This Is Why OPKO Health, Inc.'s (NASDAQ:OPK) CEO Compensation Looks Appropriate

Shareholders may be wondering what CEO Phil Frost plans to do to improve the less than great performance at OPKO Health, Inc. (NASDAQ:OPK) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 24 June 2021. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for OPKO Health

How Does Total Compensation For Phil Frost Compare With Other Companies In The Industry?

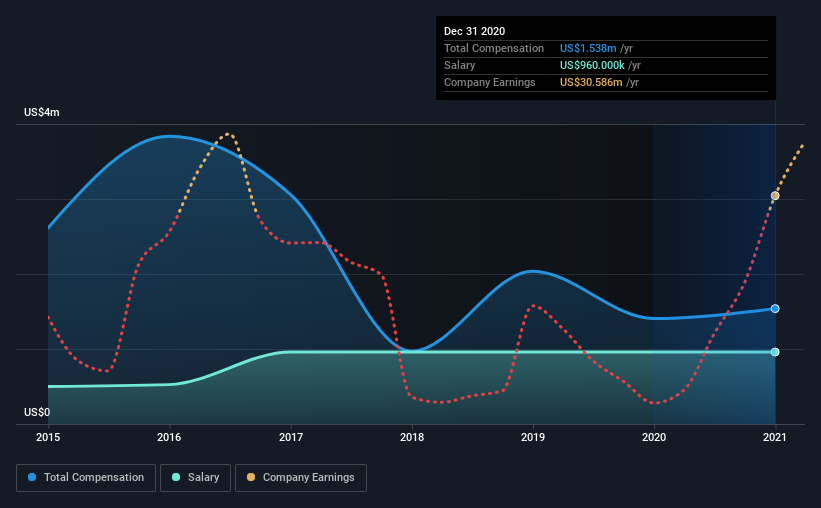

At the time of writing, our data shows that OPKO Health, Inc. has a market capitalization of US$2.6b, and reported total annual CEO compensation of US$1.5m for the year to December 2020. We note that's an increase of 9.5% above last year. Notably, the salary which is US$960.0k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$6.8m. Accordingly, OPKO Health pays its CEO under the industry median. What's more, Phil Frost holds US$725m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$960k | US$960k | 62% |

Other | US$578k | US$445k | 38% |

Total Compensation | US$1.5m | US$1.4m | 100% |

On an industry level, around 20% of total compensation represents salary and 80% is other remuneration. According to our research, OPKO Health has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at OPKO Health, Inc.'s Growth Numbers

OPKO Health, Inc.'s earnings per share (EPS) grew 48% per year over the last three years. Its revenue is up 99% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has OPKO Health, Inc. Been A Good Investment?

Given the total shareholder loss of 19% over three years, many shareholders in OPKO Health, Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for OPKO Health that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.