What's in the Cards for Green Brick Partners (GRBK) Q4 Earnings?

Green Brick Partners, Inc. GRBK is slated to release fourth-quarter and full-year 2020 results on Mar 8, after the closing bell. Results are anticipated to display year-over-year increases in revenues and earnings.

In the last reported quarter, this Plano, TX-headquartered national homebuilder and land development company delivered a 41.67% earnings surprise. Results reflected better-than-expected growth in revenues.

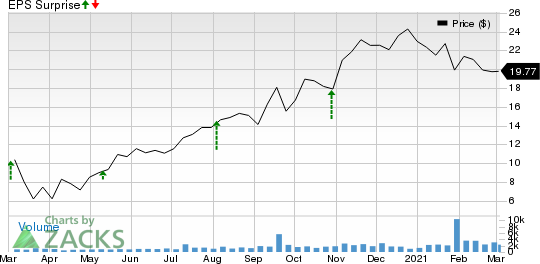

The company has a decent surprise history, having beaten the consensus mark in each of the trailing four quarters, the average beat being 32.28%. The graph below depicts this surprise history:

Green Brick Partners, Inc. Price and EPS Surprise

Green Brick Partners, Inc. price-eps-surprise | Green Brick Partners, Inc. Quote

Let’s see how things have shaped up prior to this announcement.

Factors at Play

This diversified homebuilding and land development company is likely to have gained from the solid demand for its homes during the fourth quarter. Amid the low-interest environment, there is a strong demand for homes and it also reflects increased participation by the millennial buyer. Moreover, expansion of Trophy Signature Homes is likely to have been a key growth driver.

Per management, “During the quarter, our record 848 net new orders occurred at all home builder brands and price points, outpacing our available inventory. We ended the quarter with a $687 million backlog – the highest in our history and up 98% year over year.”

With short-term demand exceeding supply, the company noted that it has rapidly expanded its capacity.

In January, the company reported preliminary results for the fourth quarter and full-year 2020. Management noted that new homes delivered totaled 585 for the fourth quarter, marking a 13.8% increase over the prior year. Net new orders were 848 homes for the quarter, reflecting a 43.7% surge year on year. In addition, average active selling communities increased to 102 communities for the fourth quarter, up 13.3% from 90 communities in the prior-year period.

The Zacks Consensus Estimate for quarterly revenues is currently pegged at $256.20 million, suggesting an increase of 11.3% year on year.

The Zacks Consensus Estimate for quarterly earnings remained unrevised at 56 cents over the past month. However, the figure calls for a year-over-year surge of 80.65%.

Per the company’s preliminary results for full-year 2020, residential unit revenues is projected at $929-$931 million, indicating an increase of 22.3-22.5%, while gross margin is expected in the band of 24-24.2%, calling for an expansion of 260-280 basis points year over year.

Moreover, as of Dec 31, 2020, backlog was $686.9 million, denoting the highest in the company’s history and reflecting a surge of 98% from $346.8 million as of Dec 31, 2019. Also, homes under construction climbed to 1,780 units as of Dec 31, 2020, representing a 37.2% increase from 1,297 as of Dec 31, 2019.

New homes delivered for the full year were 2,208, reflecting a 28.4% surge over the prior year. Also, net new orders for 2020 were 2,885 homes, displaying a 50% increase year on year.

Finally, the company expects to report 2020 earnings per share in the range of $2.21-$2.23, suggesting an increase of 90.5-92.2% year on year.

For the full year, the Zacks Consensus Estimate for earnings per share has remained unchanged at $2.23 over the past month. The figure calls for a 92.24% surge year on year. Revenues are projected to be up 23.6% year over year to $978.12 billion.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive earnings surprise for Green Brick Partners this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Green Brick Partners currently carries a Zacks Rank #2 and has an Earnings ESP of 0.00%.

Stocks to Consider

Here are a few other stocks in the broader real estate sector that you may want to consider:

CBRE Group’s CBRE Zacks Consensus Estimate for 2021 earnings per share per share has moved up 2.5% to $3.70 over the past week. The company currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Colliers International Group’s CIGI earnings per share estimate for the current year has been revised upward by 4.7% to $5.11 over the past month. The company carries a Zacks Rank of 2, currently.

FirstService Corporation’s FSV Zacks Consensus Estimate for the ongoing-year earnings per share has moved marginally north to $3.71 in a month’s time. The company holds a Zacks Rank of 2, at present.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colliers International Group Inc. (CIGI) : Free Stock Analysis Report

FirstService Corporation (FSV) : Free Stock Analysis Report

Green Brick Partners, Inc. (GRBK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research