Why Coronavirus Is Affecting Car Production

The vehicles are safe from infection—steel, aluminum and plastic make for a robust immune system. But the industry that produces them is not. As of this writing, many of the world's largest markets, China foremost among them, are feeling the coronavirus effects in a major way.

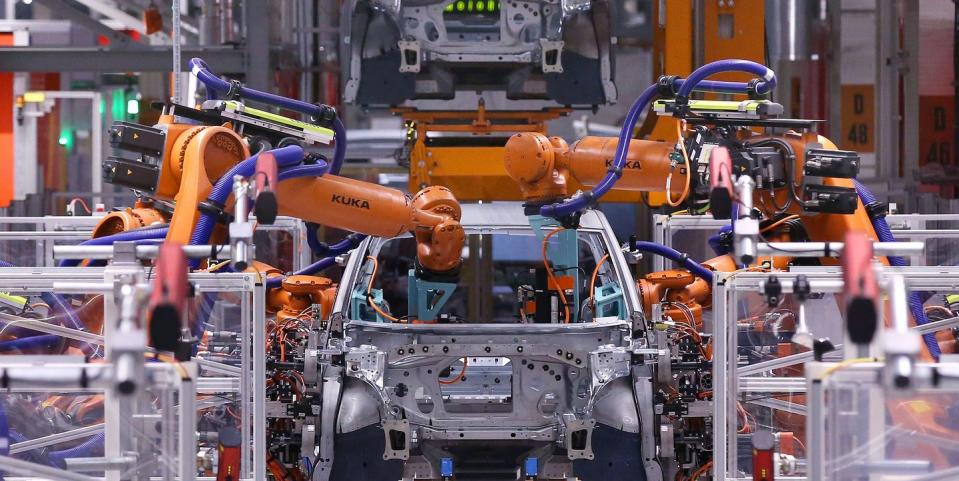

Shown above, a Volkswagen Group factory in Germany in late February 2020.

What's the connection between a new virus and the health of the car industry? It's complicated, yet simple in its origin: No other industry both enables high levels of personal and commercial mobility, and, perversely, is so dependent on it. To contain such a highly-mobile virus capable of geometric expansion, it must be isolated, contained at all costs. Huge regions in China and South Korea, the origin countries of countless thousands of automotive and electronic components, were put on official lockdown. Sick, quarantined patients, or healthy persons feared to be exposed, are effectively under house arrest. Workers can't get to work—engineers, drivers, the whole array of professionals who make an industrialized society function, are largely on the sidelines.

The car industry is served by three tiers of suppliers. Tier 3 encompasses companies that handle the raw materials. Tier 2 is made of manufacturers that supply both automotive and non-vehicular industries—for example, computer chip makers. Tier 1 companies specialize in automotive components and do business directly with OEMs—think ZF, Bosch or Delphi. Much of the production lost to coronavirus precautions comes from the vast, broad base of the pyramid—the tiny parts which normally progress smoothly through the three tiers, being incorporated into ever more valuable assemblies until they reach a car manufacturer and are installed in a vehicle.

In these days of efficient, just-in-time, low-inventory manufacturing, the effects are almost immediate: No plastic spacer, no injector body, thus no injector, and ultimately, no engine and no car. Sure, there are remedies: Production can be shifted to other suppliers in unaffected zones, but "re-sourcing" requires testing and validation, and always carries the risk of a decrease in quality. The replacement plastic spacer may look and feel the same, but will it meet the same criteria for heat, pressure, and chemical stability over hundreds of thousands of miles? At least a few weeks are required for such emergency resourcing, and even then, there are risks. We do see the Chinese industry, after weeks of COVID-19 problems, beginning to return to near-normalcy. But the flow of Chinese and Korean subcomponents, exported globally to car companies and major suppliers everywhere, has been substantially constricted, and will take a long time to rebound.

Analysts who follow the industry have noted this, and have issued negative reports on the near-term future of most, if not all, large automotive suppliers. Their stocks are down. The generalized COVID-19 panic has caused global equity markets to decline sharply, reducing investor wealth. It's not uncommon for would-be car buyers to look at tumbling financial indicators and decide to postpone a purchase. Collectively, the car markets decline. (My order for a C8 Corvette remains intact, despite portfolio shrinkage.)

If you ask me, there's no need to panic. I believe COVID-19 will be contained, its economic effect blunted by late April to mid May. A vaccine will be created, and, by the end of this year, we'll consider it to have been a speed-bump. But, yes, in our totally interwoven automotive world, the car industry can get sick from a virus.

You Might Also Like

Yahoo Autos

Yahoo Autos