Why rent is rising swiftly in Columbus and the nation according to local insiders

When Louie Robinson sold Louie Louie’s Bakery and Cafe around the late 90’s, he began looking for another income stream that could support him and his wife in their later years.

Robinson began buying properties in Columbus and Phenix City, and for the last 15 to 20 years his primary income has come from being a landlord.

He now rents out 13 properties in Columbus, and tries to keep rent under $1,000 a month to keep them affordable and be able to accept vouchers from government housing programs.

Low housing inventory and the inflated costs of taxes, insurance and maintenance has made it increasingly difficult for the 86-year-old landlord to continue helping residents find affordable housing in Columbus.

“I get anywhere from five to 15 calls a day for houses that I don’t have,” Robinson told the Ledger-Enquirer.

Rising market rate rent across the country

The market rate for rent in Columbus reported by Zillow has risen significantly since 2020 with stakeholders pointing to inflation, property taxes and a limited supply of housing as the main causes.

Rent in the city rose about $100 between January 2016 and January 2020. However, between January 2020 and January 2023 it rose another $300 to about $1,120.

In all, the market rate rent jumped 55% from January 2016 to January 2023. The median household income in Muscogee County increased about 28% between 2016 and 2021, according to data from the Federal Reserve.

The increase of the market rate rent in Columbus slightly outpaced the nation, which increased about 47% during the same period. Other cities across Georgia saw similar increases including Macon, Albany and Augusta.

Rising rents will affect people who are already burdened by rent first, said Robert Scott, director of the Community Reinvestment Department. Renters who spend more than 30% of their income on household expenses are considered “cost burdened”, Scott said, and when those costs approach 50% then individuals are at risk of becoming homeless.

It’s becoming increasingly more expensive to live in Columbus in recent years, he said. Households that earn less than $40,000 a year may struggle, Scott said. The median income was estimated to be close to $52,000 in 2022, according to the Greater Columbus Georgia Chamber of Commerce.

But this number doesn’t tell the whole story.

“Anybody could be cost burdened,” he said. “If you live in a 4,000 square foot house and your mortgage is three grand a month, you could be burdened. It can affect everyone.”

Limited housing is a primary cause

A limited housing inventory remains a primary reason for rents spiking, said Shep Mullin, a broker at Century 21 Premier Real Estate in Columbus.

“There’s not enough housing out there,” Mullin said. “And because there’s not enough housing, it’s creating demand to go up for renting and for buying.”

Nationally, the gap between single-family home construction and number of homes needed grew to 6.5 million homes between 2012 and 2022, according to a report by Realtor.com. Including multi-family home construction reduced this number to 2.3 million homes.

There are 89,653 housing units in Columbus, according to the 2022 American Community Survey, and approximately 51.5% of homes in Columbus are rentals. A little more than 200,000 people live in the city.

Finding a rental becomes even more difficult if individuals are searching for affordable housing they can use with a voucher program, said John Casteel, chief assistant housing officer at the Housing Authority of Columbus, Georgia.

Programs require recipients’ rent to not rise above a certain threshold, Casteel said, and finding rent that low, typically under $1,000 a month, can be difficult.

“They can’t find housing,” he said. “And after six months that voucher disappears and that person’s lost their opportunity to use that voucher because they haven’t been able to find anything.”

The waiting list for public housing in Columbus hovers around 3,000, currently, Casteel said. A new mixed-income housing development, The Banks at Mill Village, opened earlier this year with 102 units.

Today, the Housing Authority development has one unit available, and thousands are on the waiting list, Casteel said.

Federal best practices set the goal to find housing at 30 days for voucher recipients, said Pat Frey, vice president of Home for Good at the United Way of the Chattahoochee Valley. Years ago the organization’s average was 62 days, she said.

“We always laughed and said we were double that (federal goal),” Frey said. “We’re at four times that now. So, it’s taking up to four months once someone enrolls in a housing program.”

Inflation and taxes

The amount of taxes owed for his properties increasing can impact increases in rent, Robinson said.

