Why Are So Many Gurus Buying Cognizant?

Cognizant Technology Solutions Corp. (NASDAQ:CTSH) is a large information technolgy services company based in New Jersey that has a large technical workforce in India. The company caught my attention due to the high level of guru buying in the second quarter. During the three month period ended June 30, 13 gurus bought the stock, while only one sold shares.

The company is a leading provider of full life-cycle e-business and application development projects, taking full responsibility for management of a clients software systems and helping clients move legacy transformation projects through to completion. Cognizant is especially strong in verticals such as health care and financial services.

Segments | |||

Revenues | |||

Report Date | 12/31/2021 | 12/31/2020 | 12/31/2019 |

Currency | USD | USD | USD |

Scale | Thousands | Thousands | Thousands |

Financial Services | 6,051,000 | 5,621,000 | 5,869,000 |

Healthcare | 5,337,000 | 4,852,000 | 4,695,000 |

Products & Resources | 4,276,000 | 3,696,000 | 3,770,000 |

Communications, Media & Technology | 2,843,000 | 2,483,000 | 2,449,000 |

Total | 18,507,000 | 16,652,000 | 16,783,000 |

Cognizant operates under two broad service lines: consulting and technology services and outsourcing.

The companys solutions include application development and integration, application management and reengineering services.

Applications development services are provided using a full life-cycle application development approach in which the company assumes total start to finish responsibility and accountability for analysis, design, implementation, testing and integration of systems, or through cooperative development, in which Cognizant employees work with the customers in-house IT personnel. In either case, the companys onsite team members work closely with end-users to develop specifications and define requirements.

Cognizant's applications management services seek to ensure that a customers core operational systems are free of defects and responsive to end-users changing needs. The company is often able to introduce product and process enhancements and improve service levels.

Through its reengineering services, the company works with customers to migrate systems based on legacy computing environments to newer, open systems-based platforms and client/server architectures, often in response to the more stringent demands of e-business.

According to Morningstar, the company has a narrow moat given its long-standing client relationships and the business-critical expertise it brings to the table. Many major IT projects last many years and the company's consultants work closely with the clients' in-house personnel over extended periods of time, resulting in deep understanding of the business and building relationships which will be hard to replace.

Geographic Analysis | |

Revenues | |

Report Date | 12/31/2021 |

Currency | USD |

Scale | Thousands |

North America | 13,636,000 |

United Kingdom | 1,642,000 |

Continental Europe | 1,919,000 |

Rest of World | 1,310,000 |

Total | 18,507,000 |

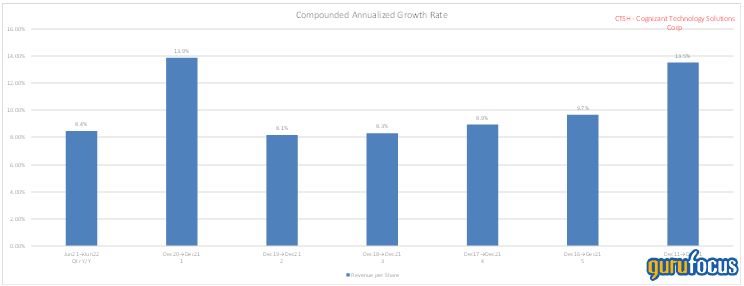

While Cognizant's revenue per share growth over the past 10 years has been in the mid-teens, it has slowed to mid-single digits over the last few years. The slowing growth as well as some erosion in net profit margins over the years has led to some price-earnings compression, so Cognizant is now more of a value stock than a growth stock.

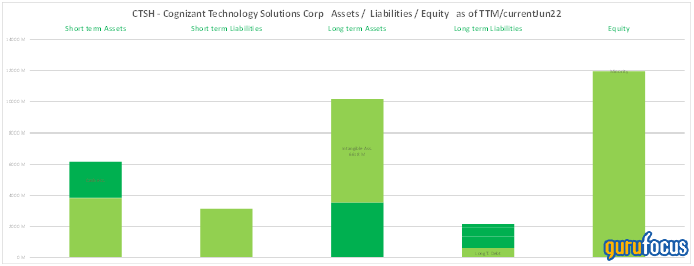

The company has an excellent balance sheet with very low debt.

