Why these Erie programs are prioritizing financial literacy education for children

Saving money to buy bedroom decorations or taking a trip to Mexico are just a couple of things students at St. James School in Erie have learned how to do in their financial literacy course.

Investopedia describes financial literacy as the ability to understand and effectively use various financial skills, including money management, budgeting and investing.

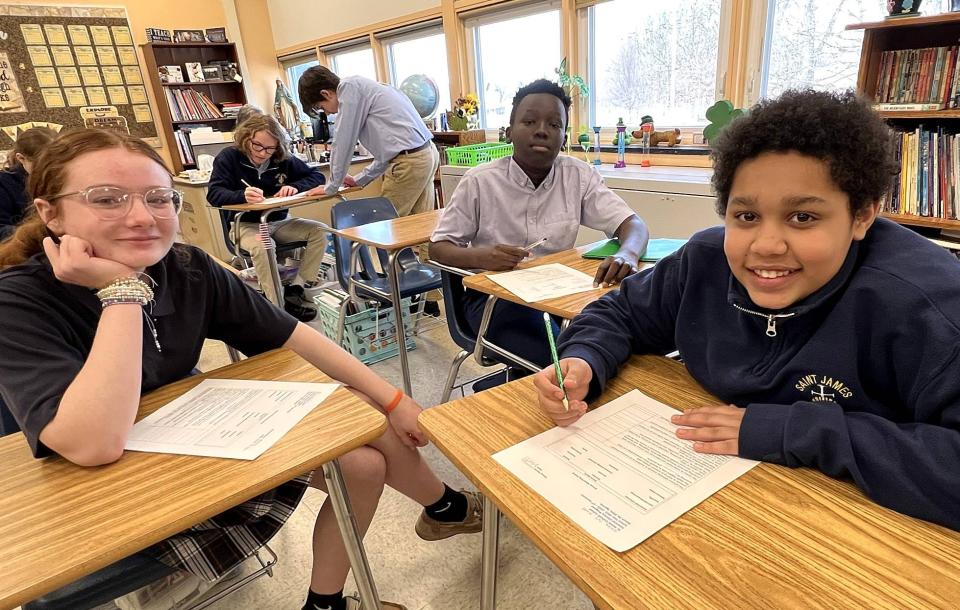

Erie Catholic School System's St. James School launched a nine-week pilot course in financial literacy in January. It's led by Financial Consultant Philip Thomas of B&T LLC in Erie in association with Youth Literacy Project, Inc. Fifteen students in grades six through eight are enrolled in the elective.

Throughout the quarter, students are learning to budget, the need to allocate money for taxes, the meaning of compounding interest and other key components to financial independence. To Thomas, the topics he's teaching are something all children need to be taught in order to have a successful future.

"The earlier we can get the students to understand the basic principles I think the better off they’ll be," Thomas said. "They'll be better citizens, better businessmen and women, and have an economic impact in our community."

Making financial literacy digestible through real-world application

Thomas knew it would be a challenge to help the students understand various financial terms, but said he focuses on basic principles to get lessons across.

"Situations may change, circumstances may change, even methods of doing things may change, but underlying principles tend to stay the same," he said. "They may not have an in-depth understanding, but to know that something exists I think in the long run puts them ahead of the game."

Real-world application: Financial literacy education has lasting impact

To understand the basic principles of saving money, Thomas had the students create what he calls smart goals. Each student picked something personal they wanted to save money for over a set period of time and tracked their progress.

Seventh-grader Benjamin Torres-Quinones said the exercise have improved his money management skills.

"I used to spend a lot of money," Torres-Quinones said. "Right when I got money I would go to the store and get a toy, but now I’m putting some of it away and getting stuff I actually need."

When deciding which elective to take, Torres-Quinones said he wanted to challenge himself.

"All the other electives were really just activities like crocheting, jewelry-making ... they were just activities to do, but this one felt different than the other ones," he said. "Over there we’re learning, but here we’re learning something that will actually help us."

Classmate Riley Eicher also chose to take the financial literacy course. For Eicher, also a seventh-grader, Thomas' instruction has shown her how to spend and save money responsibly, which is something she thinks is important for all children her age to understand.

"If you start earlier you have more control over what you do, and if you have control over what you do, you can save for the future," she said.

Thomas echoes his students' sentiments.

"I think understanding that the earlier you start on certain things, the better you position yourself, and I think that’s something they’re starting to understand," Thomas said. "And I think other school districts, other entities, they have to jump on board. The earlier we get started on this, the better off our next generation is going to be."

Where else is financial literacy offered in curriculum?

As far as other financial literacy courses offered in the curriculum across the county, Thomas said there are few.

In Erie County, several schools offer a type of financial literacy education, primarily for upperclassmen at higher grade levels. Corry Area School District provides a mathematics of finance course. Wattsburg Area School District has a finance and economics course. North East School District offers personal finance courses.

Pennsylvania Auditor General Tim DeFoor visited McDowell High School in Millcreek Township School District Tuesday to speak about his vision that financial literacy be a mandated course in all K-12 schools statewide.

In practice elsewhere: Spreading the gospel of financial literacy and generational wealth to Cape Cod teenagers

He said the financial literacy being taught at McDowell is an example of what he believes all schools should be taught.

