Where Art Thou Bitcoin ETF?

Last week, the SEC loosened rules around leveraged and inverse ETFs, sometimes referred to as “currency kerosene” for their reputation of making money go up in smoke quickly. Some saw this as an opportunity to rein in these controversial financial products, rather than to let them ride.

From Lara Crigger’s ETF.com report:

“… (SEC) passed a controversial new rule that, among other things, would make it significantly easier to launch leveraged and inverse exchange-traded funds, but at smaller multipliers than previously approved. Rule 18f-4 would allow ETFs and other funds that aren't explicitly allowed by the Investment Company Act of 1940 to use derivatives, without first having to obtain exemptive relief. New ETF launches may now apply up to a 200% multiplier, either long or inverse, on their underlying indexes.”

New launches of these sorts won’t require SEC blessing on an individual basis to use derivatives for leveraged and inverse exposure, which should ease the approval process. However, the days of new 3X leveraged or inverse ETFs are over, with 2X being the cap going forward, a tip of the hat perhaps to lessening the potential losses these can create.

Despite also gutting the requirement of presale education to investors who decide to play with this type of fire, I have no problem with allowing these alternative securities to come to market. They require investor caution, but they could also deliver stellar returns in a very short period of time.

I use this as a backdrop to the ongoing bitcoin ETF saga. It’s been dragging though the seemingly lenient SEC when it comes to risky products like leveraged and inverse ETFs, but it’s been steadfastly opposed to allowing bitcoin in an ETF wrapper.

All this got me thinking, what is going on with bitcoin ETFs? Certainly no one has thrown in the towel after all this effort:

Key Bitcoin ETF Dates:

* Winklevoss: Filed July 1, 2013; Disapproved March 10, 2017

* SolidX (with VanEck later): Filed July 12, 2016; Withdrawn Jan. 23, 2019

* Grayscale: Filed July 11, 2017: Withdrawn Oct. 25, 2017

* ProShares: Filed Sept. 27, 2017: Disapproved Aug. 22, 2018; Stayed Aug. 23, 2018

* Direxion: Filed Dec. 15, 2017: Disapproved Aug. 22, 2018; Stayed Aug. 23, 2018

* GraniteShares: Filed Dec. 15, 2017: Disapproved Aug. 22, 2018; Stayed Aug. 23, 2018

* Wilshire Phoenix: Filed Jan. 11, 2019: Disapproved Feb. 25, 2020

* Bitwise: Filed Jan. 10, 2019: Disapproved Oct. 9, 2019; Stayed Oct. 15, 2019, Withdrawn Jan. 14, 2020

More Than 7 Years Ago

The early forays into trying to launch a bitcoin ETF were certainly far ahead of the SEC’s curve of understanding—and most people’s understanding—of cryptocurrencies. But along the way, there hasn’t been any obvious progress in the SEC’s willingness to allow bitcoin ETFs.

With a market cap currently approaching $200 billion, and hundreds of millions of dollars a day in futures trading, bitcoin has come a long way since that first bitcoin filing in 2013. The SEC, however, not so much.

Some say the SEC has been growing more comfortable with the idea of a bitcoin ETF, and that one should come sooner rather than later. Matt Hougan, chief investment officer of Bitwise, a digital asset manager that just crossed $100 million in assets under management, is in that camp. He has been on the frontlines of this effort, as his firm tries to launch a bitcoin ETF. I caught up with Hougan to talk about this challenge:

ETF.com: Are there any bitcoin ETFs still alive in the SEC pipeline filing world?

Matt Hougan: There are no live filings for ETFs for crypto ETFs, and specifically for a bitcoin ETF at this time. There are a number of filings that received disapproval orders from the SEC staff, which were then appealed by commissioners and are currently sort of sitting on appeal. But there's no requirement or expectation for the commissioners to review those and move those along.

So the short answer to your question is, no, there are no live filings that I'm aware of at this time. The slightly nuanced answer is, a few filings, but disapproval orders have been sort of appealed and stayed. But they're not, that I know of, making forward progress right now.

ETF.com: Why was there this full-frontal assault on trying to get bitcoin ETFs through the SEC, but then it just completely went away. What’s going on?

Hougan: The reality is there's been sort of two waves of effort around bitcoin ETFs. There was the Winklevosses’ first shot in 2013, and then there were a number of serious follow-on efforts in the 2017/2018 era, whether that's Bitwise or VanEck or Wilshire Phoenix. And those are the ones that received the public disapproval orders.

What the industry saw in those public disapproval orders is that the SEC, rightfully so, is setting a pretty high bar that bitcoin ETFs have to clear on factors like market manipulation and custody audit. So what I’m seeing is that people realize there's a lot of work to be done.

Certainly that's happening behind the scenes at Bitwise, and I assume what's happening behind the scenes at our competitors, is that people are doing that work. But I think it was just clarity that there was significant work still to be done before you could even take a shot on goal.

ETF.com: How long does it take for the market to prove itself rather than you trying to prove that the market's safe?

Hougan: If we backpedal to like 2013 when the first ETF filings were in, we were far on one side of a wide spectrum spanning from a grassroots, anarchic, unregulated market, to its long-term future as a well-regulated piece of the global financial ecosystem. As an example, there were no regulated insured custodians in the market at that time. Full stop.

