Why the Americans have fallen for the very British Beryl Cook

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

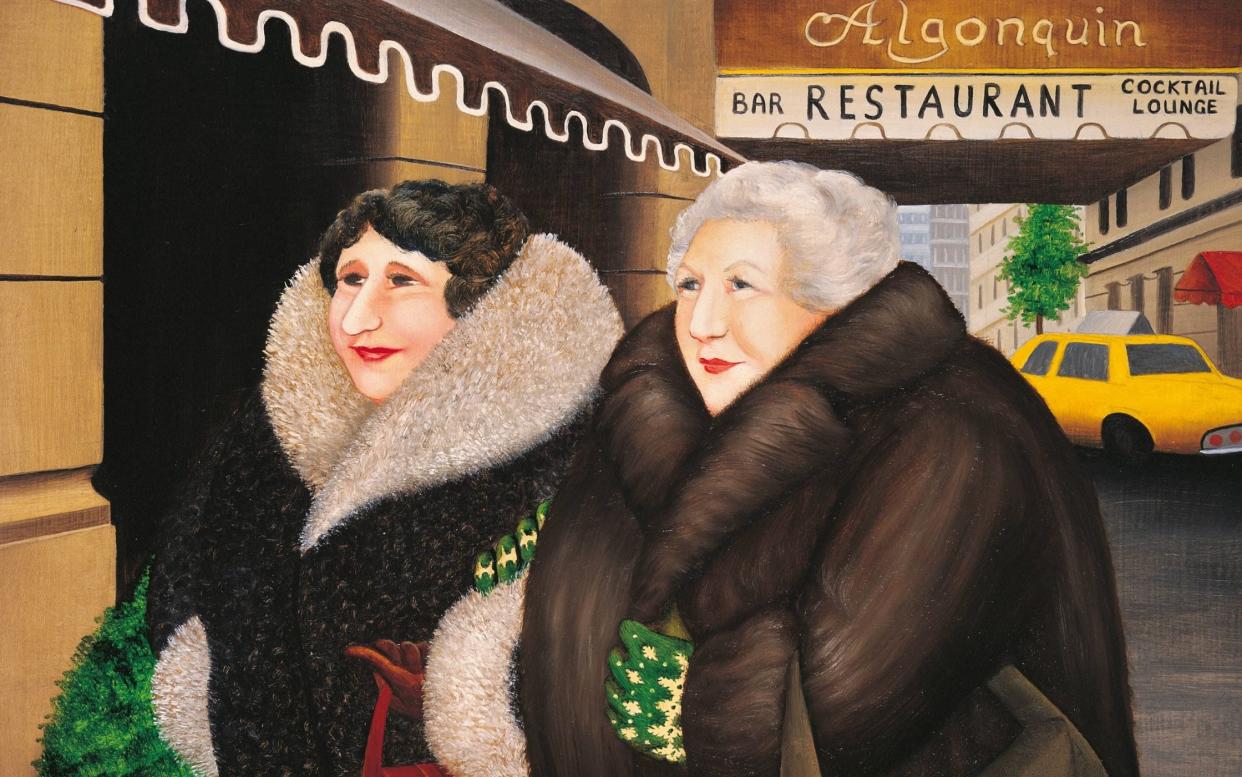

Beryl Cook, who died in 2008, is still one of Britain’s most popular artists. Her very British appeal – homespun, jokey compositions of tubular middle-aged ladies out on the town or gawking at sailors in a greasy spoon café – is reflected in the sales figures for her posters, prints, books, mugs and tea towels. They are all rooted in the graphic and colourful, cheerful sense of humour she brought to her depictions of ordinary people at play.

But Cook, who is snobbishly dismissed in academic circles, is not represented in the national collection at Tate Britain and she has never had an exhibition abroad – until now. The exhibition, which has just opened in New York, also comes at a time when her market, which grew steadily throughout her life, accelerated immediately after her death, but then tailed off, is experiencing a new lease of life.

In the early days, she recalled, she would sell her work for £10 a go. But gradually, popular demand allowed her gallery, Portal, to raise prices until, by the time of her death, they were generally in the £30,000-£40,000 range. Then, after she died in May 2008, the market went briefly crazy. In July that year two paintings at Bonhams tripled their estimates, selling for more than £60,000 each. Then in August 2008 it slipped out that Portal had sold a painting of the Café de Paris to Yoko Ono for £100,000. The price, says Jess Wilder, Portal Gallery’s director, was also influenced by the painting’s large size, one of only three she made measuring 3ft x 4ft.

But after the posthumous flurry, the Cook market cooled down, the Tate still refused to buy her work, and prices dropped to the £20,000 level.

However, in 2017 Bonhams in Los Angeles sold all 13 Cook paintings owned by romantic novelist Jackie Collins who had recently died: each one above estimate for a total of more than $260,000 (about £215,000). Promotion for the sale, searching for celebrity connections, mentioned she was also collected by film star Whoopi Goldberg and Mick Jagger’s banker, the late Rupert Loewenstein, who had a painting by Cook of a pink nude on a leopard skin rug in his office, among others.

Following the Collins estate sales, prices of £30,000 became more commonplace again with Bonhams selling all five of Cook’s paintings in a women artist only sale in September. And then, last month, they dramatically broke the artist’s record with Breakfast at Elvira’s, depicting a café in Plymouth owned by Cook’s son, which sold for £82,500 – double its auction estimate.

