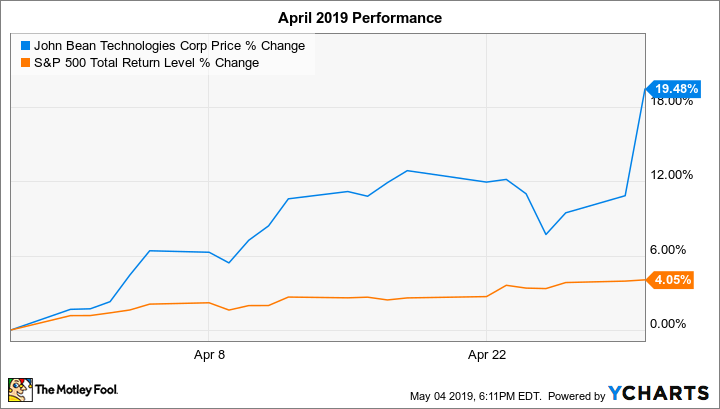

Why John Bean Technologies Stock Jumped 19.5% in April

What happened

Shares of John Bean Technologies (NYSE: JBT) gained 19.5% in April, according to data from S&P Global Market Intelligence. The S&P 500 index returned 4.1% last month.

John Bean Technologies is a provider of technology to the food processing and air transportation industries.

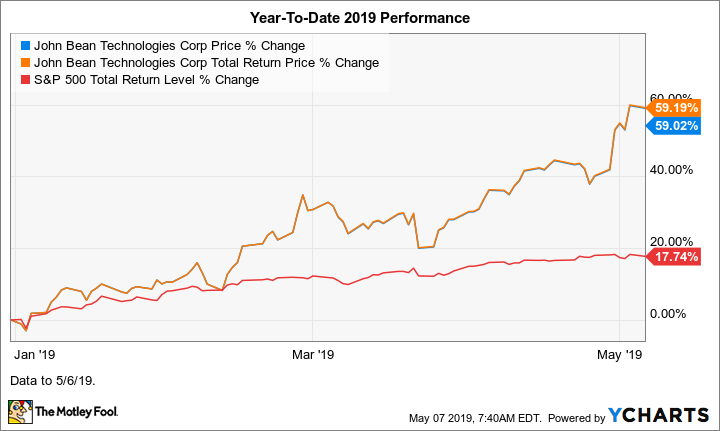

Shares have returned 59.2% in 2019 through Monday, May 6, versus the S&P 500 index's 17.7% return over this period.

Image source: JBT Corp.

So what

JBT stock entered April with solid momentum, though there was also a specific catalyst that contributed to its strong performance last month: the company's April 29 release of first-quarter 2019 earnings that beat expectations. It also raised its full-year 2019 guidance.

Data by YCharts.

In the quarter, revenue grew 2% year over year to $418 million, which "consisted of 14 percent organic growth and 3 percent from acquisitions, offset by a 12 percent decline reflecting the absence of the ASC 606 [new accounting standard] transition benefit in the first quarter of 2018 and a 3 percent headwind from foreign exchange translation," the company said. In other words, excluding the impact of the adoption of a new accounting standard in the year-ago period, revenue rose a solid 14% year over year, and 17% on a constant currency basis.

Reported earnings per share came in at $0.62, up from $0.05 in the first quarter of 2018, and EPS adjusted for one-time items was $0.77, more than double the $0.35 in the year-ago period and higher than the $0.46 Wall Street consensus estimate.

Here's how JBT stock has performed in 2019:

Data by YCharts.

Now what

Along with reporting solid Q1 results, John Bean Technologies raised its full-year 2019 guidance. The company expects organic revenue growth of 4% to 5% and growth from completed acquisitions of 2% to 3%, partially offset by a 1% headwind from foreign exchange translation. Reported revenue, however, is "expected to be flat year over year, reflecting $127 million of revenue included in 2018 results associated with the transition to ASC 606." The company anticipates reported EPS in the range of $4.00 to $4.20 and adjusted EPS of $4.35 to $4.55.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.