Why Your Portfolio Drops While Indexes Soar

That’s the narrative I’ll share with you today…we’ll observe what’s really going on with stocks. And to do that we’ll take a look under the hood of the market.

Growth stocks are getting sold, while value stocks are gaining steam.

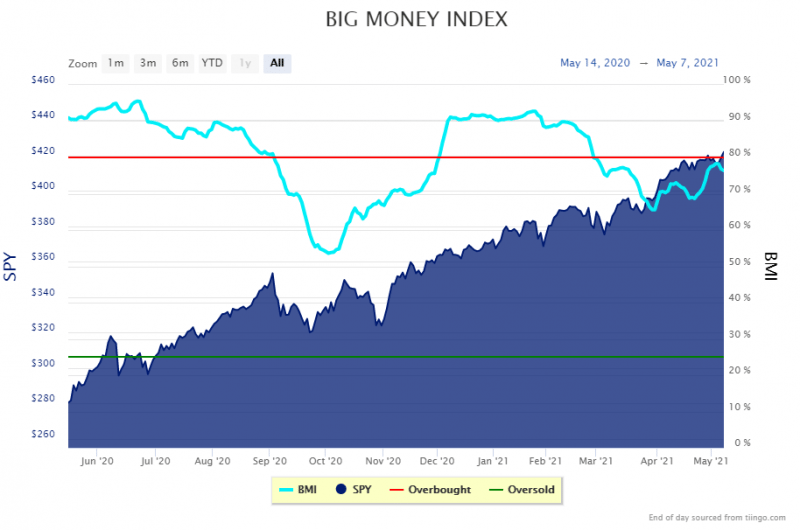

But, on the surface, market indices like the S&P 500 (SPY ETF) are practically at all-time highs. In fact, the Big Money Index, which tracks the Big Money buys and sells in stocks is hovering right near overbought levels:

To see the full story, let’s tear apart the Big Money Index and breakdown last week’s activity by sector. What you can observe is clear: Growth stocks are getting pummeled and reopen stocks are getting bought.

Below is a chart showing stock buys and sells by sector. Off to the right, in yellow is what’s important. If a sector saw 25% or more of its universe bought or sold, it’s highlighted.

Look how nearly every group traded on big volumes:

And that’s the sector rotation that’s going on. Groups like Materials (XLB), Energy (XLE), Industrials (XLI), Financials (XLF), & Discretionary (XLY) are seeing Big Money buys.

Groups seeing Big Money sells are: Technology (XLK), Utilities (XLU), & Healthcare (XLV).

It’s as clear as day what’s going on when looking at data. Growth is being abandoned, while cyclicals gather capital. But, let’s keep going.

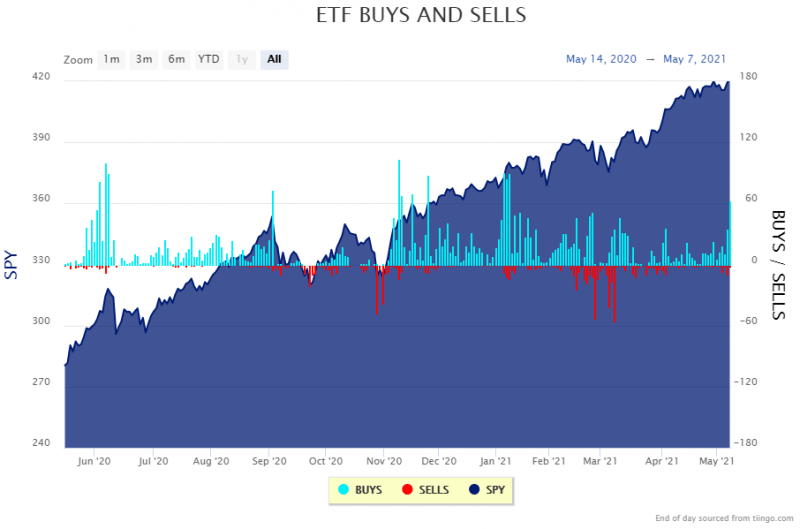

What about ETFs?

We can see this pattern emerging as well. Below is our ETF Buys and Sells Chart. It tracks the daily Big Money Buys and Sells for ETFs. Last week you can see there were a few sells (red bars) and a lot of buys (blue bars):

Friday had a big ramp in buying. Last week in total had 141 ETF buys and 12 sells. Here’s where the rotation is:

Buys:

Commodities

Value

Dividends

Industrials

Miners

Homebuilders

Sells:

Growth

Solar

Clean Energy

Biotech

Short-Term Bonds

There’s a lot of pain in growth-heavy ETFs. But 2 of them stuck out:

ARKG ARK Genomic Revolution

ARKK ARK Innovation

These are Cathie Wood’s ETFs that are full of monster growth stocks. Clearly investors are fearful of a lot of things right now…higher interest rates being the main culprit.

So, what’s an investor to do? Long-term, stay the course is what I say. Rotations are part of the game and when the crowd gets fearful…do some shopping.

The bottom line is this: There’s a lot going on with stocks even as indices are at all-time highs. Don’t get spooked out of your good stocks. Right now I’m taking some wisdom from the great Yogi Berra. He said, “You can observe a lot by just watching.”

There’s a lot of good stocks getting sold with abandon. If you pay attention to data, you might observe some good deals out there.

Disclosure: the author holds no positions in SPY, XLB, XLE, XLI, XLF, XLY, XLK, XLU, XLV, ARKG, & ARKK at the time of publication.

Learn more about the MAPsignals process here.

This article was originally posted on FX Empire