The Wild West Of ETF Performance

[Editor’s Note: The following originally appeared on FactSet.com. Elisabeth Kashner is director of ETF research and analytics for FactSet.]

When there’s no good answer to a basic question, it’s time to ask for a better one.

Investors and ETF asset managers want to know how an ETF performed over the past week, month or year. Often, they want to compare ETF performance, to see how their fund did versus its competition. They might also want to measure tracking difference or end-of-day premium/discount levels.

Often, all they get is frustrated. Shockingly, it is nearly impossible to make a fair, apples-to-apples comparison within an ETF market segment.

The most reliable metric of a fund’s valuation, the end-of-day net asset value, or NAV, can be calculated in two ways. Each tells a valid story, one which stands on its own. But too often they cannot stand together. The time is ripe to standardize NAV calculation requirements.

Pick Your Poison

NAVs can be designed to minimize calculated tracking difference or premium/discount. Often, it’s not possible to do both, because ETF asset managers must choose an NAV accounting method for setting each portfolio security’s closing price, along with a time of day for foreign currency conversions.

For two-thirds of all U.S. ETFs, the choice is a bitter one. Aligning strike times with capital market closings minimizes premiums/discounts, but can wreak havoc with tracking difference. Synchronizing with benchmark valuation tightens tracking difference but blows out premium/discount results.

The result: Major asset classes, including international equity, all fixed income, commodities and currencies have overstated tracking error or trading costs. U.S. equity portfolios are the only major group spared the trade-off.

Benchmark Style

The “benchmark” style minimizes tracking error, at the expense of premium/discount. The “no lawsuits” style, born in response to the mutual fund timing scandal, minimizes the levels of premium/discount because all currency valuations happen at 4 p.m. ET. This comes at the cost of higher tracking error, as custodian-style funds are not aligned with index valuation practices.

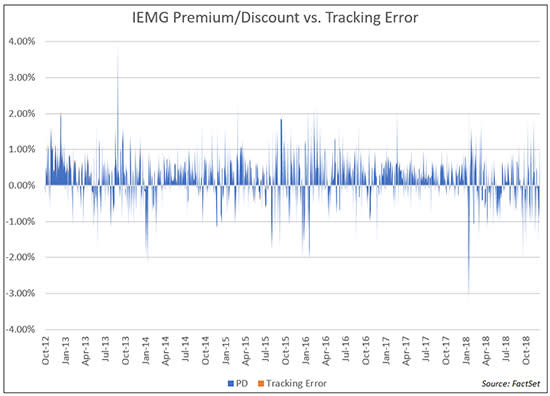

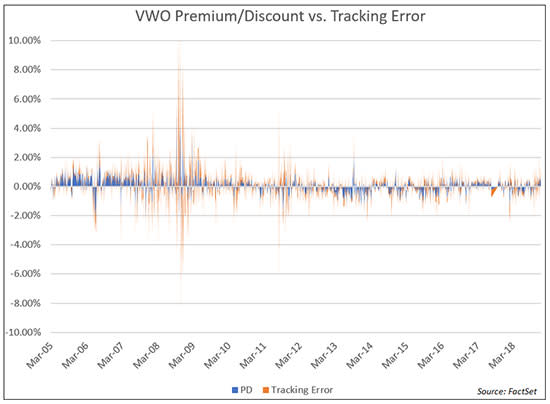

This trade-off is evident in equity funds holding foreign stocks such as the iShares Core MSCI Emerging Markets ETF (IEMG), which follows benchmark conventions, and the Vanguard FTSE Emerging Markets ETF (VWO), which follows "no lawsuits" conventions, lowering (but not eliminating) premium/discount at the expense of tracking error.

The charts below contrast each fund’s daily premium/discount with its daily tracking error. The premium/discount is shown in blue and the tracking error in orange.

Blue premium/discount dominates IEMG’s chart, to the point where orange tracking error is nearly invisible.

(For a larger view, click on the image above)

Both colors are visible in VWO’s chart, but orange tracking error stands out, while blue premium/discount is more muted.

(For a larger view, click on the image above)

Naming The Apples & Oranges

The different NAV calculation styles make a direct comparison of fund returns between major issuers impossible. Return differences might be explained by FX conversion times rather than by economic exposure.

Most asset managers do not disclose which of the methods they have chosen, leaving investors to assume the worst for fund efficiency or tradability. Worse, the lack of disclosure makes apples-to-apples performance comparisons impossible.

