Why Student Loan Company Nelnet Is Having a Meltdown

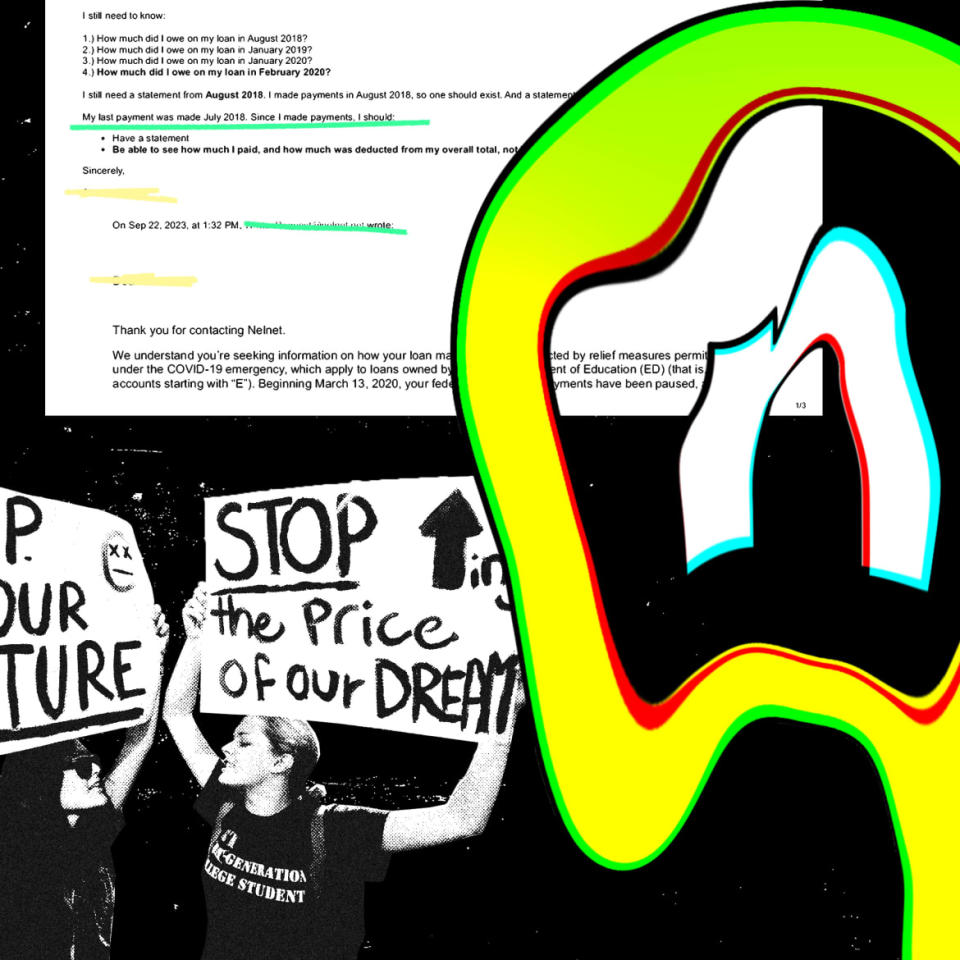

The country’s largest student loan provider, Nelnet, is under fire as borrowers say they are experiencing a litany of problems with the company as student loan payments restart. Frustrated with the lack of communication, people have taken to social media to share their stories and demand answers from the company. And most of them are still waiting.

The Daily Beast spoke to more than a dozen people who said they are experiencing a diverse range of problems with Nelnet’s website, repayment system and customer service. Many said they were struggling to get answers from the company on how much they owe, whether they are being charged interest on their loans, and if they have successfully enrolled in President Biden’s SAVE plan, which promises to reduce payments for eligible borrowers.

“Even if you’re trying to contact someone you can’t get through to them,” Wendy Kelly, an HR professional in Florida told The Daily Beast. “There’s no communication.”

All those who spoke to The Daily Beast complained about Nelnet’s customer service—or lack thereof—with many reporting waiting up to five hours on the phone to speak to a representative, or sending multiple emails with no response. On Reddit, people discussed the possibility of filing a class action lawsuit against the company.

SJ Lilly, a training professional in Chicago, says she voted for Biden based on his promise to pursue student loan forgiveness. The pause on repayments was a godsend for her, allowing her to take a dream job that paid a lower salary.