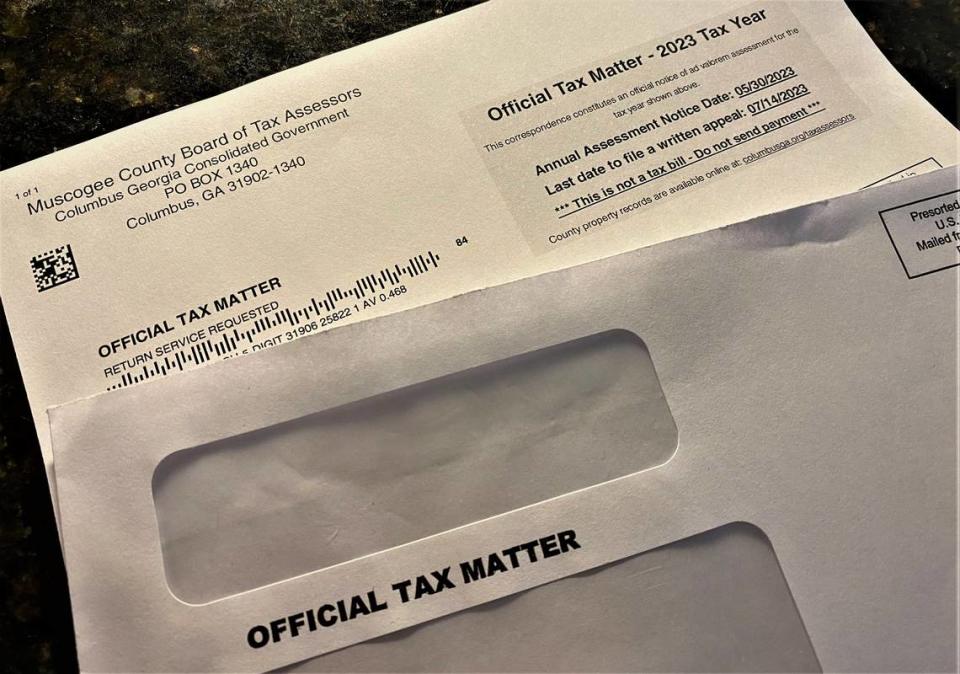

Columbus residents and landlords have found that their property values may have significantly increased this year leading to higher tax bills.

“Property values are going up,” said Suzanne Widenhouse, chief appraiser for the Board of Tax Assessors. “And they’ve been going up for a while.”

The average home value in Muscogee County is up 5% over the past year, according to Zillow.

When the pandemic began, the housing market dramatically heated up, she said, and interest rates were low.

As people started needing more space and the inventory decreased, Widenhouse said. Rent began increasing significantly during the same time period, she said, which translated to higher revenue.

These factors contributed to the rise of property values, Widenhouse said. Market adjustments paused in 2020 and 2021, she said, because assessors didn’t know if it was a true increase or the result of a “COVID bubble.”

Columbus Council cut property taxes in a June 20 meeting after taxpayers complained to councilors in a previous meeting. The effect of the cut is unclear, but the expected $10 million in revenue from taxable property was slashed to $7 million. But homeowners can only expect modest savings.

Higher tax bills is something some landlords aren’t going to be able to absorb, Robinson said, and the cost will shift to the tenant.

“Some of those people, if it went up $25 a month for rent, they don’t have $25 left in their income,” he said.

Another problem landlords are facing is higher costs for maintenance and insurance, Robinson said. Increased demand in the global economy beginning in 2021 led to conditions that raised prices, but not wages, according to a report by the Brookings Institution.

“I had to replace an air conditioner,” Robinson said. “I used to pay about $6,500 for a system. That thing went up to $9,200 for the same thing.”

The landlord has seen increases in maintenance expenses from big purchases like replacing the air conditioner to smaller purchases like paint.

Compounding the rising taxes and maintenance costs, is insurance. Robinson said he has about four homes on one insurance policy that increased about 18% in the last year.

Property insurance pricing in the United States increased 17% in the first quarter of 2023, according to the Marsh Global Insurance Market Index. This comes after the pricing rose 11% in the fourth quarter of 2022.

“Everything’s gone up,” Mullin said. “My taxes are up 20%. My insurance is up 20%. Repairs are up to hire somebody. Inflation affected rentals, sales and food costs.”

A blended approach

In order to address the problem of a lack of affordable housing in Columbus, there needs to be a blended approach, Scott said.

“They say that when a tornado forms that there are perfect conditions for it to form,” he said. “We need the right conditions.”

Much of the problem is systemic, Scott said, so education and better preparing the city’s workforce could help increase individuals’ incomes. Columbus also needs to attract more industries that are willing to pay higher wages, he said.

There has to be a strategic approach that will incentivize landlords to keep rent lower, Scott said, and one way people can get started is by understanding what he and other officials mean when they speak about affordable housing.

“People always have this negative connotation on what is affordable housing,” he said.

Scott wrote an 18-page pamphlet as a guide to debunk some of the misconceptions people may have about the subject. Ensuring everyone in Columbus has housing they can afford will require the collaboration of both the public and private sectors.

Coming together as a community is crucial to solving the problem, Frey said, and the United Way is addressing this issue by organizing a region-wide Housing Market Needs Assessment. The organization will be partnering with Georgia Institute of Technology, which will lead the assessment, she said.

This project will analyze what housing communities have at their current rate of growth, what is needed and what communities might need if there’s a change. For example, the assessment would take into account what might happen if there is another base realignment.

The assessment will help the organization understand how they can work with housing that is already built and find ways to fill them, Frey said, before looking at new construction.

Columbus will be the first phase in the assessment, she said, and the first meetings to start the process will begin in July.

“This is happening all over the United States,” Casteel said. “This isn’t just Columbus. Every other (city) in Georgia is going through the exact same thing that we’re going through.”