"Only a small number of schools in Pennsylvania require that financial literacy be taught as a graduation requirement, and I’m happy to say that this school is one of them," DeFoor said. "There are 21 states in the country that require some type of financial literacy be taught in our schools. Unfortunately, Pennsylvania is not one of them, and it’s time to change that."

When asked why more schools in Pennsylvania have not addressed the gap of teaching financial literacy, DeFoor said those in power don't want to burden teachers with another mandated course.

"But one thing we’ve learned at this school and others is that there are ways it can be taught with very little resources and very little interruption to the current curriculum," DeFoor said. "Look at what’s already being done successfully, tailor it to whatever your needs are and go from there."

DeFoor said if the state wants to see changes happen for the better, financial literacy needs to be part of a student's education.

"Right now we are at competitive disadvantage here in the commonwealth," he said. "It's our duties as elected officials to leave this commonwealth better than we found, it so we need to give these students all the tools they need to be successful."

More needs to be done in Erie County

Thomas thinks what he's teaching at St. James is taking financial literacy in the right direction with a younger student demographic.

"I think what makes this program a little different is the style of teaching financial literacy and how in-depth with certain types of concepts I'm willing to go," he said. "Every financial literacy program is not necessarily talking about compounding interest, because it’s not the easiest thing to explain. There’s other topics in our course that normally you just would not see at this grade level, but I’m at the opinion that these things can be taught, and this class is proving that."

Bishop Dwane Brock, CEO of the Eagle's Nest Leadership Corp. and Erie's East Side Renaissance, believes more needs to be done.

"I’m not faulting the school district, I’m faulting a system," Brock said. "To help these kids develop this thing, financial literacy needs to be a part of a state-mandated curriculum. I don't know of any other institution that’s doing financial literacy at the level we are."

On a mission to break the cycle of poverty

Brock started Eagle's Nest's School of Financial Literacy based on his interactions with the community as a clergyman.

"Much of the poverty that is experienced not only in our city but all over is based upon people’s ignorance of how systems work," Brock said. "There’s so many people who are on the lower rung of the economic ladder who do not understand how money works or how insurance works."

In partnership with PNC Bank, Brock developed a school that teaches seventh- and eighth-graders how budgets work, the differences between good and bad credit, the importance of banking and more.

"I have PNC Bank managers from all over coming in and teaching and training the kids to get them familiar with financial terms," Brock said. "It’s been a very good setup. The challenge is, young people have visions that are not logical, not reasonable, and that’s OK, because we’ve all been there.

"I have some kids that are good at sports and they demonstrate the physical prowess to do whatever, but they need to understand that only a very small fraction of individuals make it, so what are you going to fall back on?"

Brock stressed that understanding how to build a system of wealth early is imperative to break the cycle of poverty.

Related: To start closing the Black wealth gap, teach personal finance to high school students

"There is a larger percentage of white folk who teach and demonstrate generational wealth, so they’re going to pass it on," Brock said. "But in minority communities, the percentage is next to nothing as far as people leaving funds for children, and we want to change that dynamic. It’s a Herculean task, but that’s what we endeavor to do."

Brock believes the first step to teaching the younger generation the importance of money starts at home.

"Mothers and fathers now are younger, grandmothers are now younger," Brock said. "My point is that there was a time that the older you had gotten, the more wisdom you had, and it’s not there anymore. Somebody has to push the young adults to push their kids to get them involved in financial literacy. Somebody has to push them because they don’t know what they don’t know."

How is the problem being addressed?

In addition to Brock's partnership with PNC Bank, he's also partnered with Penn State Behrend, the Housing Authority of the City of Erie, ErieBank and other regional banks to continue shaping financial literacy education for the community.

"All these entities are going to work together to try and tackle this issue of teaching folk the importance of money, becoming bankable, developing credit, the importance of you handling money and not allowing money to handle you," Brock said. "It’s a win-win situation for everybody involved to teach the marginalized of our community how money works."

Since January, Behrend educators have been going to Eagle's Nest twice a week to teach more about financial literacy. Brock expects by summer those teachings will reach more than just Eagle's Nest students.

"What we need Penn State to concentrate on is young adults, so we’re still developing (financial literacy courses) this summer for young adults, young families along with the Housing Authority," Brock said.

Financial literacy education will continue to be at the forefront of the conversation through the East Side Renaissance's partnership with ErieBank, which is bringing a community bank to the Parade Street corridor.

In the works: New bank is coming to Parade Street in ErieBank investment in Erie's East Side Renaissance

"It won’t only be a bank but an institution of training in the dynamics of financial literacy," Brock said.

Brock recognizes his vision of providing financial literacy to all is still in the works, but he's confident his vision for the community, especially the younger generation, will come to fruition.

"I think it is paramount and of most importance to us to develop a knowledge of financial literacy for children, because in doing so, we’re able to break the bonds of poverty," he said. "I teach them about budgeting, systems of money, about capital, credit repair … all of those dynamics we need to teach our young people. That alone will break the bonds of poverty, and that will give people an opportunity to become competitive in this capitalistic society."

Baylee DeMuth can be reached at 814-450-3425 or bdemuth@timesnews.com. Follow her on Twitter @BayleeDeMuth.

This article originally appeared on Erie Times-News: Financial literacy education in Erie starts with teaching youth