The West's only licensed small reactor project is dead. It's a blow for green energy

Last month, US nuclear developer NuScale Power announced it was cancelling its first-of-a-kind small modular reactor (SMR) project in Idaho, in what is widely being seen as a blow to the nascent technology. SMRs have been hailed as one of the best hopes for achieving net zero, and while the concept is great on paper – after all small reactors have been powering nuclear submarines and ships for decades – there are real questions over its deliverability in practice.

The failure of the NuScale project is of concern because the company is the only SMR developer outside Russia and China to have received design certification for an SMR. The project was to build six 77-megawatt SMRs (for a total of 462 MW) near Idaho Falls at the Department of Energy’s Idaho National Laboratory, and sell the output to a group of local utilities who were sponsoring the project.

Since the deal was first struck in 2019, project costs ballooned from US$5.3 billion to US$9.3 billion due to rising supply chain costs, interest rates and inflation. The projected start date slipped from 2026 to 2029, leading several of the utilities to withdraw. Back in March, NuScale had said it would need customers to sign up to buy 80 per cent of the plant’s output in order for the project to go ahead, although at the time it had sold only about 25 per cent, and few if any signed up subsequently. A report by the Institute for Energy Economics and Financial Analysis, a think tank which has been critical of SMR technologies, suggested that the project costs over its expected 40 year life had risen from US$55 per megawatt-hour to US$89 per MWh.

The decision to site the first US SMR in Idaho Falls made sense. The city is small (population 70,000) but is home to the Idaho National Laboratory, a site for federal government nuclear research since the 1940s. The project also enjoyed bipartisan support, something which is increasingly rare in the US. The Trump Administration approved a cost sharing plan worth up to US$1.4 billion for the project, and support was continued under President Joe Biden.

Nuclear power also receives support under Biden’s Inflation Reduction Act with tax credits both to incentivise owners of existing nuclear power stations to keep them open, and to support investment in SMRs and other advanced reactors. Yet all of this support proved inadequate, and by February this year, the economics of the project were in trouble. Costs including steel, concrete and labour had soared, and there were clear signs they could go higher.

While the failure of NuScale’s Idaho project is indeed a blow, it isn’t a definitive one. Firstly, the project didn’t use the same design that secured approval from the US Nuclear Regulatory Commission. That was an earlier, 50 MW version of the technology, which was certified in July 2022. Approval for the larger 77 MW version in a six-unit configuration is still pending. Indeed, the company has continually tinkered with the design which is hardly helpful for controlling costs.

Secondly, the choice of this technology for the project is open to challenge. The overall size of the scheme probably lends itself to larger reactors such as the GE Hitachi Nuclear Energy (GEH) BWRX-300 which leverages the developers’ existing boiling water reactor technology, unlike the NuScale design which included features not present in existing reactors. The BWRX-300 has successfully passed the first two nuclear certification stages in Canada and has recently passed the first stage for approval in Poland, where it has been earmarked for six sites. The US, UK and Sweden are all interested in the technology with design approvals pending.

Thirdly, the Idaho utilities partnering with NuScale in the project are not experienced nuclear operators, and NuScale itself is an inexperienced developer. Jumping in to a new sector, with a vendor that has no track record, developing a new technology that possibly wasn’t the best fit for their requirement, was a recipe for trouble.

