Why the Art Market Will Soon See the First Billion Dollar Sale

After one of his paintings went for $90 million in November 2018, David Hockney enjoyed the distinction of being the most expensive living artist in the world-for a grand total of six months. This May, Jeff Koons unseated him when his sculpture, Rabbit, sold for $91 million. And how could we forget the blockbuster November 2017 sale of Leonardo da Vinci's Salvator Mundi, which went for $450 million at Christie's, the highest price ever fetched for any artist. With increasingly jaw-dropping sales, it is only a matter of time before someone unseats Koons.

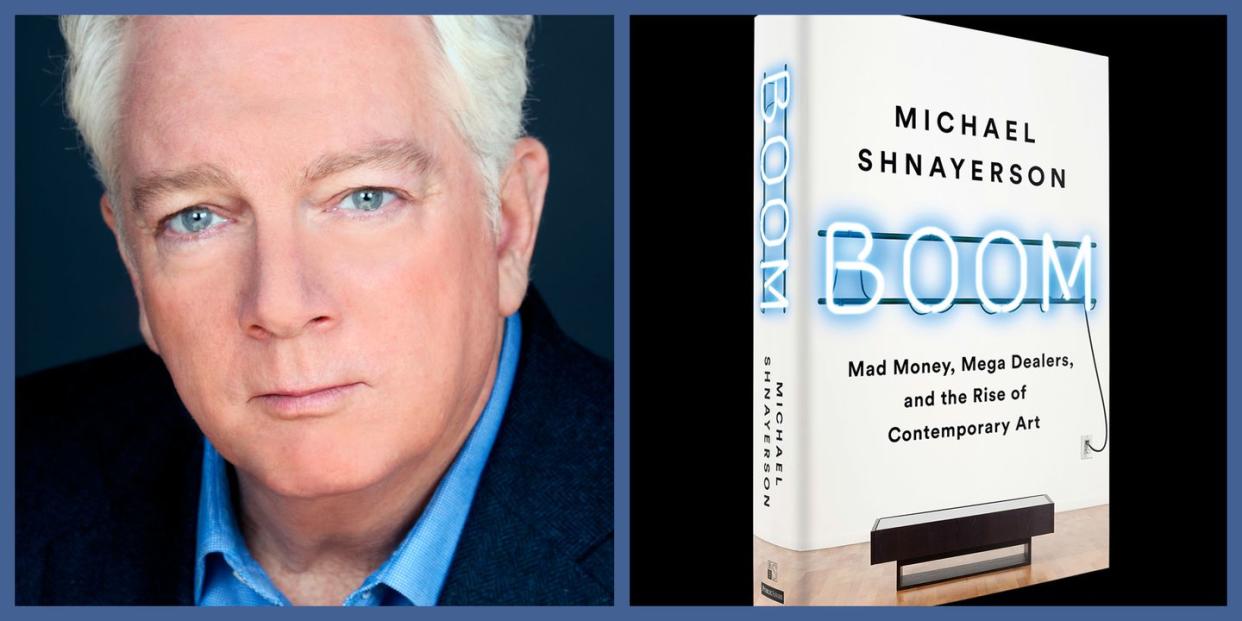

How did we get here? In his new book, Boom: Mad Money, Mega Dealers, and the Rise of Contemporary Art, T&C contributor Michael Shnayerson gets at the heart of what drives the global art market to such extraordinary heights-or more accurately, who is driving it. He shows how four "mega dealers"-David Zwirner; Arne and Marc Glimcher of Pace Gallery; Iwan Wirth of Hauser and Wirth; and Larry Gagosian-negotiate multi-million dollar deals in a tightly controlled circle of elite buyers and artists. The personalities are big, and the checks are even bigger.

For a certain class of people, buying high-priced art is a financial asset, but it's also a social one.

Art Basel, in Switzerland, is the center of the contemporary art scene. Everybody knows everybody there and it's not just American hedge-funders, but billionaires from around the world. You can be some industrialist or software king who's just made billions and you have no life, and you come over to Basel and you write a couple of checks, and you will soon have friends. And you'll see those friends at each next fair. You can spend the whole year going from art fair to art fair.

What makes art an attractive splurge?

If you're a billionaire, you've already bought everything else your money can buy. You buy art because, not only do you love it, but it's one of the few things that you can just buy and buy and buy. You only buy one yacht really, one plane, maybe 6 homes. With art it's the one sort of luxury, fantasy good that you can always buy more of.

Are art collectors loyal to an artist, or to a dealer?

There is a tendency on the part of many collectors to buy the same artist's work that their friends are buying. This is particularly true if they are Larry Gagosian's clients. He brings you into the fold. He chooses his artists carefully but his real focus is on the 10 or 12 billionaires who are his top clients. Whatever he tell them to buy, they're gonna buy. In that sense, people have told me they walk into friend's apartments and see the same five artists. It's Damien Hirst, Ed Ruscha, Christopher Wool. It's a phenomenon.

Your book focuses on the four "megas"of the art world, two of whom are over 70 years old and have been in business for decades. Who fills the void when they are gone?

It's unusual for one generation of dealers to pass on to the next, and for good reason. Artists establish a bond with the head of the gallery and if that person is gone they're more likely to establish a relationship with someone else. The megas are obviously aware of mortality and they seem to approach it with different attitudes.

Could we see a billion-dollar sale? Are we heading for an art bubble?

There is a lot of talk about a billion dollar sale and it could happen. It could be a da Vinci. There is always talk of a bubble, but there's a lot less talk than there used to be because the contemporary art market is just so much more global and the money sustaining it is so much greater. When you look at the first Forbes billionaires list in 1987 there were hardly any billionaires [Editor's note: there were 140]. Now there are something on the order of 2000 [2,153 as of March 2019].

Mary Boone, a former art world power player, was recently sentenced to two and a half years in prison for falsifying tax returns. What do you make of her story?

I think she was one of the most important dealers, certainly of the '80s. The fact that she ends up tangled up in a tax evasion thing that she should have avoided is unfortunate. Whether or not she deserved the sentence she got, I don't know. It seems a little harsh to me. But I don't think it tarnishes the art world, there's always gossip about art fraud.

In the book you say the art market is the largest unregulated legal market in the world.

That's the way it's set up and nobody shows much interest in wanting to change it. There are only two things you have to do: you have to live up to the terms of whatever deal you made and you need to pay your taxes. People think that a Mary Boone story suggests malfeasance in the art market but actually, most dealers still do their business by handshake deals, and abide by them.

What are the mega-dealers up to right now?

Three of the four mega dealers are building these vast galleries opening in the fall. In September Arne Glimcher at Pace is opening an eight-story gallery in Chelsea which will be the biggest commercial gallery in the world. He's doing it at 80 years old. Zwirner and Hauser and Wirth are both building super galleries too. And the funny thing is Gagosian was ahead of the game, he already had his super gallery years ago. But apparently not wanting to be left behind in this latest fervor of building, he's gonna put two more stories on top of his flagship.

('You Might Also Like',)