Where will Shawnee County school taxes rise the most? It depends on where you live.

Shawnee County's school districts are finalizing their budgets for the 2022-23 school year, but despite many keeping flat or even decreased mill levies, their overall budgets are expected to go up.

A surge in home valuations is the main driver behind both the bigger budgets and increased tax bills for homeowners.

All five districts have set budget hearing dates, at which members of the public will have an opportunity to give input or voice any concerns.

More: 'Substantial, but not an exodus' — Kansas teacher shortage isn't what you think it is

Here's where things stand in Shawnee County school districts.

How Kansas school taxes and mill levies work

In Kansas, schools raise their funding similarly to any other local taxing entities but receive that funding differently, using mills to calculate tax rates. A mill is $1 in tax for every $1,000 in assessed property value.

Twenty mills of each property's school-related taxes is sent directly to the state, which then distributes funding to schools on a per-student basis called base aid per pupil.

That amount, $4,846 for the 2022-23 school year, is itself weighted for certain criteria, such as number of special education students or percentage of students deemed to be at-risk.

After that, districts may separately raise funding through other mill levies, such as levies for capital projects and bonded debt for construction projects, although those are subject to certain caps. With all the levied amounts, districts aim high at the beginning of each year, so as to avoid having to go through the budget republication process should the districts' budgeted amounts come in low throughout the year.

Districts also receive receive and budget for other types of revenue, such as federal funding. With over $1 billion in federal COVID-19 relief allocated to Kansas, many school districts are seeing an influx of new dollars, although those funds have to be tied to district plans to mitigate COVID-19 and recovering learning loss.

More: Topeka teacher: 'You have to be able to accept a certain kind of weirdness' in middle school kids

Much of the federal funding is also tied to districts' percentages of Title I, or low-income, students, meaning some high-poverty districts may see disproportionate amounts of relief funding.

School property tax bills can go up one of two ways — school boards may choose to increase their mill levy amounts, or property owners may see an unavoidable increase if their property values go up. In 2022, the Shawnee County appraiser estimates that the average residential property value increased by about 10.15% countywide.

Kansas school property tax bills will also vary this year after Gov. Laura Kelly signed a bill to increase a $20,000 residential property exemption from the statewide 20-mill levy to $40,000. That should amount to a decreased tax bill of about $46 per year for most homeowners.

Examples for each of the following school district budgets take into account the increased exemption and assume a Shawnee County property valued at $200,000 in 2021-22 increasing by the average 10.15% to $220,300.

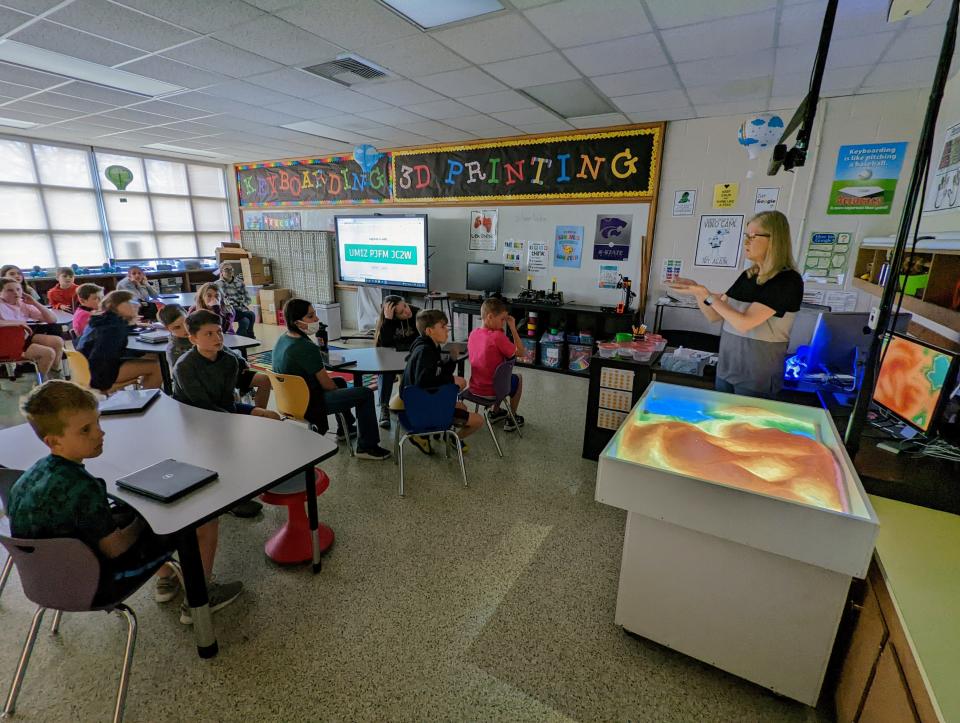

Seaman USD 345

Seaman USD 345's proposed $60.6 million budget is about $8.2 million, or 16%, higher than last year.