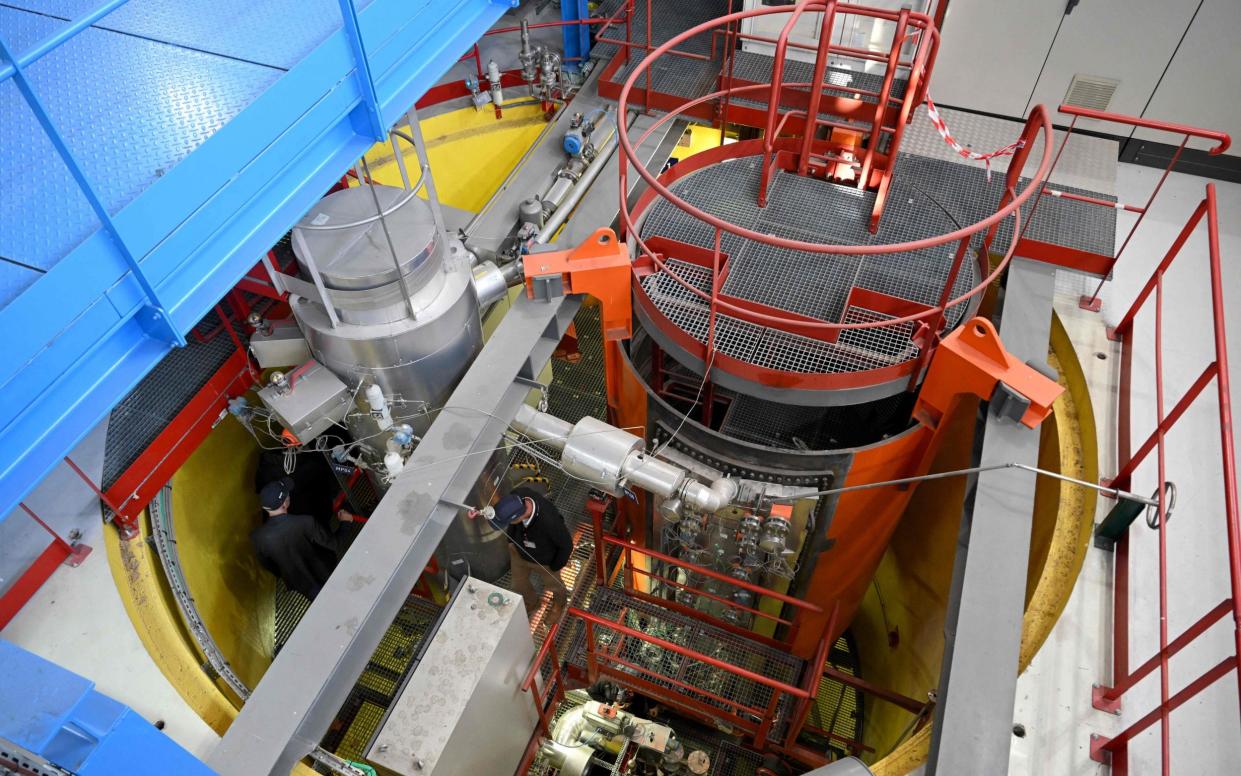

GEH has signed a deal with experienced nuclear operator, Ontario Power Generation to build four BWRX-300s at its Darlington site, with the first unit due to come online in 2029. This project will be a stronger barometer of the feasibility of SMRs – if it fails that would be a significant blow to the sector, since GE and Hitachi are experienced nuclear developers with a technology based on existing working reactors. This means that supply chains and workforce skills are at least partially already in place.

But even if it goes well, caution is needed. While SMRs have significant potential and it is possible to imagine a great many scenarios where they will be vital to ensuring zero carbon targets are met on time, they’re unlikely to make much of a mark this decade.

The key priority for nuclear power remains large-scale conventional reactors: where possible extending the lives of the ones we have, and building new ones. While the technologies recently built in the US and Europe have construction times of more than a decade, and have been subject to significant delays and cost over-runs, there are alternatives such as the pressurised water reactors being built in South Korea and the United Arab Emirates which have been delivered on time (eight years) and broadly on budget.

It is difficult to imagine a reliable, cost effective, low carbon energy system without nuclear power, but as with most technologies, some models are better than others. The trick is to choose the right ones, and that’s easier said than done.

Kathryn Porter is an independent energy consultant. She holds a Master’s degree in Physics and an MBA, and is an associate member of the All-Party Parliamentary Group for Energy Studies executive council