Why one woman's nightmarish tax bill doubled overnight and can she do anything about it?

So how does a property tax bill go from $23,945 to $51,447 — a hefty increase of $27,502?

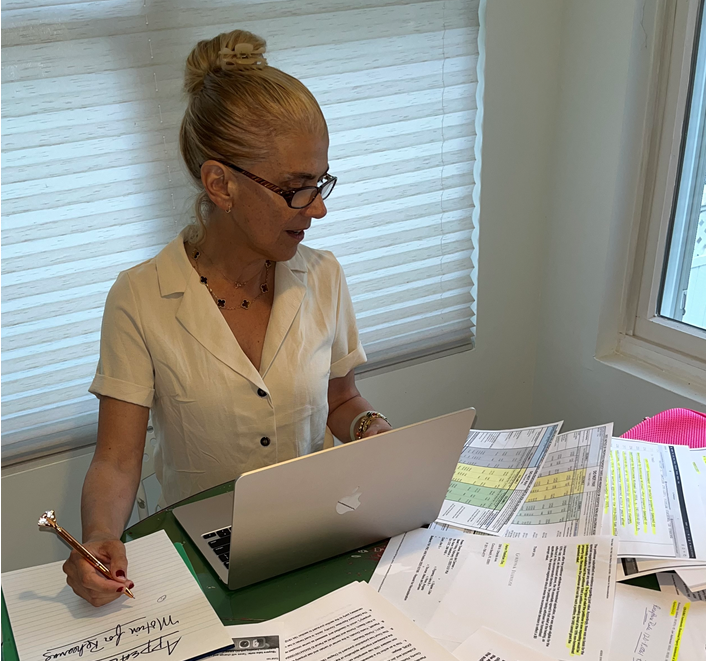

That is what Yvette Donato wants to know. The former New Yorker was prepared for a big tax bill when she bought her retirement home in Palm Beach in 2019.

After all, she bought in the island town and she had lived in a co-op in New York, so she was used to high taxes. She was comfortable with the $1.9 million taxable value placed on her Palm Beach house as of Jan. 1, 2020.

She paid $2.4 million for the one-story, 2,438-square foot home. Eventually, she would apply for and obtain a homestead exemption to keep her assessed value from exceeding 3% a year. Donato planned to move to Palm Beach earlier, but personal reasons, as well as COVID-19, kept her in New York and prevented her from applying for the homestead exemption.

So in the interim, her taxable valuable increases were limited, for the most part, to 10%.

She applied for the homestead exemption in December 2021, and was approved for calendar year 2022. In August 2022, she received her preliminary tax bill. Her taxable value had more than doubled to $3.3 million, generating a bill of more than $51,000.

She would have been better off not doing anything because the Palm Beach County Property Appraiser office set the value of her house on the Jan. 1 after she filed for the exemption. That meant as of Jan. 1, 2022. By then, property values had surged.

"I could not believe what I saw. I might lose my home," Donato said.

Now what? New homeowner lost a tax appeal and a lawsuit

She is not going down without a fight. In a tax appeal and lawsuit, Donato, representing herself, argued that the only time that the appraiser can reset value is when there is an ownership change. She lost the tax appeal before the Value Adjustment Board and the lawsuit before a circuit court judge.

She plans on hiring a lawyer to appeal the circuit court decision and also is preparing to ask the circuit judge for a rehearing.

Property Appraiser spokesperson Becky Robinson said the office does not comment on litigation but said it has always interpreted the law as saying that a new value has to be placed on a home when it becomes homesteaded.

Your property taxes: County millage rate cut, but soaring property values likely means higher taxes

Florida’s Save Our Homes law provides some protection for nonresidents like Donato, but she was looking forward to the benefits of the 3% cap. In addition to that cap, the first $50,000 of value is not taxed at all. And the law protects homesteaded properties, for the most part, from being taken through a lawsuit.

Donato’s lawsuit contended that the property appraiser illegally removed her 10% homestead exemption, placing the much-higher taxable value on the property. She says that is when the office suggested she withdraw her application to revert back to a lower assessment with the 10% cap.

Should the homestead exemption law be changed? State Rep. Mike Caruso wants to clarify it

Donato has an ally in State Rep. Mike Caruso, R-Delray Beach. Despite the VAB decision and the court ruling, Caruso believes Donato’s argument has merit. He says he will clarify the law.

"She has gone through a real nightmare," said Caruso, noting that he agrees with Donato that because there was no ownership change, the value should not be set when she applied for the homestead exemption.

“They (the appraiser) are trying to set the value twice, once when she buys the home and then when she files for the homestead exemption. The appraisers always seem to err on the side of higher taxes.”

More: Palm Beach County cuts millage rate by nearly 5%; largest percentage cut in 15 years

Donato claims she was also the victim of bad advice.

She says the property appraiser’s office told her to appeal the assessment to the VAB, which ruled in favor of the appraiser because the property's value was not disputed. The VAB said she should have appealed to the Homestead Division within the property appraiser’s office.

When she did that, she said she was told the deadline for such an appeal had passed.

"I was told that I needed to change the law, and that is what I'm now trying to do," Donato said.

Nonetheless, once Donato withdrew the homestead exemption and accepted the 10% cap, the property appraiser agreed to continue to tax Donato as if she had not sought the 3% exemption. The result was a roughly 10% increase on her house's taxable value, and a tax bill of $36,197.

Marilyn Martinez, director of administrative services for the Hillsborough County Property Appraiser, acknowledged that the unprecedented increase in property values have caused problems for non-homesteaded property owners who want a homestead exemption.

"I can see their point, but the current law ties our hands," she said. "There is not much we can do. Maybe the law does need to be changed."

There could be unintended consequences from a law change. Many out-of-state home owners have bought in Florida with the intention of one day moving to there. The state could lose millions of dollars in revenue if they were allowed to seek an assessment based on the value of a purchase price from a decade or more ago.

Meanwhile, Robinson said taxpayers can "maximize their tax savings" by filing for a homestead exemption when they purchase their property.

"We try to make it as easy as possible to file. You can e-file on our website the day you close on your home, even if your name is not on the deed yet. You can also download the PDF form from our website, call us to get your application started over the phone, or stop in one of our five branch offices. We want to help taxpayers save money and receive every exemption that they are legally entitled to."

What is a homestead exemption and how does it work?

What is it? A homestead exemption is when a state reduces the property taxes you have to pay on your home. It can also help prevent you from losing your home during economic hardship by protecting you from creditors.

Why is it worth it? Homestead exemptions basically lower your home value in the eyes of the tax assessor. For example, if you qualify for a $50,000 exemption and your home is worth $250,000, then you will be taxed as if your home is worth only $200,000.

How your property tax bill is capped: After the first year a home receives the homestead exemption, its assessed value for each following year cannot increase more than 3 percent. The accumulated difference between the just value and the assessed value is the Save Our Homes benefit.

How do you apply? To qualify for the exemption, the home you purchased must be your permanent residence as of Jan. 1 of the tax year.

What the law says: The law says you have until March 1 to file an application, but the deadline can be extended until mid-September if there are extenuating circumstances. You also can appeal property appraiser decisions to the Value Adjustment Board. You also must file for the year that you are seeking the exemption.

For further questions, contact the Property Appraiser's Office at 561-355-2866.

Mike Diamond is a journalist at The Palm Beach Post, part of the USA TODAY Florida Network. He covers Palm Beach County government and transportation. You can reach him atmdiamond@pbpost.com. Help support local journalism.Subscribe today.

This article originally appeared on Palm Beach Post: Homestead exemption debacle: Woman's property tax bill doubles overnight