Why We Are Not Worried About Intel's (NASDAQ:INTC) Dividend

This article first appeared on Simply Wall St News.

After reporting the Q3 earnings, Intel Corporation (NASDAQ: INTC) "took one on the chin" as the stock is down 10% pre-market.

Like (almost) every major tech company, Intel's operations have also been plagued with supply chain bottlenecks and component shortages. Yet, the CEO, Pat Gelsinger, remains optimistic that the worst is in the rear-view mirror.

Q3 Earnings Results

Non-GAAP EPS: US$1.71 (beat by US$0.60)

GAAP EPS: US$1.67 (beat by US$0.61)

Non-GAAP Revenue: US$18.1b (missed by US$170m)

Despite the EPS beat, it was evident that the market didn't like the EPS Q4 guidance of US$0.90. perhaps not following Mr.Gelsinger's optimism.

Furthermore, as the company has abandoned the efforts to acquire a chip design startup SiFive, it is turning to its foundry efforts. Yet, Intel seems to be learning from its mistakes, as the new Intel Foundry Services will be a standalone business unit, reporting directly to the CEO.

With companies like Samsung and TSMC pledging billions for semiconductor production and brands like Apple or Google exploring their own designs – Intel is entering a transitory period. Therefore, we'll examine its dividend to examine its quality and the margin of safety.

The Dividend Outlook

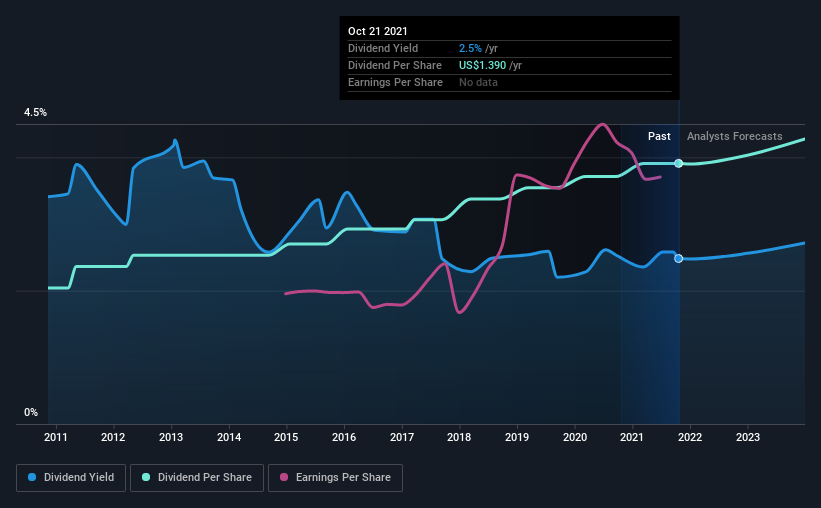

A slim 2.5% yield is hard to get excited about, but the long payment history is respectable. The company also bought back stock equivalent to around 5.0% of market capitalization this year. Some simple analysis can offer a lot of insights when buying a company for its dividend.

Click the interactive chart for our full dividend analysis

Payout ratios

A solid dividend should be paid from sustainable earnings. Thus, we need to form a view on if a company's dividend is sustainable relative to its net profit after tax. Intel paid out 30% of its profit as dividends over the trailing twelve-month period. A medium payout ratio makes a good balance between paying dividends and keeping enough back to invest in the business. Plus, there is room to increase the payout ratio over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Intel's cash payout ratio in the last year was 34%, suggesting cash generated by the business well-covered dividends. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally indicates the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Intel every 24 hours, so you can always get our latest analysis of its financial health here.

Dividend Volatility

One of the significant risks of relying on dividend income is the potential for a company to struggle financially and cut its dividend.

For this article, we only scrutinize the last decade of Intel's dividend payments. During this period, the dividend has been stable, implying the business could have relatively consistent earnings power.

In the past 10-year period, the first annual payment was US$0.7 in 2011, compared to US$1.4 last year. Dividends per share have grown at approximately 6.7% per year over this time.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term.

Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Intel has grown its earnings per share at 16% per annum over the past five years. Earnings per share have been growing at a reasonable rate, and the company is paying less than half its earnings as dividends. We generally think this is an attractive combination, as it permits further reinvestment in the business.

Conclusion

By entering into the foundry business, Intel is also entering into a transitory period. In the 2020s, it looks like that is the only way to maintain the leading technology.

While a peculiar and expensive task, it wouldn't be surprising to see the higher stock volatility through this period. However, dividend investors should sleep soundly.

First of all, it's great to see that Intel is paying out a low percentage of its earnings and cash flow. We like that it has been delivering solid improvement in its earnings per share and relatively consistent dividend payments. Overall, we think there are a lot of positives to Intel from a dividend perspective.

Market movements attest to how highly valued a consistent dividend policy is compared to a more unpredictable one. Still, investors need to consider a host of other factors, apart from dividend payments, when analyzing a company. For example, we've picked out 1 warning sign for Intel that investors should know about before committing capital to this stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com