“I took a job under the presumption that student loans would be forgiven or that they would be delayed until at least 2025,” Lilly told The Daily Beast. “I thought, it will be OK, as long as they forgive student loans.”

As the cost of living has increased over the last year, Lilly has cut back her expenses, looking for any way she can to save money. When Biden’s much-touted plan to forgive $400 billion in student loan debt was struck down by the Supreme Court in June, her heart sank. In response, Biden instructed the Education Department to find another way to achieve loan relief, but no concrete plan has yet emerged.

In July, Lilly logged into her Nelnet account to see how much she owed. In March 2020, when repayments were paused, she remembers owing around $90,000 in loans for her master’s degree at Northwestern. But the number she saw on Nelnet’s website was much higher—$97,775. When she tried to access her statements, Lilly says they had been removed from the website.

“I was thinking, like, do we have any friends who are attorneys who can help us with bankruptcy? Because there’s no way I’m going to be able to pay for this, and pay for rent and pay for groceries,” Lilly says.

Heather Schroering, a journalist and podcast producer based in Brooklyn, spent five hours on hold with Nelnet, trying to find out whether she had been successfully enrolled in the SAVE program, which she applied for through the U.S. Department of Education in August. When she checked Nelnet’s website she saw she’d been charged $243 in interest while waiting for the application to be approved.

That was two hours ago. If the tactic is to hope I’ll just give up and never find another 5 hours to call back, joke’s on @Nelnet because I camped out in the front row of the stage waiting for Lady Gaga at Lollapalooza 2010.

— Heather Schroering (@OhItsHeather) October 20, 2023

“This is really convenient for Nelnet that they just get to decide when to review my application, and they’re benefiting from that,” Schroering told The Daily Beast. “What is stopping them from taking two years to review my application? Or anyone’s?”

More than 40 million Americans have federal student loan debt, totaling almost $1.7 trillion, according to the Education Data Initiative. They were granted a reprieve when student loan repayments were paused and interest rates on loans set to zero by the Trump administration in March 2020, as a result of the COVID pandemic. But the pause on repayments ended this month, forcing many to cut expenses and take on additional work in order to start making payments again.

Since then, people have reported problems with almost every part of Nelnet’s service. Several people shared copies of letters they have received from Nelnet where the amount they owed was left blank, as was the date by which they needed to pay.

Realize it’s screaming into the void but this is the quality of communication from @Nelnet about my app to change my #studentloans to the SAVE plan. Fucking amazing. Just blank spaces where dollar amounts and dates should be. pic.twitter.com/4u32GL4nzQ

— Karina Stenquist (@karinastenquist) October 24, 2023

Oliver Goldstein, a developer in North Carolina, told The Daily Beast he was struggling to make payments through the site.

“As a diabetic Pell Grant recipient, saving has not always been easy, but I've managed to save up the total amount on my loan, so that if needed, after the pause ending, I could pay it all off at once. I tried submitting the payment in full from my bank account,” Goldstein said. “I thought it was over with then. I was saddened by the failures of our government but was planning to move beyond it.”

Nelnet told Goldstein the payment could not be processed by his financial institution. He spent last weekend trying to get answers from his bank, while interest continued to accumulate on his debt. His bank said Nelnet had not attempted to charge the account. He spent more than two and half hours waiting on Nelnet's customer service line, only to find out his payment was still processing.

“I never thought just submitting the payment would give me the most trouble,” Goldstein told The Daily Beast in a message. “In the grand scheme it’s far from the worst problem to have, but even knowing I have that total ready to go, watching that interest pile up (DAILY!!) and not having anyone you can reach out to for guidance in less than 2.5 hours feels like being stuck in a well with no ladder to pull yourself out.”

As the October deadline for repayments approached, student loan companies like Nelnet faced an influx of queries from confused borrowers seeking clarity on how much they would be expected to pay back, and when.

On two occasions in August, Nelnet’s call center and website were temporarily shut down due to “technical difficulties,” according to Business Insider. Borrowers were unable to log into their accounts or view payment information.

@POTUS did you know that student loan borrowers can’t get their payment plans processed? While we wait, our loans are put in forbearance, accruing interest and we get zero information.

I’ve been on hold with @Nelnet for 2.5 hours. This is unacceptable. pic.twitter.com/epkdRJbQee— Katelyn Unterborn (@kchiccino) October 17, 2023

Donny Winter, a poet and YouTuber from Michigan, told the Daily Beast he spent days trying to speak to someone at Nelnet.