While the district expects to see a continued gradual decline in enrollment in the coming year, it also expects to see higher numbers of students deemed at-risk. Free- and reduced-price lunch eligibility — one of the main qualifiers for at-risk status — decreased in Seaman USD 345 these past couple of years, when families were not required to apply for free lunch to receive it.

More: Laura Kelly calls herself the 'education governor.' Derek Schmidt says she broke promises to Kansas.

Despite a 0.133 mill decrease, the owner of a $200,000 house will see a tax bill increase of $70.05 to $1,200.57, under the proposed budget.

The Seaman Board of Education held a public hearing and approved its budget Thursday.

Silver Lake USD 372

In Silver USD 372, even a relatively flat total mill levy is part of an overall budget increase of nearly a third.

Silver Lake USD 372's overall budget, after transfers, is proposed at $13.7 million, up from $10.3 million in 2021-22. Much of that comes from a $1.1 million increase in budgeted capital outlay expenses, although the bulk of that increase will come from state aid.

With the proposed 0.019-mill decrease to 54.935 mills, the average owner of a $200,000 home in 2021-22 would pay $1,299.75 in property taxes next year, or $81.81 more in taxes.

More: Jerry Farley's $762K exit agreement includes presidential house, country club dues — and a statue

The Silver Lake Board of Education will hold its public budget hearing at 5:55 p.m. Wednesday, Aug. 31, in the boardroom in the south hallway of Silver Lake Elementary School, 200 Rice Road, Silver Lake.

Auburn-Washburn USD 437

Coming off the heels of a successful $145 million bond initiative in April, Auburn-Washburn USD 437's budget features a hike in the district's yearly bond and interest payments.

The district's $32.9 million budget, less transfers, for 2022-23 includes 13.989 mills for bond and interest payments, compared to 6.648 mills last year.

The Auburn-Washburn Board of Education had worked for years to whittle the district's total levy down to about 50 mills, in anticipation of increased debt service from a successful bond election. This year's budget puts the district at 55.066 mills.

More: Balancing playing field, or punishing success? Kansas board hears KSHSAA reclassification proposal

With that mill increase and other budget changes, the owner of a $200,000 home last year will pay $1,303.07 in tax next year, or $199.58 more.

The district's public budget hearing will be 6:30 p.m. Tuesday, Sept. 6, at the Shuler Education Center, 5928 S.W. 53rd St.

Shawnee Heights USD 450

Shawnee Heights USD 450's proposed budget is a $7.2 million increase, or 14%, to $58.3 million, less transfers, based on a mill levy of 51.315.

A decrease of 0.487 mills will still lead to a $62.59 tax bill increase to $1,208.04 for the average owner of a $200,000 home.

The Shawnee Heights Board of Education has its public budget hearing at 6:50 p.m. Tuesday, Sept. 6, at Shawnee Heights High School, 4201 S.E. Shawnee Heights Road, Tecumseh.

Topeka USD 501

Topeka USD 501 is proposing one of the largest tax rate cuts among local taxing entities, although its $274.3 million budget, after transfers, still includes a 25% increase in projected expenditures.

As a district with more low-income families and higher numbers of at-risk students, the district receives additional weighting and funding for its students, and 62% of the budget comes from state funding.

Additionally, federal funding is budgeted at $61.5 million in 2022-23, or more than double what it was last year. Most of that comes from the district's award of $40 million in federal dollars from the third round of COVID-19 relief funding.

More: With incentive program, Topeka USD 501 staff face dilemma — go to work sick or lose $2,000

Combined with portions of funding in other district programs, federal dollars make up 29% of the district's budget this year, up from around 20% in typical years.

The district's 2.377 mill decrease would keep tax bills mostly flat for residential property owners, with a $6.73 increase to $1,073.59 for the owner of a $200,000 house.

Rafael Garcia is an education reporter for the Topeka Capital-Journal. He can be reached at rgarcia@cjonline.com or by phone at 785-289-5325. Follow him on Twitter at @byRafaelGarcia.

This article originally appeared on Topeka Capital-Journal: Here's where Shawnee County school taxes will rise the most