Today you have firms like Fidelity that have insurance from Lloyd's of London that are offering custody for bitcoin under New York State specialized trust charters. You have the New York Stock Exchange setting up a bitcoin custodian that, again, operates under that same regulatory structure and also has insurance in place. You have the Coinbase company which is now an $8 billion company. They also have insurance in place and they're also regulated.

In 2013, the market was not prepared to support an ETF that should be available to all investors. There were no well-established trading venues. There was no regulated market at all. There were still a lot of really bad actors. Things have vastly improved.

People like me will argue that we're well along that path, and that the Bitcoin market, as it stands today, is actually a well-functioning market supported by regulated markets like the CME when it comes to futures. But the SEC is fully within its rights to say "prove it." Because it's not like we're coming from a place that's entirely well-established and clean and a well-arbitraged market with clear regulations in place. We're evolving to that space.

ETF.com: There seems to be demand there. How do you quantify that?

Hougan: Bitwise has a full sales team that calls on thousands of advisors a month. And so we hear from them directly. They would like an ETF that allows them to buy and sell bitcoin at net asset value and that fits into their workflow. And they want to do it because there's client demand, and currently those clients are doing it themselves on Coinbase. There are more Coinbase accounts than there are Charles Schwab accounts. So it would be great to bring bitcoin inside that advised setting.

You can see there's demand. I hear from people who say, “We don't need a bitcoin ETF.” Their argument is that there are plenty of ways to buy bitcoin today. [On Oct. 21, 2020,] PayPal said it was going to make it possible for people to buy Bitcoin through the PayPal app. That's great, but it doesn't solve the problem for financial advisors who need a regulated product that fits into their workflow. And the only real, robust answer for that is an ETF. I think eventually we'll get there.

ETF.com: What's eventually? A year? Five?

Hougan: I hope it's fewer than five years. I think the best estimate is somewhere between 12 and 36 months out. I know it's a wide window, but people have been cracking on this thing since 2013, and there's still some road to go. I do think it's a matter of when and not if.

PayPal's a $250 billion company. It has 350 million users, 200 million in the U.S. It's got 26 million merchants who are going to be able to accept crypto. If you have a company of that size that embraces crypto and endorses it and allows it to live in a regulated setting for a huge number of clients, it gets a step further.

The Time Has Come

It’s hard to knock the SEC for being overly cautious in allowing bitcoin to enter the capital markets as a listed and regulated security. But that many-years grace period and bitcoin’s continued success as a financial product have made the steadfast rejection by regulators seem out of step with change.

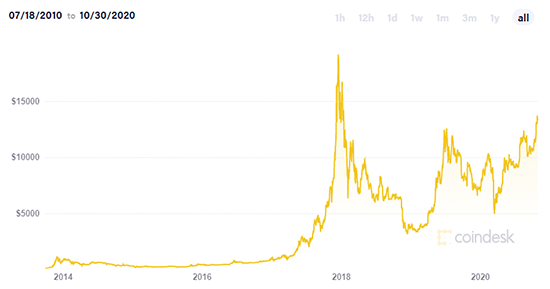

Currently, bitcoin trades around $13,500, and as the bitcoin price chart below shows, price volatility has cooled considerably. Take away March’s financial market meltdown that impacted all securities, and bitcoin pricing looks relatively rangebound.

(For a larger view, click on the image above)

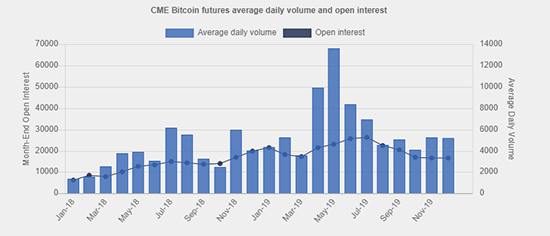

One reason for that is a futures market in bitcoin that keeps price discovery honest in theory and apparently in practical terms as well.

Trading volume has also been stable, adding another positive piece to the stability puzzle.

(For a larger view, click on the image above)

A report this month by Wilshire Phoenix, a firm that’s also looking for a SEC bitcoin ETF blessing, adds credence to the idea a futures market in bitcoin is legitimizing its status as a trading vehicle every day.

“The findings of Wilshire Phoenix indicate that CME Bitcoin Futures contribute more to price discovery than its related spot markets,” said an Oct. 14 report from Wilshire Phoenix, adding: “A leading futures market suggests the existence of a robust base of traders who may trade on such markets for many reasons such as trust in the exchange venue and lower latency.”

Trading in bitcoin futures rivals those of some currency.

“There are 85 institutions holding open positions in Bitcoin futures; this represents a similar number versus other CME futures in major currency markets such as the Swiss Franc, US Dollar Index, and Fed Funds,” Wilshire Phoenix partner and report co-author Alexander Chang told Cointelegraph.

The longer time marches on without the SEC’s approval, the more likely investors will wander into less transparent and less regulated arenas to buy and sell bitcoin. The last seven years have seen the maturation necessary in both bitcoin and in underlying markets to warrant a bitcoin ETF.

To disallow it, the SEC comes across like Juliet’s unreasonable father forbidding her to love Romeo, clinging simply to the old rules of a changing world.

Drew Voros can be reached at dvoros@etf.com

Recommended Stories