Why the market doesn’t have to plummet further amid coronavirus

Over the near-term, it’s worth staying defensive in the stock market because it still needs time to repair the recent technical damage, but I wouldn’t get too negative. The coronavirus numbers will likely continue higher but that doesn’t mean the stock market has to go lower. In other words, the stock market is a discounting mechanism. It trades on what will happen 6-9 months from now.

The big question on everyone’s mind is “has the stock market already priced in the upcoming slowdown in the economy?” Of course no one knows for sure, but here are four reasons I remain positive on this market.

Price Action

The number one factor I use to judge the health of the market is the price action of leading stocks. While many growth stocks still need time to build proper technical bases, I’m encouraged by the strength I’m seeing. Before this correction started, the leading growth sectors were software, biotech, semiconductors and medical products. Over the past week, many stocks from these sectors recovered well and are already close to new highs. I need to stress that patience is still required before one can aggressively get back into growth stocks, but the recent price action is constructive and a small step in the right direction.

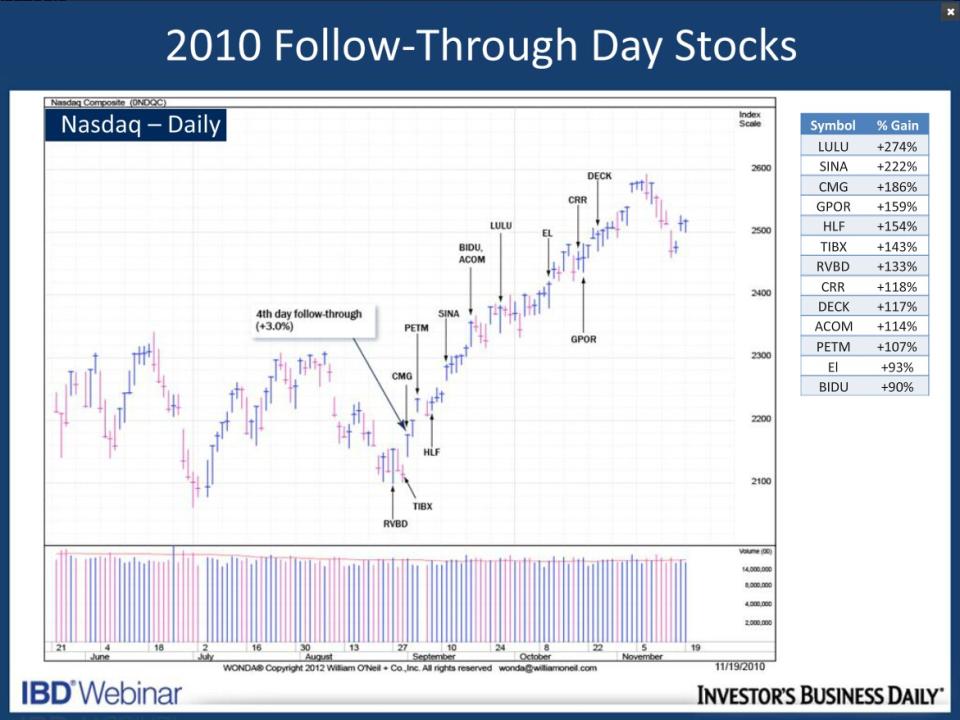

In my early trading days, I would get discouraged during market corrections. As I matured in my trading career, I’ve learned to embrace corrections because I know the type of explosive moves growth stocks can make when we get a confirmed bottom. The pressure of the market is keeping these stocks down and once a little tension is relieved, many stocks can see rapid gains of 50% or more. Again, it will require patience before this happens but the chart below explains my optimism. It shows the strong gains that were made in growth stocks coming out of the four month “Flash Crash” correction in 2010. I discuss many of these bottoming concepts in the educational portion of my website.

Negative sentiment

I pay attention to sentiment because the market tends to fool the majority. Right now, the majority of people are expecting the market to go much lower and many funds managers are underinvested. Unfortunately, the mental damage from the 2008-09 financial crisis is still fresh in people’s minds. Many market participants feel that every major correction has to be a 50% decline, but the average bear market sees a drop of 27%.