“I’m still being charged interest on my student loans despite being on the SAVE program,” Winter told the Daily Beast.

When Winter finally did get through to a Nelnet representative, after a week of panic and another hours-long wait on hold, he was somewhat comforted to be told that interest is waived if payments are made on time.

In Chicago, Lilly began to suspect she’d been charged interest during the period that Biden’s CARE Act had guaranteed that she would not be. She wrote to the company asking for a copy of her statements and demanding any interest be reimbursed. In response, Nelnet told her it was a “complicated matter,” according to email correspondence viewed by The Daily Beast.

Three months later, Lilly still has no answers from Nelnet. She says she doesn’t blame the call center employees who are fielding requests from hundreds of confused borrowers, but believes the company needs to do more.

“What I don’t sympathize with is the CEO, and the executive leadership who are pocketing all that interest. While they are buying their yachts, I am reusing my tea bags,” Lilly told The Daily Beast.

Former students say they are getting no answers about their student loans from Nelnet.

Since 2018, when the Nebraska-based company acquired one its rivals, Great Lakes Educational Loan Services, Nelnet has handled around 40 percent of all student loan payments, according to MarketWatch. The company did not respond directly to requests for comment, referring The Daily Beast to the Department of Education.

“As a contractor for the Department, we are required to direct all media inquiries related to federally managed loans to FSA’s Office of Communications and Outreach for their response,” Nelnet said in an email.

The Office of Federal Student Aid did respond to a request for comment.

Bobby Matson, the founder of Payitoff, a debt management software company, said he was not surprised by the chaotic roll out of the repayment restart, or by borrower’s woes.

“Of course it was going to go down like this. You’re looking at a zero percent increase in Dept of Ed funding. You also look at payment resumption that wasn’t really certain, because it had been pushed nine times,” Matson said.

He described loan providers, such as Nelnet, as an “easy punching bag,” but said governmental upheaval and under-resourcing were to blame. He said he sympathized with borrowers navigating a confusing period.

“You feel a loss of control as a borrower that is not a result of your actions,” Matson said. “For borrowers right now, they want clarity. But they won’t always get it, and they might need to be patient.”

Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers, told The Daily Beast providers were doing all they could to weather a difficult time.

“One of the challenges that we’ve faced, and the Department [of Education] has faced themselves, is the last year has been filled with multiple changes to the entire servicing ecosystem,” Buchanan said, pointing to changes in repayment plans that providers are having to adjust to in the space of only two months. “The possibility of mistakes and errors is amplified. That’s why we’ve expressed our concern to the government about doing it at this pace.”

“All of sudden, 30 million people at the same time are trying to get assistance and figure out what the solution is. And that is really a bottleneck on a system that was never designed for 30 million people going into repayment all at once,” Buchanan continued. “I hope people appreciate it is frustrating for us too. We are in the business of doing customer service too.”

Buchanan also blamed a lack of government funding for providers for the “handful of issues” he’s seen.

“It’s important to remember the context of the resource constraint. The government has flat-funded providers while we’ve been asked to do more and more,” Buchanan said, “That limits our ability to get things done as efficiently and quickly.”

Some students said they felt betrayed by President Biden’s failed promise to relieve student debt.

Last month, shortly before repayment was due to begin, Sen. Elizabeth Warren and three other Democrats, sent letters to the CEOs of Nelnet and other loan servicers MOHELA, EdFinanical, and Maximus Federal Services, requesting information on how they had prepared for the restart. Sen. Warren wrote that she was “deeply worried” and the companies’ “preparedness for this unprecedented return to repayment.”

Warren and her colleagues pushed back on arguments from the loan providers that they were under-resourced.

“We are skeptical of their claim that insufficient funding is keeping them from fulfilling their most foundational obligation considering that they were paid on average approximately $2 a month per account amounting to billions of dollars, while payments, interest, and collections were suspended during the public health emergency,” Sen. Warren wrote.

For some borrowers like Lilly, who still say they still don’t have clarity from Nelnet, the lack of answers is creating stress in an already difficult economic atmosphere.

“I am completely disappointed. I feel let down by my elected officials,” she said, “They say that people are a paycheck away from being unhoused, and that’s how it’s looking for me.”

Get the Daily Beast's biggest scoops and scandals delivered right to your inbox. Sign up now.

Stay informed and gain unlimited access to the Daily Beast's unmatched reporting. Subscribe now.