Why Bulls Should Target Wayfair Stock Next Month

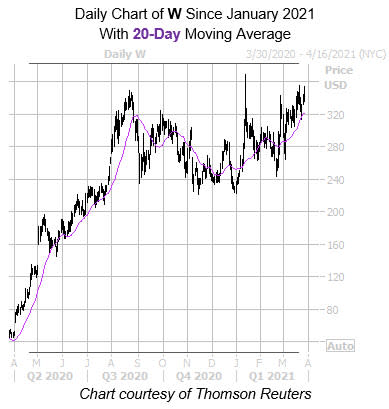

The shares of furniture name Wayfair Inc (NYSE:W) are down 1.1% at $339.50 at last check. Shares have been trekking higher over the past few weeks, though, after pulling back from a Jan. 14 all-time high of $369. Plus, the security is receiving support from the 20-day moving average, and sports a jaw-dropping 627.9% over-over-year lead. Another reason why investors shouldn't look away just yet is that a historically bullish signal flashing could be indicative of more record highs for W in the near future.

Digging deeper, the stock's latest peak comes amid historically low implied volatility (IV), which has been a bullish combination for the security in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been two other times in the past five years when the security was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) stood in the 20th percentile of its annual range or lower. This is now the case with W's SVI of 60%, which sits in the seventh percentile of its 12-month range.

White's data shows that a month after these signals, the security was higher, averaging a 11.2% return for that time period. From its current perch, a move of similar magnitude would put W just over the $377 mark, which is an higher level than its January peak.

Analysts are still hesitant towards the equity, leaving ample room for upgrades and/or price-target hikes moving forward, which could send the shares higher still. Of the 22 in question, 12 carry a tepid "hold" or worse rating, while the remaining 10 say "strong buy." Plus, the 12-month consensus target price of $321.38 is a 5.1% discount to the equity's current perch.

A short squeeze could fuel additional gains for Wayfair stock. Short interest is up 10.4% over the last two reporting periods, and the 12.90 million shares sold short account for a whopping 20.1% of the stock's available float, or over a week's worth of pent-up buying power.

Lastly, the security's Schaeffer's Volatility Scorecard (SVS) sits at an elevated 94 out of 100. This indicates the security has exceeded volatility expectations during the past year, a good thing for options buyers.