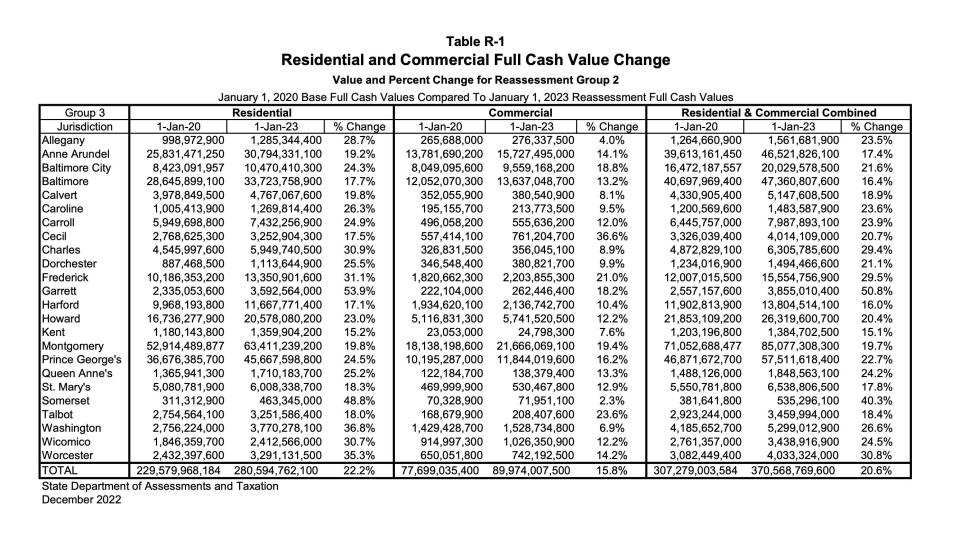

Western Maryland, Lower Shore among highest increases in 2023 reassessment

Western Maryland and the Lower Eastern Shore saw most of the highest percentage increases in residential property values in the state's latest reassessment.

Maryland property values jumped 20.6% over the last three years amid the pandemic's strong market, the largest increase in recent years, state tax officials announced Thursday.

Property owners have already started receiving their reassessments in the mail.

Inside look: How Amazon, USPS ship thousands of packages each day from Maryland

While residential property values increased in all counties and Baltimore city for the fifth consecutive year, Maryland Department of Assessments and Taxation Director Michael Higgs noted increases were substantially higher than state averages on the Eastern Shore and in parts of Western Maryland. Higgs attributed that to people escaping more urban and suburban areas for the "relative peace and quiet of the countryside during COVID, when they could work remotely."

Maryland's 2 million property accounts are split into three groups and appraised once every three years to help determine property taxes owed. The 2023 reassessment was the first for the nearly 800,000 commercial and residential properties for this group since the pandemic began, according to the state assessments department.

The reassessment, based on 89,880 sales, saw an increase in value for 96.4% of the residential properties in the group. The residential property values alone for Group 2 increased 22.2%, or by $51 billion, since January 2020.

Washington, Frederick, Garrett and Wicomico counties were among the 11 counties with over 99% of Group 2 residential properties seeing increases in assessed value.

The Lower Eastern Shore and Western Maryland counties account for eight of the top 10 percentage increases in residential values, with Garrett having the highest at 53.9%.

The rest of the top 10:

Somerset County: 48.8%

Washington County: 36.8%

Worcester County: 35.3%

Frederick County: 31.1%

Charles County: 30.9%

Wicomico County: 30.7%

Allegany County: 28.7%

Caroline County: 26.3%

Dorchester County: 25.5%

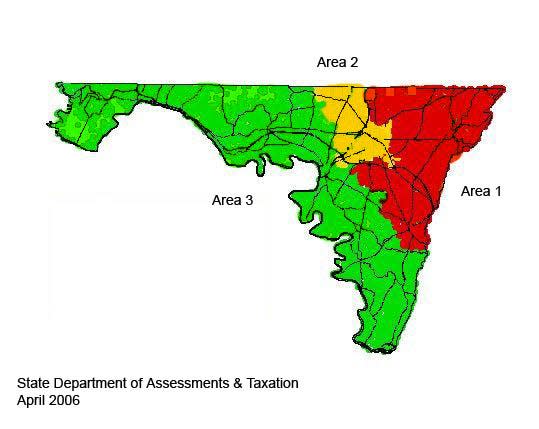

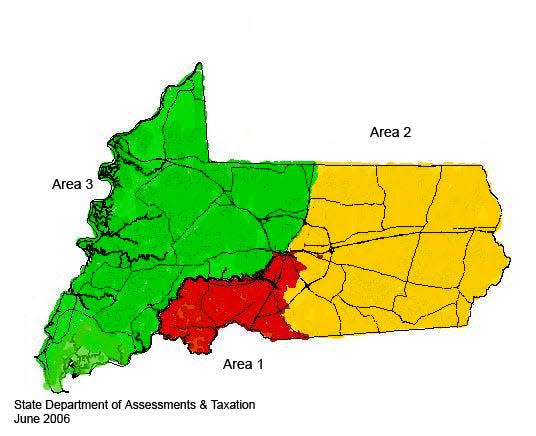

In Washington County, Group 2 includes Hagerstown, Halfway and Maugansville.

In Wicomico County, Group 2 includes the eastern part of the county including the eastern edges of Salisbury as well as Parsonsburg, Pittsville and Willards. Worcester's Group 2 is the southern part of the county including Snow Hill, West Ocean City and Assateague Island. The latest reassessment includes southern Somerset County with Crisfield and Smith Island.

Among Maryland's 24 jurisdictions, Kent County had the lowest residential property value increase percentagewise, at 15.2%.

Check for tax credit eligibility

Assessment increases are phased-in equally over the next three years and decreases will be fully implemented in the 2023 tax year.

About one-third of appeals at the first of the three levels of action result in some reduction in value, Higgs said.

The state's Homestead Tax Credit limits how much the taxable assessment can increase each year, regardless of income, for eligible property owners.

Washington County and its municipalities have a 5% cap on the taxable assessment increase, according to the department's website.

Wicomico, Garrett and Frederick counties also have 5% caps, though municipal cap amounts in those counties vary. Somerset has a 10% cap, according to the state assessment department. Worcester County's cap is 3%, as is Snow Hill's.

Commercial property values also went up

Commercial properties in Group 2 increased in assessed value by 15.8% statewide, or by almost $12.3 billion.

Washington County's Group 2 commercial property values went up 6.9%, or by $99.3 million to $1.53 billion.

Wicomico County's Group 2 commercial property values increased 12.2%, or by $111.3 million to $1 billion.

The state's Group 3 properties will be reassessed for 2024.

Contributing: Associated Press.

This article originally appeared on The Herald-Mail: Maryland's far rural ends among highest property-assessment increases