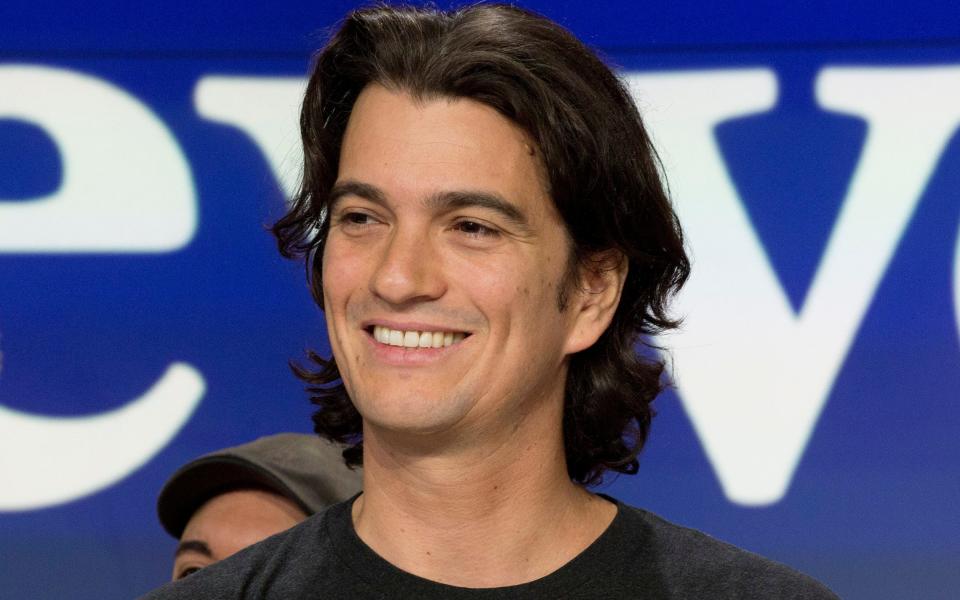

WeWork boss Adam Neumann faces bid to oust him as chief executive

WeWork’s controversial chief executive Adam Neumann faces being ousted by the office space company’s board as it seeks to get its tumultuous US flotation back on track.

Directors, including those affiliated with the company’s biggest investors SoftBank, are seeking to move Mr Neumann, 40, to a chairman role as they seek to take the spotlight off his eccentric management style and reports of drug taking.

The board is due to meet as early as this week to discuss the proposal, which follows a series of questions about its chief executive’s suitability for running a public company.

Mr Neumann, who co-founded WeWork in 2010, has been at the centre of the chaos engulfing its plans to go public. He has been criticised for taking out more than $700m (£561m) in share sales and loans ahead of the company’s listing, and for receiving a $5.9m payment from the company for a trademark he owned.

WeWork has also rented properties personally owned by Mr Neumann, and had given his wife Rebekah a vital role in choosing any successor to him.

Last week, reports emerged that he had smoked marijuana on a private jet from New York to Israel, which led the owner of the plane to recall it.

Mr Neumann has reversed many of the more contentious issues about his leadership, undoing the trademark transaction and reducing his voting power, but it has not been enough to kickstart momentum for WeWork’s float.

Last week it delayed the proposed initial public offering after its prospective valuation was repeatedly slashed to as low as two thirds of its previous $47bn valuation, leaving it racing against time to hit an end-of-year deadline.

WeWork is under pressure to go public by the end of the year because this would unlock a $6bn credit facility seen as vital to the company’s continued investment and growth.

The company’s seven-strong board includes SoftBank’s vice chairman Ron Fisher, representatives of venture capital firms that have invested in WeWork, and Mark Schwartz, a former Goldman Sachs executive who was formerly on SoftBank’s board. It recently said it would appoint its first female director, Harvard Business School professor Frances Frei, following criticism of its all-male board.

Although Mr Neumann’s shares carry enough voting rights to allow him to fire members of its board, WeWork needs the support of SoftBank, which was expected to invest further in the company when it goes public.

SoftBank and WeWork did not comment. The news was first reported by the Wall Street Journal.