Why the art market is abandoning London

Last week, all eyes were on the London market as the capital’s salerooms staged the first major series of international modern and contemporary art auctions of the year. The two big questions being asked were whether the depleted state of the war-torn, inflation-hit economy would knock the stuffing out of the global art market, and whether London could maintain its status as Europe’s lead player in the face of concerns over the negative impact of Brexit red tape, tax and regulations which has handed France the initiative.

As Christie’s chief executive officer, Guillaume Cerutti, says: “Brexit has indeed had an impact on works traditionally imported from continental Europe to be sold in London. The addition of a new import VAT for buyers in the UK, plus the complexities of the customs clearance process often lead to a decision by our clients and Christie’s to sell in Paris or to use our online platforms in Amsterdam and Milan.”

Nonetheless, Christie’s did meet its target, as did the London auctions in general. Estimated at between £350 million and £500 million, they realised a healthy £427 million; no one could say the market had tanked. Highlights included five £15 million-plus paintings, led by a record £37.2 million for a historically important painting by Wassily Kandinsky at Sotheby’s, and a £25 million collection of surrealist works at Christie’s sent to London from California by the tech entrepreneur Gary Heidenreich and his wife Kathie.

In the booming younger artist sector, multiple estimate record prices were set for British figurative painters Michael Armitage (£1.9 million), Michaela Yearwood-Dan (£730,800) and Caroline Walker (£730,000), to name only three. Buyers were spread out globally, Asian bidders as prominent as ever. There was, however, one conspicuous weakness. The overall sale total was down by some 30 per cent on this time last year. The issue was not demand (nearly 90 per cent of lots offered were sold) but supply to the UK.

The UK art market was never pro-Brexit. Apart from the restrictions of movement among personnel in and out of the UK, there has been a massive increase in paperwork, import taxes and delays in the transport of goods that have impacted business efficiency.

This has affected London as an international entrepôt for selling art. One by one, the big international galleries in London – Hauser & Wirth, Thaddaeus Ropac, David Zwirner and Gagosian – have been opening branches in Paris – Zwirner spelling out that he wants to be part of Europe. One of the main reasons cited for the cancellation of London’s swanky summer fair, Masterpiece, was a lack of overseas exhibitor interest due to Brexit (though a smaller replacement has been found already).

The cross-Channel drift can be charted statistically. Between 2001 and 2021, France’s share of the global art market has remained steady at around seven per cent and currently accounts for 50 per cent of the entire European art market, with art auctions hitting €1 billion (£880 million) last year for the first time. According to a report by UBS last year, Britain’s share of the global market fell by 3 per cent to 17 per cent. While the UK’s annual auction figures have fallen by 28.6 per cent since 2018, the French have improved by over 50 per cent.

Sadie Coles, the owner of London’s Sadie Coles HQ gallery, told The Art Newspaper this month: “I’m seriously worried about the next few years in terms of the primacy of the art market here. London was number two behind New York but now it’s slipping down. It doesn’t feel like we’re a place to do business as we once were.”

However, there could be an unexpected twist in the tale. Under a new EU VAT directive which comes into force in January 2025, sales of works of art that have been imported into France under the reduced 5.5 per cent rate it currently enjoys will be subject to a 20 per cent standard EU tax rate on the entire sale value, a substantial increase from the present EU arrangement in which the 20 per cent tax is applied only to the profit margin on a sale. Thus, a €1,000 sale that makes €200 profit will be taxed €200 on the total price rather than €40 just on the profit.

This “would bring France’s art market renaissance to an abrupt end”, says dealer Thaddaeus Ropac who has galleries in London, Paris and Salzburg. French art market sociologist professor Alain Quemin looks further ahead: “If we destroy what we’ve built over the last few years, the door will be wide open for the English to step in.” Heaven forbid!