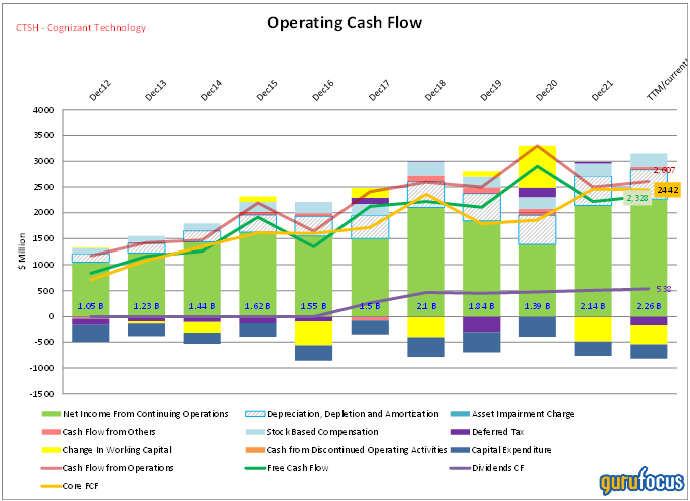

The company produces consistent and high-quality cash flows. Core cash flows (free cash flow without changes to working capital and less stock-based compensation) as represented by the orange line is growing in the high single digits. Growth of core cash flow has been very strong over the last four years at well over a 15% compound annual growth rate.

Valuation

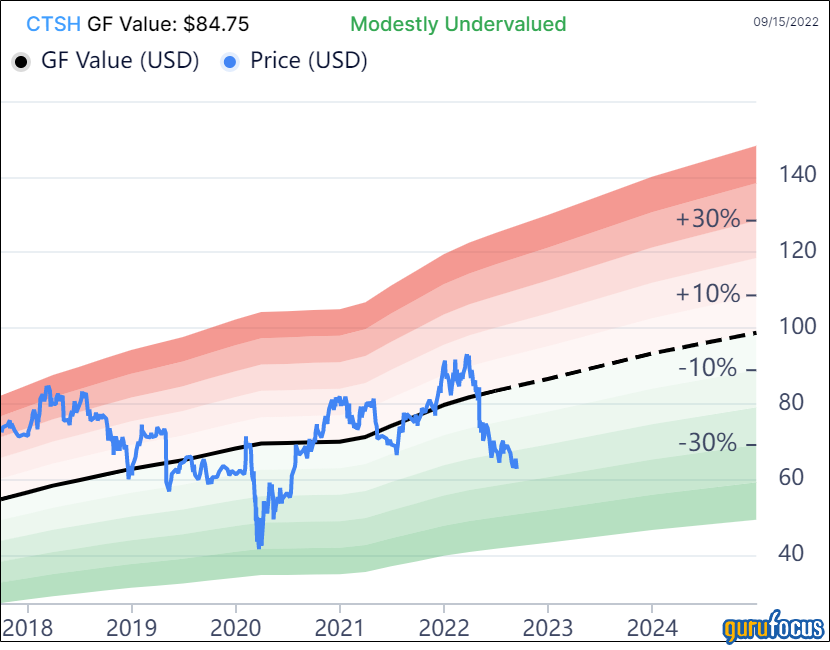

The GF Value Line shows the stock to be moderately undervalued based on historical ratios, past financial performance and analysts' future earnings projections. The stock is down about 33% from its high.

The GF Value is approximately $85, which I think is accurate. Morningstar gives a more generous fair value of $96 a share, while CFRA has a 12-month target of $81 and a buy recommendation.

