Why Leoch International Technology Limited (HKG:842) Is A Top Dividend Stock

Could Leoch International Technology Limited (HKG:842) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

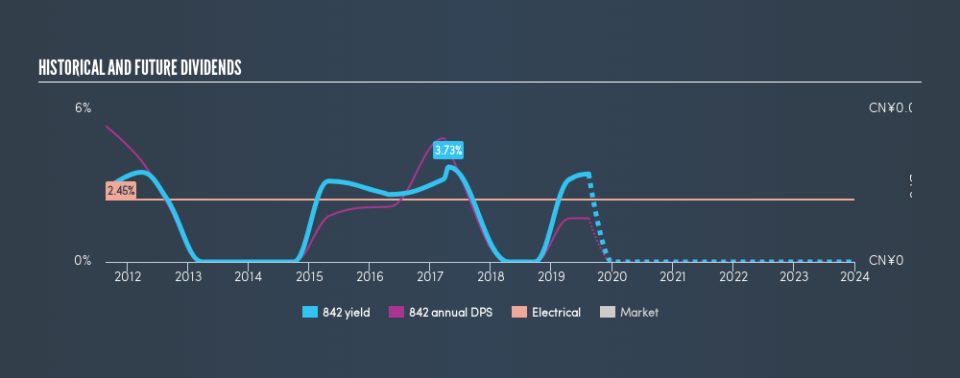

In this case, Leoch International Technology likely looks attractive to dividend investors, given its 3.5% dividend yield and eight-year payment history. We'd agree the yield does look enticing. Some simple research can reduce the risk of buying Leoch International Technology for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Leoch International Technology!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Leoch International Technology paid out 22% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

Is Leoch International Technology's Balance Sheet Risky?

As Leoch International Technology has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Leoch International Technology is carrying net debt of 3.90 times its EBITDA, which is getting towards the upper limit of our comfort range on a dividend stock that the investor hopes will endure a wide range of economic circumstances.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. With EBIT of 1.34 times its interest expense, Leoch International Technology's interest cover is starting to look a bit thin.

Consider getting our latest analysis on Leoch International Technology's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Leoch International Technology paid its first dividend at least eight years ago. It's good to see that Leoch International Technology has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past eight-year period, the first annual payment was CN¥0.054 in 2011, compared to CN¥0.017 last year. Dividend payments have fallen sharply, down 68% over that time.

We struggle to make a case for buying Leoch International Technology for its dividend, given that payments have shrunk over the past eight years.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Leoch International Technology has grown its earnings per share at 28% per annum over the past five years. Earnings per share have grown rapidly, and the company is retaining a majority of its earnings. We think this is ideal from an investment perspective, if the company is able to reinvest these earnings effectively.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Leoch International Technology has low and conservative payout ratios. Unfortunately, the company has not been able to generate earnings per share growth, and cut its dividend at least once in the past. Overall we think Leoch International Technology scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Now, if you want to look closer, it would be worth checking out our free research on Leoch International Technology management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.