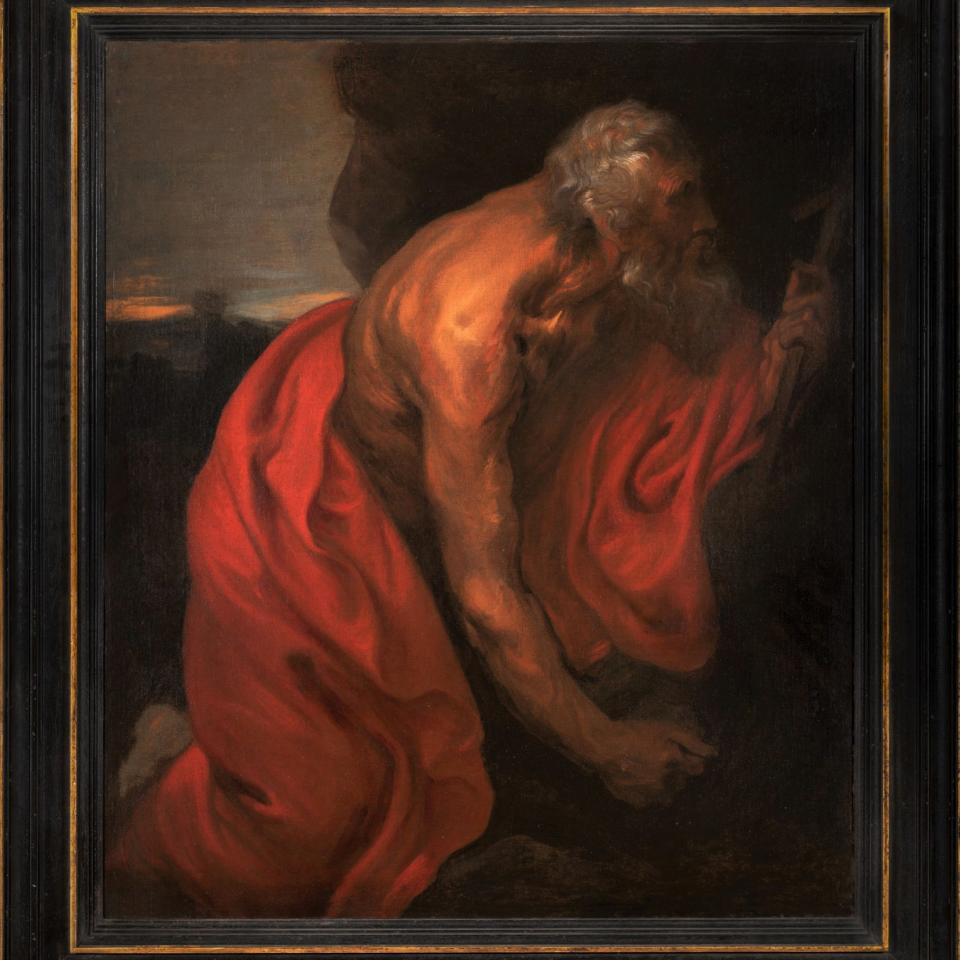

The Van Dyck that went for less than £40,000

This week sees the opening of TEFAF, the European Fine Art Fair in Maastricht, perhaps the most important fair in the world for Old Master paintings and antiques of every description. The fair attracts more museum curators globally than any other, so is an ideal place to unveil your latest discovery – which is what London dealers Dickinson is doing with a long-lost Van Dyck painting of St Jerome.

Thought to be the original of several versions by the artist, it was spotted by Simon Dickinson, online and in extremely grubby condition, catalogued as 17th- century Flemish School at a minor Paris auction last summer with a €4,000-€6,000 estimate. Dickinson had a hunch it would clean up nicely and prove to be the real thing – but so did someone else, and the bidding rose to a final price of €42,240 (£37,340).

However, the auctioneers should be kicking themselves, as that is nowhere near what a rediscovered Van Dyck should fetch. With academic validation, Dickinson will be asking £750,000 for it this week, and will, no doubt, be a first port of call for many Maastricht- bound museum curators.

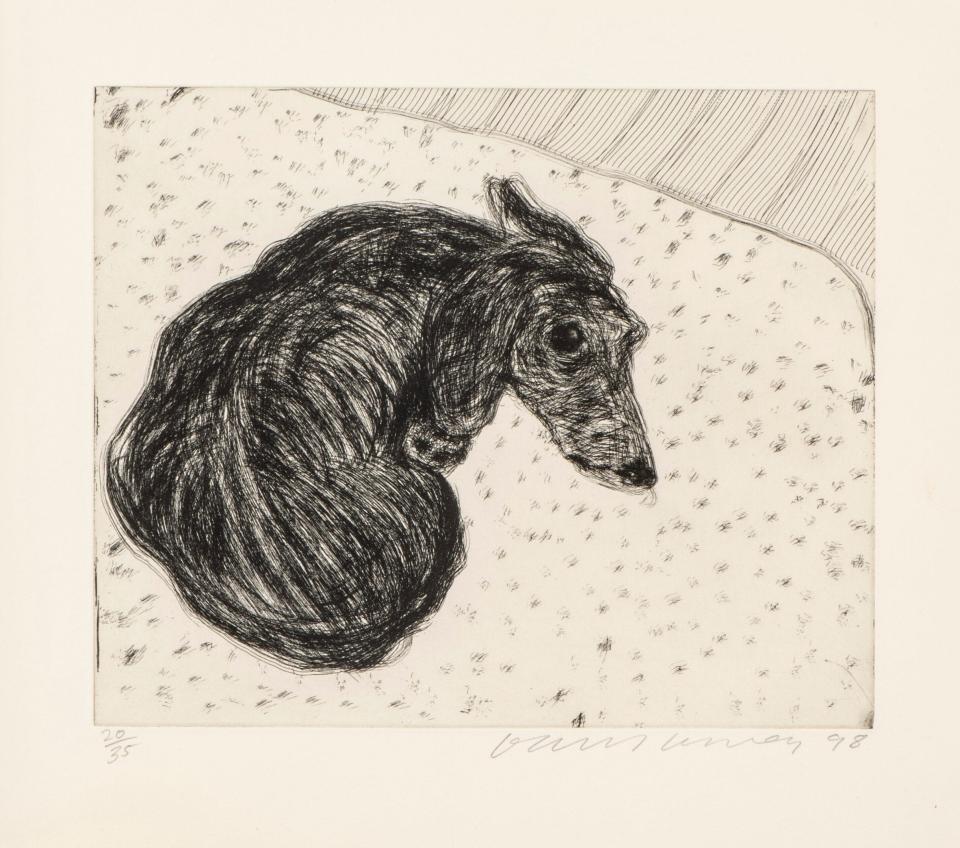

Your chance to collar a Hockney dog sketch

In 2007, when Richard Caring bought Mayfair’s George club from Mark Birley, he inherited the art collection that adorned its walls. Being proudly dog-friendly, the club boasted numerous etchings and lithographs by David Hockney of his dachshunds, Stanley and Boogie.

Recently, the club has been closed for redecoration and Caring is clearing out the doggie pictures (estimations of which start at £600 and go up to £6,000) at Christie’s together with around 30 Hockney exhibition posters, some signed by the artist (£400-£1,500), Swiss ski posters (£2,000-£15,000), with some original drawings by former Daily Telegraph cartoonist Nicholas Garland thrown in.

The most valuable lot at £70,000-£100,000, is a Tracey Emin heart-shaped neon light encircling the words “I’m a Rare Bear” which Caring did not inherit but, having developed a strong creative relationship with the artist, bought from her in 2014. The George club clearance sale goes on view online only from today, with bidding closing on March 28 and all proceeds going to The Caring Family Foundation.