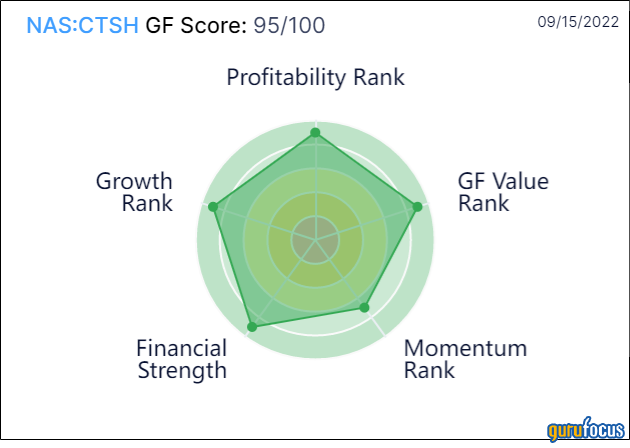

The GF Score is excellent at 95 out of 100, indicating Cognizant has high outperformance potential.

As the following table shows, Cognizant's valuation compares well against a set of global IT service providers. Its price-to-operating cash flow and free Cash flow is among the lowest, as it its enterprise value/Ebitda ratio.

Exchange | Symbol | Company | Current Price | Market Cap ($M) | Forward PE Ratio | Price-to-Free-Cash-Flow | Price-to-Operating-Cash-Flow | Dividend Yield % | EV-to-EBITDA | |

NAS | CTSH | Cognizant Technology Solutions Corp | 62.20 | $32,206 | 12.69 | 13.99 | 12.51 | 1.69 | 8.87 | |

NYSE | IT | Gartner Inc | 300.08 | $23,734 | 0.00 | 22.37 | 20.96 | 0.00 | 21.78 | |

NYSE | LDOS | Leidos Holdings Inc | 93.29 | $12,738 | 13.04 | 16.72 | 14.75 | 1.54 | 12.55 | |

NYSE | GLOB | Globant SA | 209.02 | $8,732 | 0.00 | 89.97 | 50.92 | 0.00 | 49.46 | |

NYSE | G | Genpact Ltd | 44.97 | $8,251 | 0.00 | 22.72 | 19.45 | 1.07 | 14.63 | |

NYSE | ACN | Accenture PLC | 272.68 | $172,483 | 22.52 | 23.61 | 21.37 | 1.42 | 15.40 | |

NSE | TCS | Tata Consultancy Services Ltd | 3008.70 | $138,216 | 26.18 | 30.11 | 27.84 | 1.46 | 18.31 | |

NSE | INFY | Infosys Ltd | 1377.05 | $72,510 | 24.04 | 26.82 | 24.18 | 2.25 | 16.32 | |

NSE | HCLTECH | HCL Technologies Ltd | 896.90 | $30,557 | 17.12 | 58.28 | 46.60 | 5.35 | 10.92 | |

XPAR | CAP | Capgemini SE | 166.25 | $28,390 | 14.47 | 14.11 | 12.17 | 1.44 | 11.82 | |

BOM | 507685 | Wipro Ltd | 401.85 | $27,605 | 18.25 | 37.56 | 27.88 | 1.49 | 11.38 | |

17.40 | Average |

Conclusion

Given the amount of guru investor interest in this name and the apparent undervaluation, Cognizant deserves serious consideration.

The company is well managed with strong cash flow generation. While Cognizant's growth has slowed in recent years, mid-single-digit growth should continue. It operates in a very competitive industry and faces some key risks, particularly in talent and recruiting given the shortage of IT personnel.

On the other hand, the overall IT services market continues to grow with market research firm IDC estimating overall worldwide services spending will rise at about a 4.4% CAGR between 2018 and 2022, reaching $1.2 trillion. Worldwide IT outsourcing spending is expected to rise 3.1% annually over the same period. Business consulting and IT business process services revenues are projected to expand 8.7% and 4.7%.

Cognizant appears to be growing faster than the overall market, so it could be considered a good company trading at a fair price.

This article first appeared on GuruFocus.