Why it still does not pay to stick with your car insurer

Car insurers are exploiting a loophole to charge existing customers more, consumer group Which? has warned.

The City watchdog banned insurers from offering new customers better deals two years ago in an effort to put an end to the so-called loyalty penalty.

However, drivers who pose as new customers are still offered lower prices when renewing car insurance policies, the Which? research found.

One in five customers renewing their policy said they compared their insurer’s renewal offer with quotes it gave if they applied as a new customer for the same cover. Half of these motorists said they were offered lower prices when they posed as a new customer.

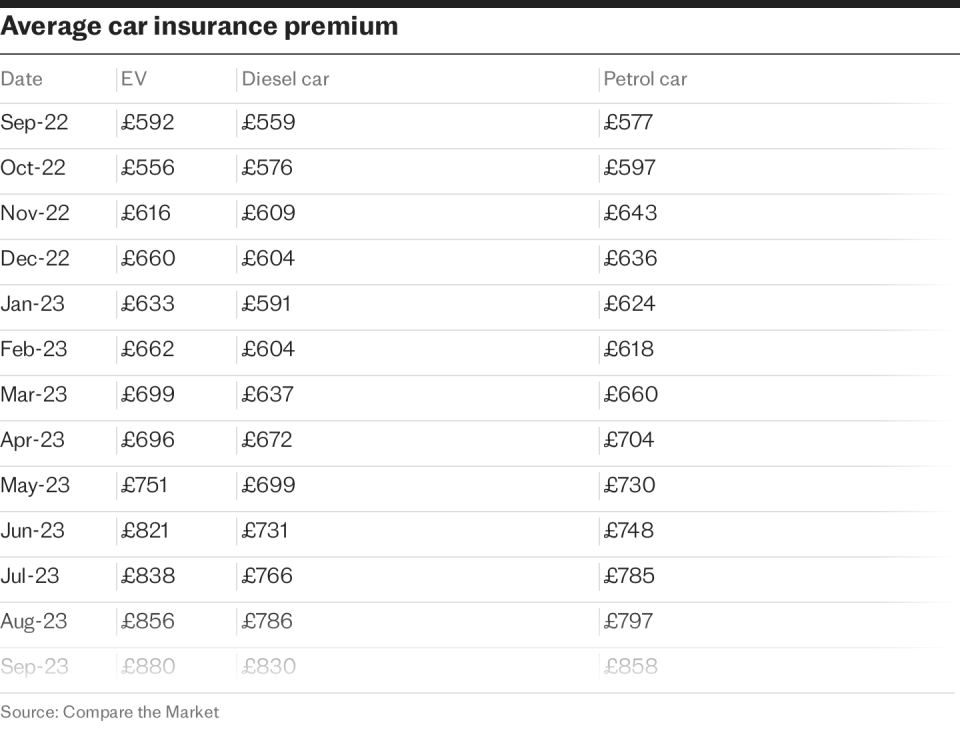

It comes after The Association of British Insurers said car insurance premiums were at their highest level on record. Drivers paid an average of £561 from July to September – up 29pc (or £126) compared with the same period a year ago.

Jenny Ross, money editor at Which?, said: “Existing customers still face financial disadvantages compared to new customers, suggesting the regulator needs to ensure its rules are working as intended – by making insurance pricing fundamentally fairer and saving consumers money.

“With household budgets under huge strain at the moment, and car insurance prices at record highs, it’s important not to renew your policy without first checking if you could pay less. The price quoted by your insurer is not necessarily the best price you can get.”

The Financial Conduct Authority’s (FCA) rules state that insurers must offer the same price to new and existing customers – but only if they use the same purchasing method at the same time, such as a specific website or a specific phone service.

This means that a driver could get a better quote as a new customer using a comparison website compared with a phone line for existing customers and it would be allowed. Price comparison prices tend to be cheaper than other purchasing methods.

If the quotes are obtained at different times it is also acceptable for these discrepancies to occur.

In one example highlighted by Which?, Mike Cooper, from Merseyside, said his premium rose from £550 to £842 in November when he received a renewal quote from Direct Line, even though he had not made any claims since October 2022. He managed to reduce the new premium by £150 by haggling with his provider.

Another customer said she had received a renewal quote that was nearly double last year’s premium. By using a comparison site she said she then found a policy with better cover for £100 less than she paid last year.

The FCA plans to evaluate the impact of its loyalty penalty ban in 2024.

Ceri McMillan, of comparison website Go Compare, said: “Always shop around and compare quotes via a comparison site to get the best deal for you and help save on your insurance premiums. In times like these, drivers need to be savvy and make sure they are getting the best deal that provides the cover they need.”

An FCA spokesman said: “While firms have a duty to ensure renewing customers are offered a fair price, we also advise people to shop around to get the best deal.

“We have taken action where we have seen firms not meeting the rules, and we’ll continue to do so. We will carry out a full evaluation of the impact of our pricing rules in 2024.”

Direct Line said: “Renewal quotes for our customers are based on our current view of risk and vary according to the latest data available, taking into account factors like the model of car and inflation.

“The Association of British Insurers has highlighted recently that ‘insurers are doing all they can to keep motor insurance as competitively priced as possible’. Insurers are experiencing inflationary pressures as well as delays in their repair and supply chains, with the cost of parts and materials going up.”

In September, Direct Line agreed to pay £30m to customers who were overcharged when they renewed their home or car insurance. The insurer blamed an “error” in implementing the FCA’s new pricing rules.