Why something needs to be done about the debt ceiling

U.S. Treasury Secretary Steven Mnuchin announced Monday that the Trump administration was “very close” to reaching a bipartisan deal on the debt ceiling.

Despite this proclaimed progress, Maya MacGuineas, president of the Committee for a Responsible Federal Budget, is “quite pessimistic” regarding the odds of a “sensible” outcome. “Years ago, it would have been preposterous to think that we [would] actually have routine fights in this country about whether we're going to default or not,” MacGuineas told Yahoo Finance. “It's really scary. It's something the financial markets should be completely concerned about.”

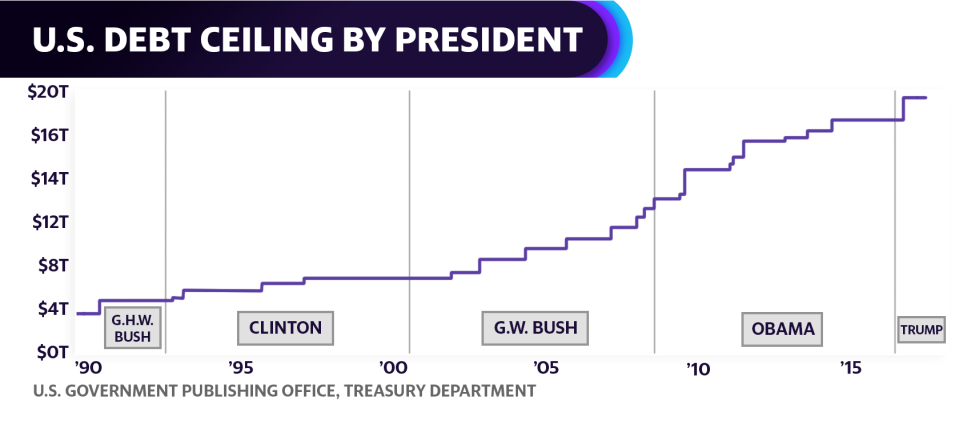

MacGuineas expressed concern about what the U.S. will do when it does lift the debt ceiling, which is really “a reminder that we are borrowing on an unsustainable path,” MacGuineas said. “Right now, our debt is growing faster than the economy.”

Ideally what the government should do is put a plan in place to reduce debt, she said, but at this point she believes what will happen is the ceiling will be lifted with policies that will just make the debt worse, as the U.S. has done in the past. “With how dysfunctional our government is right now, it's something that appears quite likely to do again,” she said.

Currently, there is no budget for this year or next and when Congress eventually passes a budget “there is no fiscal objectives” and the government “is allowed to borrow limitlessly and given how broken, partisan, and toxic things are that is something we’re doing more and more regularly.”

There’s a lack of fiscal responsibility

MacGuineas noted that there needs to be limitations and backstops that make the U.S. think about whether it is borrowing for “good reasons.” According to MacGuineas, the U.S. is borrowing “for political reasons, not economic reasons.”

She recalls a time when there were spending caps put in place when the debt ceiling was lifted but today that is not the case and something needs to be done.

“Right now, interest payments are the single fastest growing part of the budget. Next year, we'll spend more on them than we do on children. Within five years, we'll spend more on them than we do on national defense,” MacGuineas expressed. “There are so many reasons this is damaging to the economy, to the budget, to how we'll handle the next recession. I don't think we should do nothing about it.”

Taylor Locke is a producer for Yahoo Finance. You can follow her on Twitter @itstaylorlocke.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.