WeWork could be worth zero, says veteran investor Bill Ackman

WeWork could be worth zero, a prominent activist investor has said, as the office space company prepares to cut staff after a $9.5bn (£7.4bn) SoftBank rescue package.

Bill Ackman, a billionaire hedge fund manager, told an investor conference in New York that the company was "enormously levered".

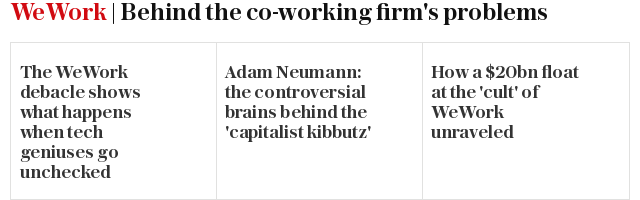

Plans to go public failed earlier this year after pre-flotation documents released by the firm cast doubt on its business model and the financial management of founder and former chief executive Adam Neumann.

“I think WeWork has a pretty high probability of being a zero for the equity, as well as for the debt,” Mr Ackman said at the event, organised by anti-poverty organisation Robin Hood, according to the Financial Times.

"As someone who has put good money after bad, I think this looks like putting good money after bad, and SoftBank should have walked away.”

The co-working company was valued at $8bn by the SoftBank deal, a fraction of the $47bn valuation it received in January.

The bailout also wrested control of the company away from Mr Neumann, who stepped down as chief executive last month but had retained the role of chairman.

Mr Neumann also received a $1.7bn exit package as part of the deal, while as many as 4,000 staff are expected to lose their jobs as the company looks to cut costs.

Mr Ackman, the founder of New York hedge fund Pershing Square Capital Management, is known for trying to pressure the companies he invests in into changing their strategy.

In 2011 he pushed the drinks company Suntory into breaking itself up into separate companies, and in 2013 persuaded Proctor and Gamble to replace its chief executive.

He also lost hundreds of millions of dollars betting against the health multi-level marketing company Herbalife, holding a short position for five years until 2018.

SoftBank declined to comment.