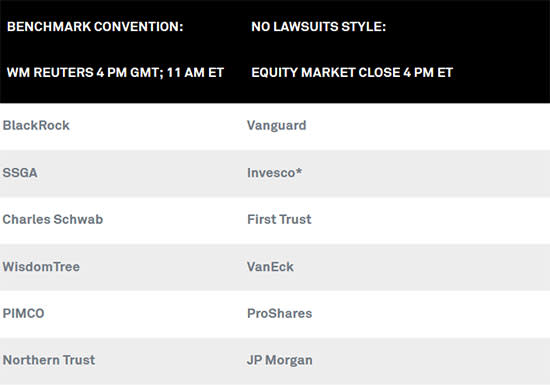

This table lays out the FX conversion times for the top ETF issuers in the U.S. Funds domiciled in Canada and Europe are more likely to use the market close timing over WM Reuters.

*Invesco mostly follows WM Reuters rules, but switches to fund custodian rules when exchange rate changes exceed a threshold.

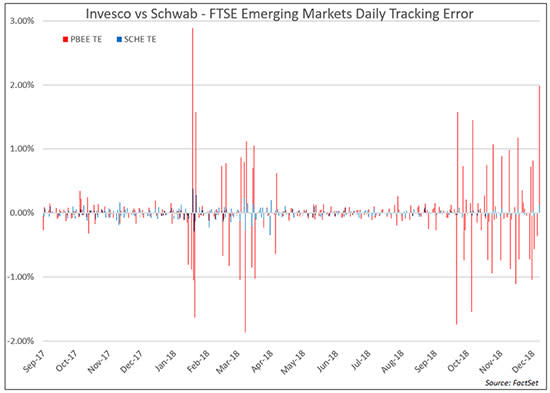

The apples-to-oranges NAVs make comparisons difficult. Sometimes, it’s not even possible to compare two ETFs that track the same underlying index.

For example, the Schwab Emerging Markets Equity ETF (SCHE) and the Invesco PureBeta FTSE Emerging Markets ETF (PBEE) both track the FTSE Emerging Markets Index. Their portfolios are quite similar. Schwab’s SCHE calculates NAVs benchmark-style, while Invesco’s PBEE switches back and forth between benchmark and "no lawsuits" styles. It’s easy to pick out the days when PBEE uses no-lawsuits-style rules.

(For a larger view, click on the image above)

If Not NAV, Then What?

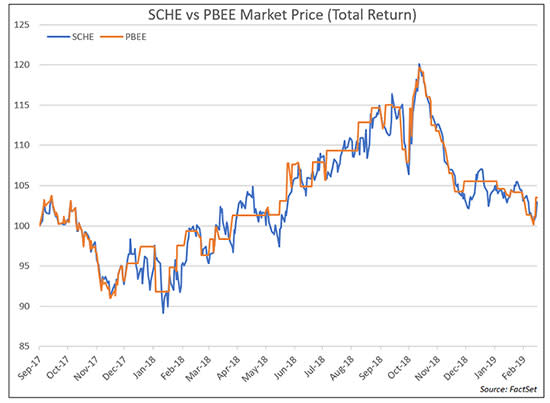

If NAV doesn't work, what does? It is tempting to look to a fund's closing market price as a normalized performance indicator. After all, market forces should value the two portfolios equally, and ETFs trade right up through the closing bell.

That’s true in theory, but not always in practice. Some ETFs trade thinly, or not at all. PBEE doesn’t trade at all most days, with an average daily share volume of 23 (23, not 23,000!). PBEE’s pricing is often stale, and not reflective of its current market value. Below is a comparison chart based on normalized closing prices.

(For a larger view, click on the image above)

It turns out that price can be a fraught metric, sometimes more extremely than NAV.

Another possible solution would be to reference each fund’s underlying index, and then adjust performance based on median tracking difference. But this approach comes with a price tag. Most indexes require a paid license as a prerequisite for data access. Moreover, index calculation methodologies can differ, especially their treatments of foreign withholding taxes.

With NAVs following at least two sets of rules, closing prices are useful only for the most liquid funds. In addition, index values locked behind a paywall and that are inconsistent across the industry leave ETF holders who want a definitive portfolio value with imperfect options.

ETF Rule Amendment?

The ETF industry can fix this problem and improve the public’s understanding of their funds’ performance. The solution: Publish two NAV series, one synchronized with the underlying index methodology, the other with the securities markets. The first could be used to evaluate tracking difference, the second for calculating end-of-day premium/discount.

Either would be suitable for performance reporting and comparisons. As the SEC puts its finishing touches on the “ETF Rule,” perhaps it should consider adding a new requirement: standardized NAVs, in two flavors.

At the time of writing, the author held no positions in the securities mentioned. Elisabeth Kashner is director of ETF research and analytics for FactSet. Check out Elisabeth Kashner’s new e-book, “Uncover The Key To ETF Tax Efficiency.”

Recommended Stories