I honestly feel the concept of shorting the market is an obsession with many young traders. Some of the highly shorted stocks are 50%-70% off their highs and people are still screaming for them to go to zero. I’m not against shorting; I’m simply encouraging people to be open-minded that most of the slowdown in business might already be priced in. In addition, you don’t want to be aggressively short a market 30% off its highs because any positive news towards a vaccine will likely result in a powerful short covering rally.

Global central banks

Before this pandemic began, the global central banks were already providing us with a liquidity driven, low interest rate environment. The economic slowdown and uncertainty from the virus has led to even more stimulus. During the month of March, The U.S. Fed cut interest rates to zero and revealed a historic “QE infinity” program, the European Central Bank announced a 750 billion euro ($820 billion) asset purchase plan program through the end of 2020, the Bank of Japan said it would buy $700 billion in Treasury and mortgage-backed securities, and the People’s Bank of China cut rates by the largest amount since 2015 and continues to provide liquidity. Basically, in an effort to help mitigate the impact of the coronavirus outbreak, the global central banks are now providing us with an equity friendly environment on steroids.

History

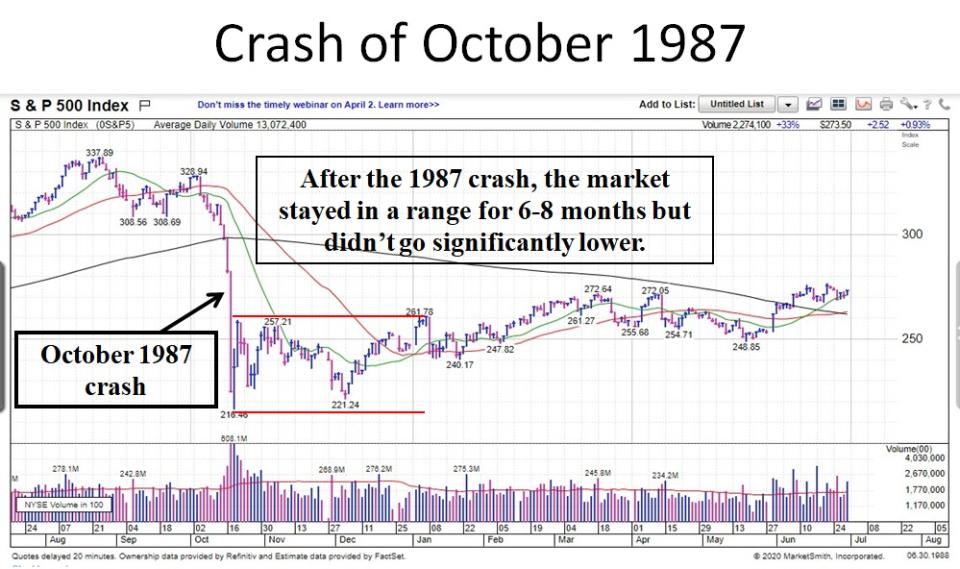

I consider any major decline in a short period of time to be a crash. Therefore, it is worth studying two previous crashes (the Crash of 1987 and the Flash Crash of 2010) to anticipate what could happen after this most recent crash. The basic point of both charts is that after the initial low was made, the market didn’t have to go significantly lower. It simply stayed in a range for 4-6 months before eventually moving higher. That is why I am stressing patience in order to give the market time to heal its current technical damage.

Charts are provided by MarketSmith.

When the coronavirus fears subside and we get a confirmed market bottom, we will be in one of the most favorable stock market environments in history. We will see explosive moves higher in many growth stocks, the global central banks will be on our side, and the damaging psychological effects of this decline will keep sentiment muted. I continue to maintain a larger than normal cash position for my clients because I believe one should be defensive and patient until market conditions improve, but I also remain optimistic because I know the tremendous opportunities that will come out of this correction. I encourage people to be open minded that even though the virus might get worse, it doesn’t mean the stock market has to go significantly lower.

Read more:

2 things the market needs to recover post-coronavirus

I can be reached at: jfahmy@zorcapital.com

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.