The New York exhibition is the brainchild of Adam Cohen, a director of the hugely powerful Gagosian gallery which focuses on seriously expensive superstars such as Willem de Kooning and Robert Rauschenberg. Cook may seem like an odd choice to share such company until you discover that Cohen is the son of Mancunian collector Frank Cohen, and grew up surrounded by the work of Stanley Spencer and Edward Burra, two historical figures Cook admired and to whom she has been most frequently compared because of the rounded figures (Spencer without the religious connotations) and bar room sailors (as in Burra). For the benefit of his transatlantic audience, Cohen adds Norman Rockwell and Fernando Botero to the mix of art historical references. He is keen, though, to point out that this is not a Gagosian show, it’s just him in his town house calling the gallery ‘A Hug from The Art World.’

There is also a sense in which Cook’s rounded figuration chimes with some of the new figurative paintings that have been making waves in the art market, says Cohen. Influential US curators like White Columns director, Matthew Higgs, have been expressing interest, while in the UK, Joe Scotland, who steers south London’s fashionable Studio Voltaire, told The Art Newspaper last year: “Beryl Cook is really underrated as an artist. The majority of the UK art world just see her as a naff calendar artist. I love her paintings. So much around class, commerciality, social history, body size, pleasure.”

In New York, 40 paintings and several rarely seen drawings have been lent by the artist’s estate and various family friends. The selection covers five decades of her output including early, formative works. Only a dozen paintings are for sale, priced from £25,000 to £70,000, and the sketches, which she always made for her paintings, are priced at £3,500.

New York, it seems, is slowly warming to Cook, and half of the available works were sold in the early stages of the exhibition which continues into January.

A record-breaking Seurat – but the party couldn’t last

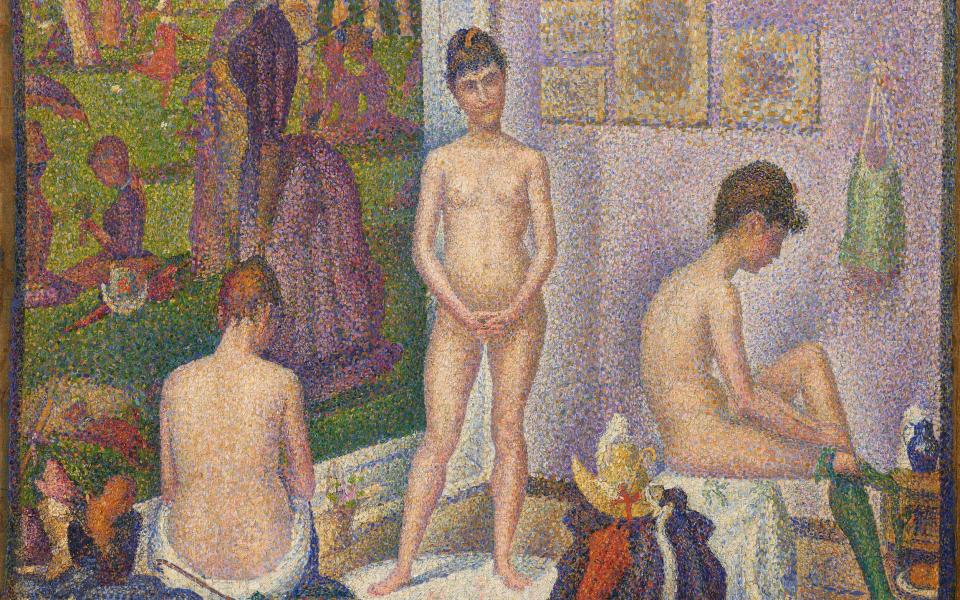

The art market appears to be standing on something of a precipice. The magnificent height was in New York in mid-November when the impressionist, modern and contemporary art sales realised a record $3.2 billion (£2.6 billion). The strongest part of that was in the sale of classic masterpieces from the collection of the late billionaire Microsoft co-founder, Paul G Allen, which made the highest price of any single-owner collection ever at $1.6 billion. A rare pointillist painting of studio models, Les Poseuses, by Georges Seurat topped the list of individual artist records at $149 million. But after the Allen sale, things began to sag. More lots than usual sold below their estimates or were withdrawn from sale because of insufficient pre-sale interest.

A similar pattern unfolded in Hong Kong last week when sales of modern and contemporary art dropped by 34.3 per cent on last autumn to $220 million and by 50.7 per cent from spring 2021, according to number cruncher, ArtTactic. By next year, I predict, pre-sale estimates will be down. Some owners may be reluctant to sell at the lower thresholds, but the supply will not dry up because estate planners are busy disposing of valuable collections that were built in the post-war era.

In the meantime, London’s supply-starved Old Master sales this week are estimated to bring a historically low £40-£60 million. The top lots at both Sotheby’s and Christie’s were both, coincidentally, unsold the last time at auction.

Christie’s has one of many versions of Titian’s Venus and Adonis which it could not sell in 1998 with a £1 million estimate, but have convinced a third party to promise a bid in the region of its new £8 million estimate, so it will sell this time.

Van Dyck’s portrait of Queen Henrietta Maria was offered at Sotheby’s in 2015 with a £1.5 million estimate and only sold privately after the auction where it had been unsold. Since then, the lower part of the composition, thought to be by another artist, has been removed and the work is now re-presented in trimmer state with a £2 million estimate.