Why We Think Atrion Corporation's (NASDAQ:ATRI) CEO Compensation Is Not Excessive At All

Performance at Atrion Corporation (NASDAQ:ATRI) has been rather uninspiring recently and shareholders may be wondering how CEO David Battat plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 21 May 2021. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Atrion

Comparing Atrion Corporation's CEO Compensation With the industry

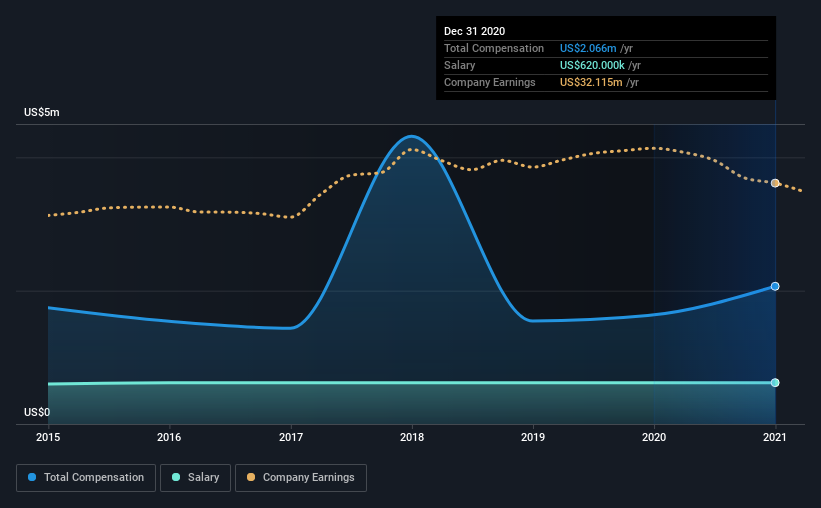

According to our data, Atrion Corporation has a market capitalization of US$1.1b, and paid its CEO total annual compensation worth US$2.1m over the year to December 2020. We note that's an increase of 27% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$620k.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$3.3m. That is to say, David Battat is paid under the industry median. Furthermore, David Battat directly owns US$57m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$620k | US$620k | 30% |

Other | US$1.4m | US$1.0m | 70% |

Total Compensation | US$2.1m | US$1.6m | 100% |

On an industry level, around 20% of total compensation represents salary and 80% is other remuneration. Atrion is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Atrion Corporation's Growth

Over the last three years, Atrion Corporation has shrunk its earnings per share by 3.8% per year. Its revenue is down 8.8% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Atrion Corporation Been A Good Investment?

Atrion Corporation has generated a total shareholder return of 3.7% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

So you may want to check if insiders are buying Atrion shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.