Why Is Prem Watsa Underperforming the Market?

Fairfax Financial Holdings Ltd. (TSX:FFH) has been an incredible long-term investment for more than three decades.

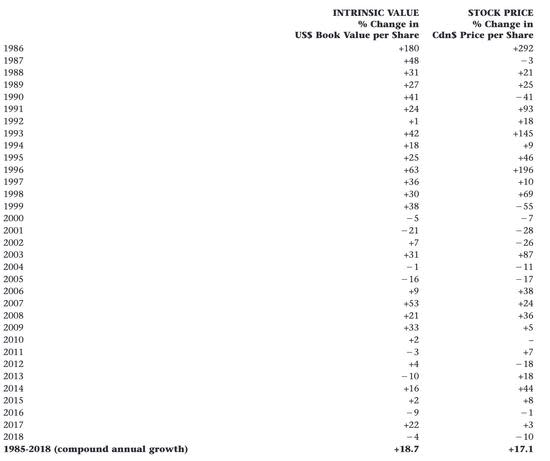

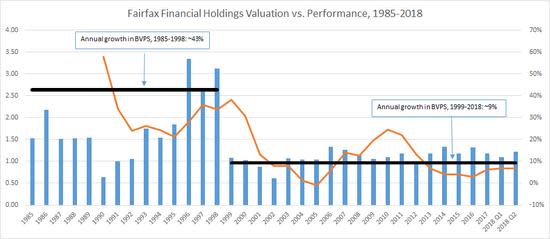

Since 1985, book value per share has increased by nearly 19% annually. The share price has followed suit, rising a bit more than 17% annually. Prem Watsa (Trades, Portfolio), who is often referred to as the "Warren Buffett (Trades, Portfolio) of Canada," is to thank. He's not well known, but his investing track record is only rivaled by the likes of Berkshire Hathaway's (NYSE:BRK.A)(NYSE:BRK.B) CEO.

Here's the interesting part: Currently, shares trade for less than book value. That's incredible considering Berkshire Hathaway--which runs a very similar strategy along with a comparable multi-decade track record--trades at 130% book value. Buffett is also 20 years older than Watsa, and Berkshire is more than 20 times larger than Fairfax.

If you can understand why Fairfax is trading at big discount despite having a younger founder and CEO, significantly more room for growth and a top-tier track record, you can capitalize on a very rare buying opportunity.

It's a lumpy game

One of the biggest reasons why Fairfax trades at a discount should be well known: the market cares more about the short term than the long term. Take a look at the table below. Since 2015, Fairfax shares have returned roughly 5%. Berkshire Hathaway, for comparison, has returned more than 40%. Fairfax has actually grown book value per share since 2015, but due to a falling valuation, shares haven't risen much. Compare that with Berkshire Hathaway, which saw an increase in book value per share and its valuation multiple.

Here's the important thing to remember: Long-term investing is a lumpy game, but as long as you win in the end, it doesn't matter the route you took to get there. For example, from 1999 through 2002, Fairfax posted four consecutive years of share price declines. In three of those years, the stock fell by double digits. Despite the pessimism, long-term investors were healthily rewarded over the coming decade, especially if they added to their positions along the way.

Importantly, nearly any time the share price approached book value, it has been an incredible time to buy. That's especially true when the price is falling but book value is rising. Consider 1990, 2002 and 2012; in each of these years, the stock struggled despite improving fundamentals. Often, the fall in valuation came after years of book value declines. If you purchased at or below book value during these periods, you would have been healthily rewarded for your patience and long-term outlook.

Looking at Watsa's investing strategy, the current period seems to be a great buying opportunity. None of the fundamentals have changed, yet the valuation is at multiyear lows due to the prolonged bull market.

It's important to note Fairfax has a history of underperforming during bull markets. From mid-2003 to mid-2007, the S&P 500 (SPY) rose nearly 50%. Fairfax's stock, meanwhile, was relatively flat, causing its valuation to dip. When the stock market crashed in 2007 and 2008, however, Fairfax shares actually increased by 24% and 36%.

The most recent bull market is no exception. Equity indexes continue to surge higher, yet Fairfax shares have been left behind. If a recession hits, expect these trends to reverse course quickly.

Here's what to expect

Watsa targets a 15% annual return on shareholder equity. The guru believes this is achievable as long as the company earns "7% on our investment portfolio and our insurance operations produce a combined ratio of 95%."

Last year, the insurance operations performed incredibly well, recording a multiyear record combined ratio of just 90.8%. A combined ratio of under 100% means the insurance arms are profitable. The lower the ratio, the better the performance. However, the investment portfolio returned just 3%. What happened?

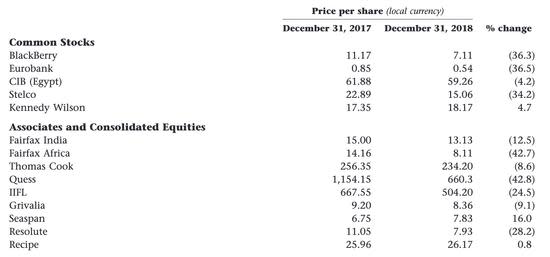

You can see from the chart below that the investment portfolio took some big hits in 2018, especially when factoring in foreign exchange losses. The question you have to ask is: has Watsa lost his magic touch? Judging by his 35-year track record, probably not. Likely, this is simply a multiyear stretch of lumpy returns, a phenomenon that has occurred multiple times in the past. Developing and emergingt markets have dipped heavily relative to U.S. equity markets, but over the long term, value should be rewarded.

What should you expect for the stock? At the minimum, Fairfax Financial should handily outperform the market when a recession hits because its insurance operations are downturn resistant, and lower equity prices should allow it to invest new float at extremely attractive prices. Long term, Fairfax investors should actually welcome a recession.

I also suspect the insurance operation's combined ratio will trend toward 95% over the long term. If Watsa can achieve even 5% annual returns on its investment portfolio (a reasonable probability), shareholders should see book value rise by around 10% annually. In fact, that's pretty close to the real returns of Fairfax over the last two decades. This is a rare opportunity to buy a high-quality stock at a bargain discount. No matter where the market heads, I expect Fairfax to deliver low-correlation returns with a sizable margin of safety.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.