Why You Should Leave Gibson Energy Inc. (TSE:GEI)'s Upcoming Dividend On The Shelf

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Gibson Energy Inc. (TSE:GEI) is about to go ex-dividend in just 4 days. Ex-dividend means that investors that purchase the stock on or after the 27th of September will not receive this dividend, which will be paid on the 17th of October.

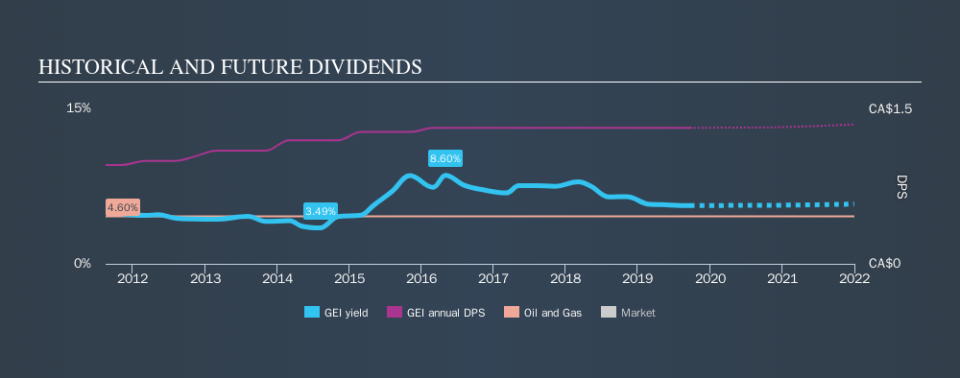

Gibson Energy's next dividend payment will be CA$0.3 per share, on the back of last year when the company paid a total of CA$1.3 to shareholders. Looking at the last 12 months of distributions, Gibson Energy has a trailing yield of approximately 5.7% on its current stock price of CA$23.32. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Gibson Energy

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Gibson Energy paid out 129% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 96% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Cash is slightly more important than profit from a dividend perspective, but given Gibson Energy's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see Gibson Energy earnings per share are up 3.6% per annum over the last five years. Minimal earnings growth, combined with concerningly high payout ratios suggests that Gibson Energy is unlikely to grow the dividend much in future, and indeed the payment could be vulnerable to a cut.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past eight years, Gibson Energy has increased its dividend at approximately 4.1% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Has Gibson Energy got what it takes to maintain its dividend payments? Gibson Energy is paying out an uncomfortably high percentage of both earnings and cash flow as dividends, although at least earnings per share are growing somewhat. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Ever wonder what the future holds for Gibson Energy? See what the nine analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.